The Economic Context

A Derailing System

The global economy has been experiencing unprecedented turbulence, with traditional financial systems showing signs of significant strain. The economic policies of recent years, particularly those under the Trump administration, have been a hotbed of debate. Critics argue that these policies have introduced considerable chaos into the system, leading to widespread uncertainty and volatility. This instability has created a fertile ground for alternative financial instruments, with Bitcoin emerging as a prominent player.

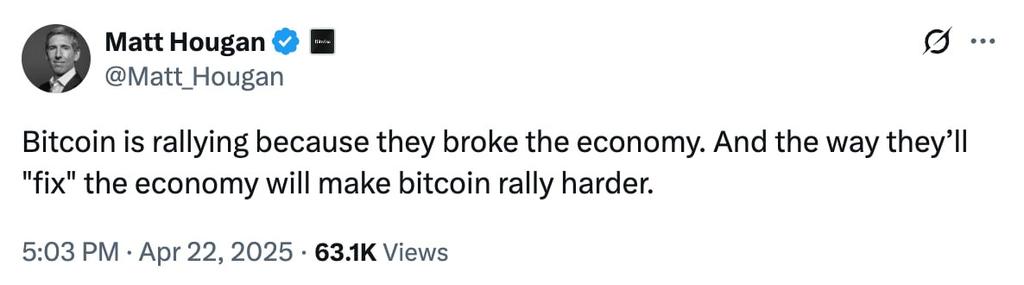

Matt Hougan, the Chief Investment Officer (CIO) of Bitwise, posits that this very chaos is fueling Bitcoin’s rise. The traditional economy, with its reliance on fiat currencies and centralized control, is struggling to maintain stability in the face of unprecedented challenges. This instability has made Bitcoin, with its decentralized nature and finite supply, an attractive option for investors seeking stability and growth in uncertain times[1].

The Role of Bitcoin

Bitcoin, introduced in 2009 by an anonymous entity known as Satoshi Nakamoto, was initially met with skepticism. However, it has since evolved into a significant player in the global financial arena. Unlike traditional currencies, Bitcoin is not subject to the same political and economic pressures. This independence has made it an attractive option for investors seeking stability and growth in uncertain times. As the traditional economy falters, Bitcoin’s value proposition becomes increasingly compelling.

Bitcoin’s decentralized nature means it is not controlled by any single entity, such as a government or financial institution. This decentralization is one of its key strengths, as it makes Bitcoin resistant to manipulation and corruption. Additionally, Bitcoin has a finite supply of 21 million coins, which makes it a deflationary asset. This scarcity is another factor driving its value, as it ensures that Bitcoin will always be in demand.

Technical Analysis and Market Trends

Bullish Indicators

The technical analysis of Bitcoin paints a bullish picture. The cryptocurrency has shown a robust upward trend on the intraday level, with significant gains in recent weeks. For instance, on April 22, 2025, Bitcoin saw a notable increase, reinforcing its upward trajectory[6]. This trend is supported by various technical indicators, such as the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD), which suggest strong momentum and room for further growth[10].

The RSI, for example, measures the speed and change of price movements. A high RSI indicates that an asset is overbought, while a low RSI indicates that it is oversold. Bitcoin’s RSI has been consistently high, suggesting that the cryptocurrency is in a strong uptrend. Similarly, the MACD, which measures the relationship between two moving averages of a security’s price, has also been bullish, indicating that Bitcoin’s momentum is strong and likely to continue.

Layer 2 Innovations

Bitcoin’s Layer 2 solutions are unlocking powerful DeFi (Decentralized Finance) potentials. Innovations such as cross-chain lending via Ordinals and BRC20 are expanding the utility and appeal of Bitcoin. These developments are not only enhancing Bitcoin’s functionality but also attracting more investors and users to the ecosystem[4].

Layer 2 solutions are built on top of the Bitcoin blockchain and aim to improve its scalability and functionality. For example, the Lightning Network is a Layer 2 solution that enables fast and cheap Bitcoin transactions. This makes Bitcoin more suitable for everyday use, such as buying coffee or paying for goods and services online.

Ethereum’s Performance

While Bitcoin is stealing the spotlight, Ethereum is also making waves. The second-largest cryptocurrency by market capitalization has seen an 8% increase in value, indicating a broader bullish sentiment in the crypto market. Ethereum’s rally is supported by its own set of technical indicators and market dynamics, adding to the overall positive outlook for cryptocurrencies[11].

Ethereum, unlike Bitcoin, is not just a cryptocurrency but also a platform for building decentralized applications (dApps). This makes it a more versatile asset, with a wider range of use cases. Ethereum’s recent upgrade to Ethereum 2.0, which aims to improve its scalability and security, has also contributed to its bullish sentiment.

The Path Forward

Fixing the Chaos

Matt Hougan suggests that “fixing the chaos” in the traditional economy could push Bitcoin even higher. This implies that as the traditional system stabilizes, it could lead to a more favorable environment for Bitcoin. However, it also means that Bitcoin’s value could be further enhanced if the traditional system continues to struggle. This duality highlights the unique position of Bitcoin in the financial landscape.

The traditional economy is facing numerous challenges, from inflation and debt to geopolitical tensions and climate change. These challenges are likely to persist, if not worsen, in the coming years. This makes Bitcoin’s value proposition even more compelling, as it offers an alternative to the traditional financial system.

The Future of Bitcoin

The future of Bitcoin looks promising, but it is not without challenges. Regulatory scrutiny, market volatility, and technological hurdles are some of the obstacles that Bitcoin must navigate. However, the cryptocurrency’s resilience and adaptability have proven to be its strongest assets. As the traditional economy continues to evolve, Bitcoin is poised to play an increasingly significant role.

Bitcoin’s regulatory environment is still uncertain, with different countries taking different approaches. Some countries, such as El Salvador, have embraced Bitcoin as legal tender, while others, such as China, have banned it outright. This regulatory uncertainty is a challenge for Bitcoin, but it is also an opportunity for the cryptocurrency to prove its value and resilience.

Conclusion: A New Financial Paradigm

The ascendancy of Bitcoin in a faltering traditional economy marks a shift in the financial paradigm. This digital currency, with its decentralized nature and finite supply, offers an alternative to the traditional financial system. As the traditional economy struggles to maintain stability, Bitcoin’s value proposition becomes increasingly compelling. The technical analysis and market trends support a bullish outlook for Bitcoin, with innovations in Layer 2 solutions and Ethereum’s performance adding to the positive sentiment. The path forward for Bitcoin is filled with both opportunities and challenges, but its resilience and adaptability make it a formidable player in the global financial arena. As we move forward, it is clear that Bitcoin is not just a passing fad but a significant force shaping the future of finance.