The Intriguing World of Harmonic Patterns

Imagine the market as a vast, ever-changing landscape, much like the ocean. Just as waves follow a rhythmic pattern, market prices often adhere to recognizable structures. Among these, harmonic patterns stand out for their precision and potential to signal significant price movements. The Butterfly pattern, in particular, is celebrated for its accuracy and the substantial gains it can unlock. Let’s embark on a journey to explore the fascinating world of the Butterfly pattern, its applications, and its power in trading.

Unraveling Harmonic Patterns

Harmonic patterns are geometric formations that traders use to pinpoint potential reversal points in the market. These patterns are grounded in Fibonacci numbers and ratios, which are prevalent in both nature and finance. The most well-known harmonic patterns include the Gartley, Butterfly, Bat, and Crab. Each pattern has its unique characteristics and implications, but they all aim to identify high-probability reversal zones.

The Butterfly pattern is especially prized for its precision and the potential for significant price movements. It consists of five points: X, A, B, C, and D. The pattern is complete when point D reaches specific Fibonacci extension levels from point X.

Dissecting the Butterfly Pattern

To grasp the Butterfly pattern, let’s examine its structure:

– Point X: The starting point of the pattern.

– Point A: The first significant price movement from X, typically a 78.6% Fibonacci retracement.

– Point B: A retracement from A, usually around 38.2% to 88.6% of the XA leg.

– Point C: A continuation from B, often extending 127% to 161.8% of the AB leg.

– Point D: The final point, which completes the pattern. It is a 127% to 161.8% extension of the XA leg and a 161.8% to 261.8% extension of the BC leg.

The Butterfly pattern is considered complete when point D reaches the specified Fibonacci extension levels. This completion often signals a potential reversal in the market.

The Strength of the Butterfly Pattern

The Butterfly pattern is renowned for its precision and the potential for substantial price movements. Traders often use this pattern to identify high-probability reversal zones, allowing them to enter trades with a favorable risk-reward ratio. The pattern’s reliability is rooted in its adherence to Fibonacci ratios, which are deeply ingrained in financial markets.

One of the key advantages of the Butterfly pattern is its ability to provide clear entry and exit points. By identifying the completion of the pattern at point D, traders can set precise stop-loss and take-profit levels, enhancing their trading strategy’s effectiveness.

Implementing the Butterfly Pattern in Trading

To apply the Butterfly pattern in trading, follow these steps:

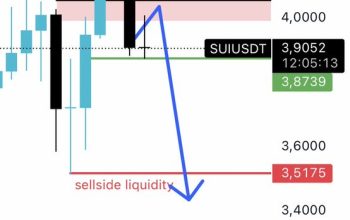

Real-World Application: The Butterfly Pattern in Action

Let’s delve into a real-world example of the Butterfly pattern in action. In a recent analysis, a trader identified a bullish Butterfly pattern on the Bitcoin chart. The pattern’s completion at point D signaled a potential reversal, and the trader entered a long position. The trade resulted in a significant price movement, with Bitcoin’s price increasing by over 1000% from the pattern’s completion point. This example underscores the pattern’s precision and potential for substantial gains.

The Evolution of Harmonic Patterns

As the trading landscape continues to evolve, harmonic patterns like the Butterfly will remain invaluable tools for traders. Their adherence to Fibonacci ratios and geometric structures provides a reliable framework for identifying market reversals. With advancements in technology and data analysis, traders can expect even more precise and effective applications of harmonic patterns in the future.

Conclusion: Embracing the Power of Precision

The Butterfly pattern is a testament to the power of precision in trading. By understanding its structure and applying it effectively, traders can identify high-probability reversal zones and capitalize on significant price movements. As we continue to explore the depths of harmonic patterns, let us embrace the precision they offer and use it to navigate the ever-changing landscape of financial markets.