Bitmine’s Bold Bet: A Deep Dive into the $1 Billion Buyback and Ethereum Strategy

A Billion-Dollar Vote of Confidence: The Share Buyback Program

Bitmine Immersion Technologies (BMNR) has made a significant splash in the cryptocurrency world with its announcement of a $1 billion share buyback program. This move, approved by the company’s Board of Directors, is a bold statement of confidence in Bitmine’s future prospects. The buyback program is open-ended, allowing Bitmine to repurchase its outstanding common stock through various methods, including open market purchases and negotiated transactions.

The sheer scale of the buyback is impressive, especially when considering Bitmine’s market capitalization of $11.9 million at the time of the announcement. This discrepancy raises questions about the feasibility and long-term impact of the program. However, the buyback could be a strategic move to address potential undervaluation in the market and to counter dilution caused by previous equity offerings.

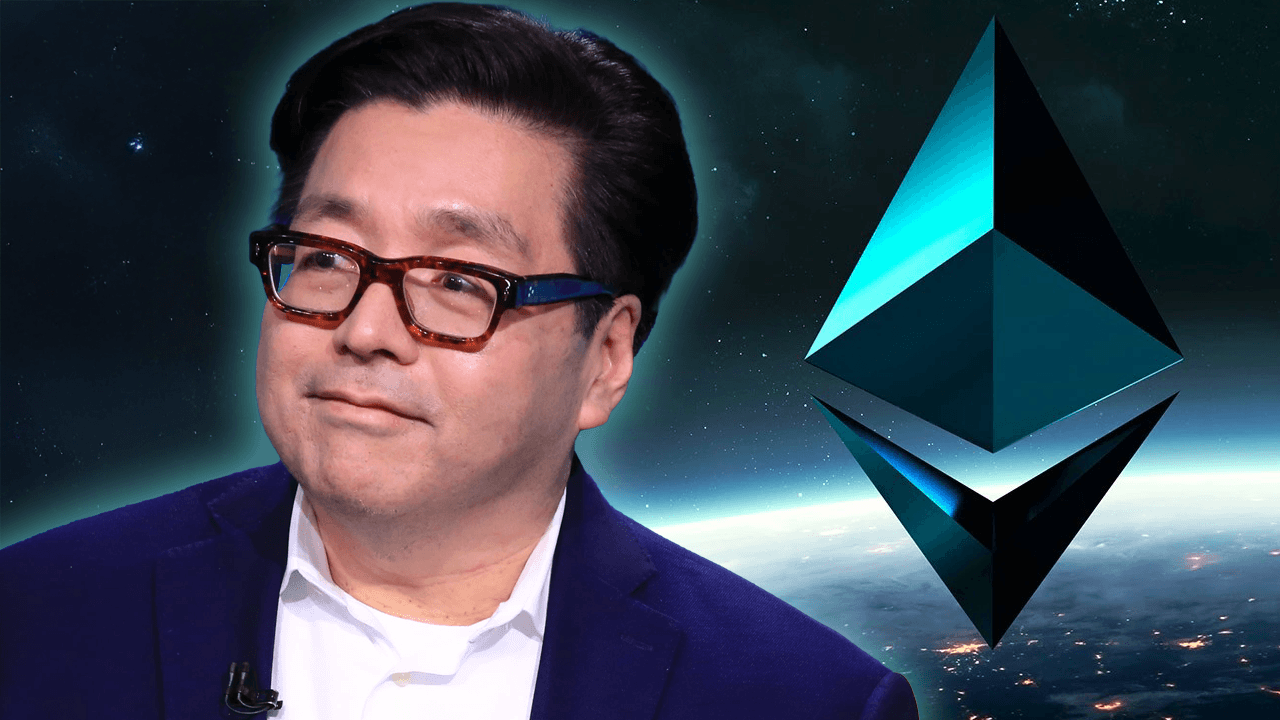

Bitmine Chairman Tom Lee’s statement that the buyback aligns with achieving “the alchemy of 5% of ETH” adds an intriguing layer to the strategy. This suggests that the buyback could be indirectly linked to the company’s Ethereum strategy, possibly indicating that repurchasing shares is considered a more efficient use of capital than other potential investments within the Ethereum ecosystem. It could also imply that the company aims to accumulate enough ETH to influence the network, although this remains speculative.

From Bitcoin Mining to Ethereum Giant: The $1 Billion ETH Stash

Simultaneous with the buyback announcement, Bitmine revealed that its Ethereum holdings had surpassed $1 billion as of July 17, 2025. The company reported holding 300,657 ETH, valued at approximately $3,461.89 per ETH. This significant accumulation of ETH represents a major strategic shift for Bitmine, transitioning it from a primarily Bitcoin-focused entity to a major player in the Ethereum ecosystem.

The move into Ethereum likely reflects a broader trend of diversification within the cryptocurrency industry. With Ethereum’s growing importance as a platform for decentralized applications (dApps), decentralized finance (DeFi), and non-fungible tokens (NFTs), Bitmine’s investment positions it to capitalize on the burgeoning growth of the Ethereum ecosystem.

The fact that Bitmine is backed by venture capitalist Peter Thiel adds further weight to its Ethereum strategy. Thiel has been a long-time proponent of cryptocurrencies, and his involvement likely played a role in shaping Bitmine’s decision to allocate significant capital to Ethereum. Thiel’s reputation for identifying disruptive technologies suggests that he sees significant potential in the Ethereum ecosystem.

Some reports even suggested that Bitmine’s ETH holdings had surpassed those of the Ethereum Foundation. While the exact figures for the Ethereum Foundation’s holdings are not always publicly available, the comparison highlights the scale of Bitmine’s accumulation. This development underscores Bitmine’s ambition to become a significant stakeholder in the Ethereum network.

Bitmine has also expressed plans to stake 5% of the circulating supply of ETH. Staking involves locking up ETH to support the network’s operations and earn rewards. This move would not only generate passive income for Bitmine but also further solidify its position as a key participant in the Ethereum ecosystem.

Synergies and Risks: The Interplay Between Buyback and Ethereum Strategy

The $1 billion buyback program and the accumulation of over $1 billion in Ethereum are not mutually exclusive events. They likely represent a coordinated strategy aimed at maximizing shareholder value and positioning Bitmine for long-term success in the evolving cryptocurrency landscape.

The buyback program could be funded, in part, by profits generated from Bitmine’s Ethereum holdings. As the price of ETH increases, Bitmine could strategically sell portions of its holdings to finance the buyback, creating a positive feedback loop. The buyback, in turn, could boost the stock price, further enhancing the value of Bitmine’s remaining Ethereum holdings.

However, this strategy also carries potential risks. The cryptocurrency market is notoriously volatile, and a significant downturn in the price of ETH could jeopardize Bitmine’s ability to execute the buyback program and maintain its financial stability. Furthermore, regulatory changes or technological disruptions could negatively impact the Ethereum ecosystem, undermining Bitmine’s investment.

Bitmine’s success will depend on its ability to navigate these uncertainties and execute its strategy effectively. The company will need to carefully manage its risk exposure, monitor market trends, and adapt its plans as needed. Strong leadership, sound financial management, and a deep understanding of the cryptocurrency landscape will be crucial for Bitmine to achieve its goals.

Conclusion: A Gamble with Potential

Bitmine’s $1 billion share buyback and its accumulation of over $1 billion in Ethereum represent a bold bet on the future of cryptocurrency. The company’s strategic shift reflects the growing importance of Ethereum within the broader digital asset ecosystem and underscores the potential for innovative companies to capitalize on emerging opportunities. While the strategy carries inherent risks, the potential rewards are significant. Whether Bitmine can successfully execute its vision remains to be seen, but its actions have undoubtedly captured the attention of the crypto world and set the stage for an exciting chapter in the company’s evolution.