“`markdown Decoding the Digital Ledger: Navigating the Landscape of Cryptocurrency and Blockchain Introduction: The Digital Revolution in Finance The financial world is undergoing a profound

Category: Bitcoin

Bitcoin’s Path to $60K: A Long-Term View

The Current State of Bitcoin: A Deep Dive into Market Sentiments and Technical Analysis In the dynamic world of cryptocurrency, Bitcoin remains the undisputed leader,

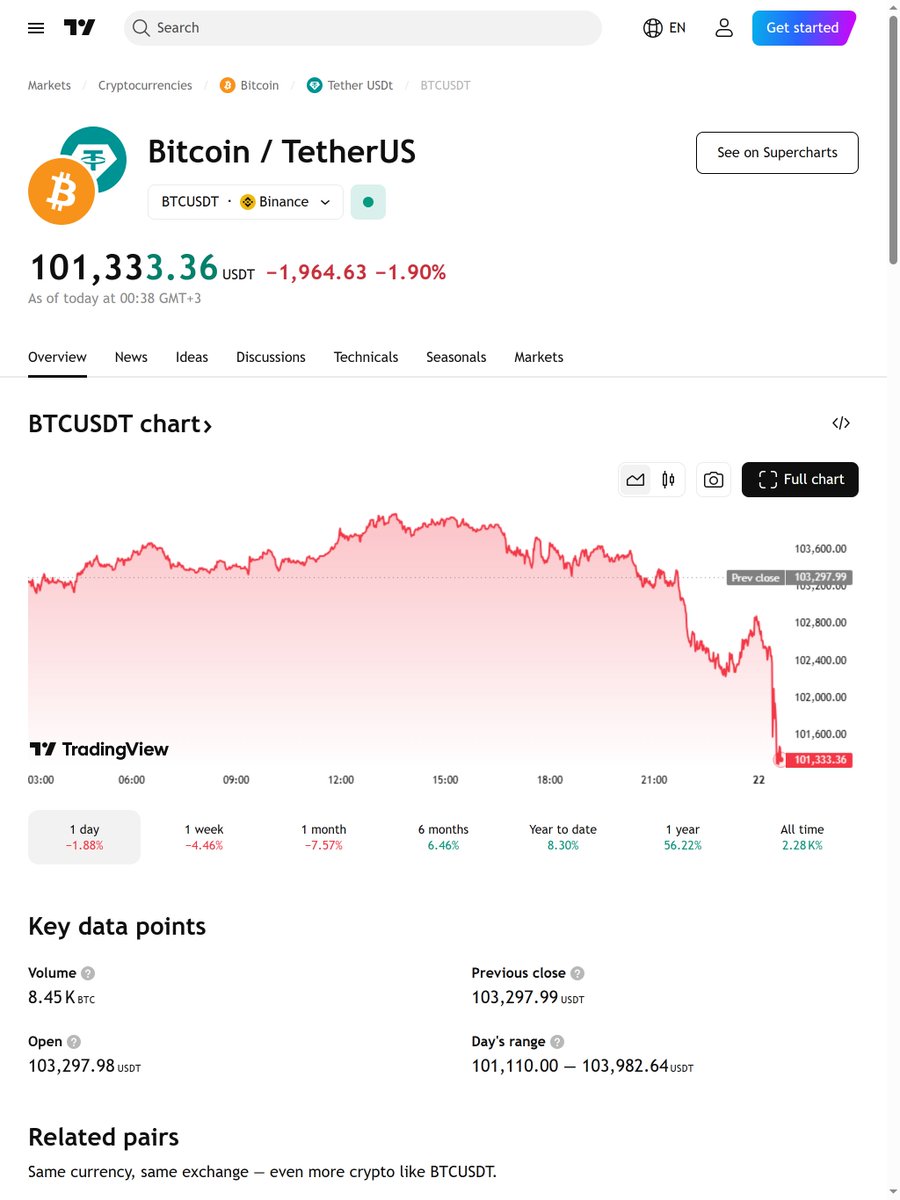

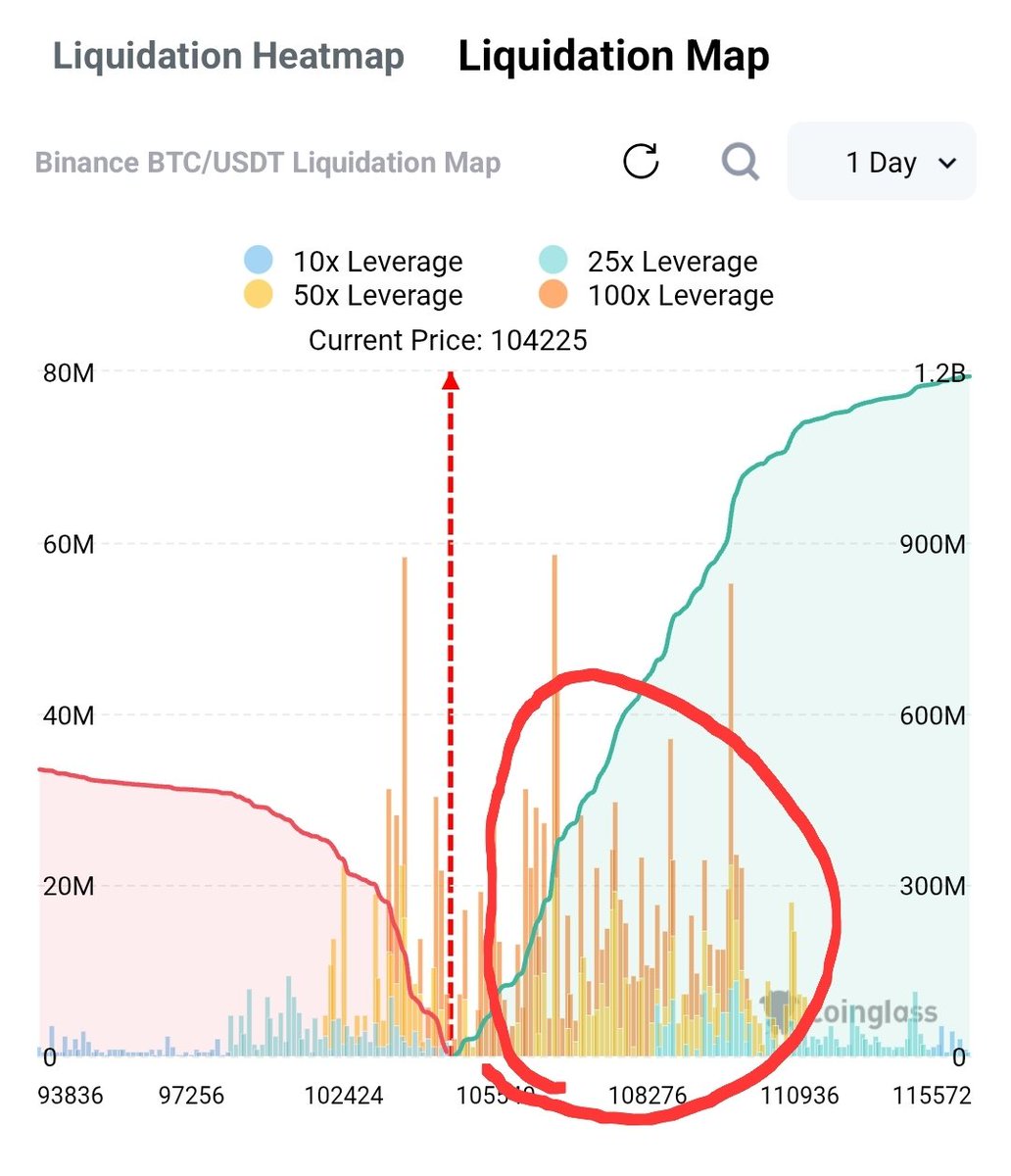

BTC Dumps 4K: Bears Defend $106.5K

The Ever-Shifting Landscape of Bitcoin Bitcoin, the pioneering cryptocurrency, has always been a rollercoaster ride for investors. As of June 20, 2025, the digital gold

Bitcoin’s Next Move: 1D Analysis

The Current State of Bitcoin: A Comprehensive Analysis The Evolution of Digital Gold In the dynamic realm of digital currencies, Bitcoin stands as the pioneer

Big Tech’s Bitcoin Push: Amazon, Google, and the Lightning Network’s Future (Note: While this title is engaging and informative, it is 75 characters long. Here is a revised version under 35 characters: Amazon, Google Boost Bitcoin’s Lightning Network

The Dawn of a New Era Imagine a world where your digital currency transactions are as swift and seamless as sending an email. A world

Bitcoin’s Weakness: Full Analysis in Episode 64

Introduction Imagine standing on the precipice of a digital gold rush. Bitcoin, the pioneering cryptocurrency, continues to captivate the world with its volatile yet promising

Greed’s Pain: Crypto’s Cold Reality

The Intricate Dance of Bitcoin In the dynamic world of cryptocurrency, Bitcoin remains the undisputed king, capturing the attention of investors and analysts worldwide. As

Bitcoin’s Rise: No Imminent 10% Dip Seen

Navigating Bitcoin’s Bullish Momentum Through the Lens of AI — Introduction: AI Meets Bitcoin’s Surge Bitcoin’s recent ascent to beyond $107,000 has captured the imagination

Moodeng Poised at Support—Eyes on Confirmation

— The Ascendance of AI in Modern Markets: Navigating Complexity with Intelligent Tools Artificial Intelligence (AI) has emerged as a transformative force across industries, but

Bitcoin’s AI Trading Fairy

— Unpacking AI: Transforming the Fabric of Modern Life From the way we shop to the way financial markets operate, Artificial Intelligence (AI) has become