The Cryptocurrency Market: A Dance with Global Politics

The Rollercoaster Ride of Cryptocurrency

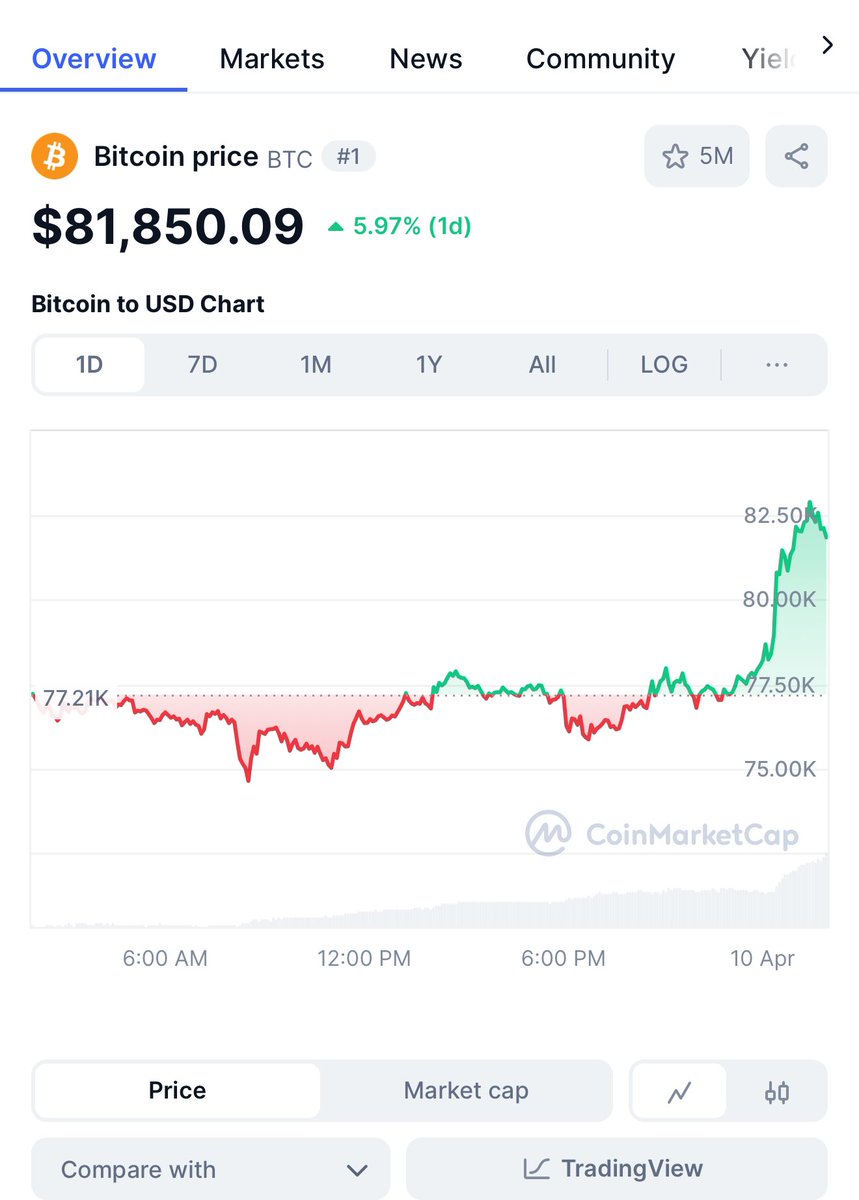

The cryptocurrency market has been on a rollercoaster ride in recent months. The volatility is not just a result of internal market forces but also external factors, particularly global economic policies. The decisions made by political leaders can have a profound impact on the crypto market, as seen with the recent tariff suspension announcement by former U.S. President Donald Trump. This announcement has sparked a wave of optimism, with many investors hoping for a market rebound. Understanding these dynamics is crucial for anyone looking to navigate the complex world of cryptocurrency.

The Impact of Trump’s Tariff Decisions

Understanding the Tariff Suspension

The suspension of tariffs by former President Trump was a significant move that aimed to ease trade tensions and stimulate economic growth. Tariffs are essentially taxes on imported goods, and their suspension can lead to increased trade, lower prices for consumers, and a boost in economic activity. This economic stimulus can have a positive ripple effect on the cryptocurrency market, as investors gain more confidence in the global economy. The suspension of tariffs can reduce uncertainty, making cryptocurrencies a more attractive investment option. This shift in economic policy can lead to increased liquidity and market stability, which are essential for long-term growth.

Market Reactions and Sentiment

The market reaction to the tariff suspension has been largely positive. Cryptocurrency prices, which had been under pressure due to trade uncertainties, saw a surge in value. This is because investors view the suspension of tariffs as a sign of reduced economic risk, making cryptocurrencies a more attractive investment option. The sentiment shift is crucial, as market sentiment often drives short-term price movements. Positive sentiment can lead to increased buying activity, further driving up prices. However, it is essential to remember that market sentiment can be volatile and subject to rapid changes based on new information or events.

The Role of Memecoins in the Market

PeanutTheSquirrel ($PNUT)

One of the more whimsical entries in the cryptocurrency market is PeanutTheSquirrel ($PNUT). This memecoin is designed to create a fun and playful cryptocurrency experience, embracing the popular meme culture. While it may not have the same market capitalization as major cryptocurrencies, it represents a segment of the market that is driven by community engagement and social trends. Memecoins like $PNUT often experience significant price volatility due to their community-driven nature and the influence of social media trends. This volatility can present both opportunities and risks for investors.

OfficialTrump ($TRUMP)

Another interesting memecoin is OfficialTrump ($TRUMP), which captures the spirit of former U.S. President Donald Trump in the world of cryptocurrency. This token is promoted as a meme and has gained a following among those who support Trump’s policies and persona. Memecoins like these often experience significant price volatility due to their community-driven nature and the influence of social media trends. The popularity of these memecoins can be attributed to their ability to tap into current events and cultural phenomena, making them appealing to a broad audience.

Technical Analysis: A Glimpse into the Future

Bitcoin ($BTC) Technical Analysis

Technical analysis is a crucial tool for understanding market trends and predicting future price movements. For Bitcoin ($BTC), a detailed technical analysis based on the 15-minute, 4-hour, and 1-day charts can provide valuable insights. The 200 Exponential Moving Average (EMA) on the 1-hour chart is often watched closely by traders, as it can indicate potential support or resistance levels. Technical indicators like the EMA can help traders identify trends and make informed decisions. However, it is essential to remember that technical analysis is just one tool among many and should be used in conjunction with other forms of analysis.

Litecoin ($LTC) Price Drop

Litecoin ($LTC) has also been in the spotlight, with recent price drops that were expected by many analysts. The $LTC/USDT pair saw a decline, which was anticipated due to various technical indicators and market conditions. Understanding these price movements is essential for traders looking to capitalize on short-term opportunities. Price drops can present buying opportunities for those who believe in the long-term potential of a cryptocurrency. However, it is crucial to conduct thorough research and analysis before making any investment decisions.

The Future of Stablecoins

The Gold Standard and Stablecoins

Stablecoins have been hailed as a breakthrough in the cryptocurrency space, offering the stability of traditional currencies with the benefits of digital assets. However, the concept of ‘backing’ in stablecoins is undergoing a rethink. The gold standard, which historically backed currencies with gold reserves, is being revisited in the context of stablecoins. This rethinking is crucial for ensuring the long-term viability and trustworthiness of stablecoins. As the cryptocurrency market continues to evolve, stablecoins will play an increasingly important role in providing stability and liquidity.

The Need for Rethinking ‘Backing’

As stablecoins continue to gain popularity, there is a growing need to redefine what ‘backing’ really means. Traditional backing methods, such as reserves of fiat currencies or commodities, may not be sufficient in the digital age. Innovative solutions, such as decentralized backing mechanisms and algorithmic stablecoins, are being explored to address these challenges. These new approaches can provide greater transparency and security, making stablecoins a more reliable option for investors and users alike.

Conclusion: Navigating the Crypto Landscape

The cryptocurrency market is a complex and dynamic landscape, influenced by a multitude of factors. From global economic policies to the whims of meme culture, every element plays a role in shaping market trends. As we look to the future, it is clear that the relationship between global politics and the crypto market will continue to evolve. Investors and traders must stay informed and adaptable, ready to navigate the ever-changing tides of this exciting and unpredictable market. By understanding the various factors at play and staying up-to-date with the latest developments, individuals can make more informed decisions and capitalize on the opportunities presented by the cryptocurrency market.

References

[1]: Ricky_Linh. “Crypto Market Analysis: A Rebound in Sight After Trump’s Tariff Suspension Announcement.” Twitter, 9 Apr. 2025, link.

[2]: CryptoJournaal. “#PeanutTheSquirrel ( $PNUT ) – #Fundamental #Analysis[ #Update: April 2025 ].” Twitter, 9 Apr. 2025, link.

[3]: Chxrm EXpreSs. “Update on my prediction: The Price of “LTC/USDT dropped as expected!.” Twitter, 9 Apr. 2025, link.

[4]: Chxrm EXpreSs. “Update on my prediction: The Price of “LTC/USDT dropped as expected!.” Twitter, 9 Apr. 2025, link.

[5]: CryptoJournaal. “#OfficialTrump ( $TRUMP ) – #Fundamental #Analysis[ #Update: April 2025 ].” Twitter, 9 Apr. 2025, link.

[6]: cryptogyanpatt. “Here’s a brief technical analysis of #BTC/USDT based on the 15m, 4h, and 1D charts.” Twitter, 9 Apr. 2025, link.

[7]: Yiannis Andreou. “The Gold Standard Is Back – Stablecoins Need To Rethink What ‘Backing’ Really Means.” Twitter, 9 Apr. 2025, link.