Navigating the NFT Market: A Deep Dive into Trends, Whale Behavior, and Future Potential

Introduction: The Ever-Evolving NFT Landscape

The NFT (Non-Fungible Token) market has been a rollercoaster of highs and lows, with explosive growth followed by sharp declines. Yet, beneath the surface, intriguing patterns emerge—patterns that could shape the future of digital ownership. This report dissects recent NFT trading volumes, whale behavior, and emerging trends to provide a comprehensive analysis of where the market stands and where it might be heading.

—

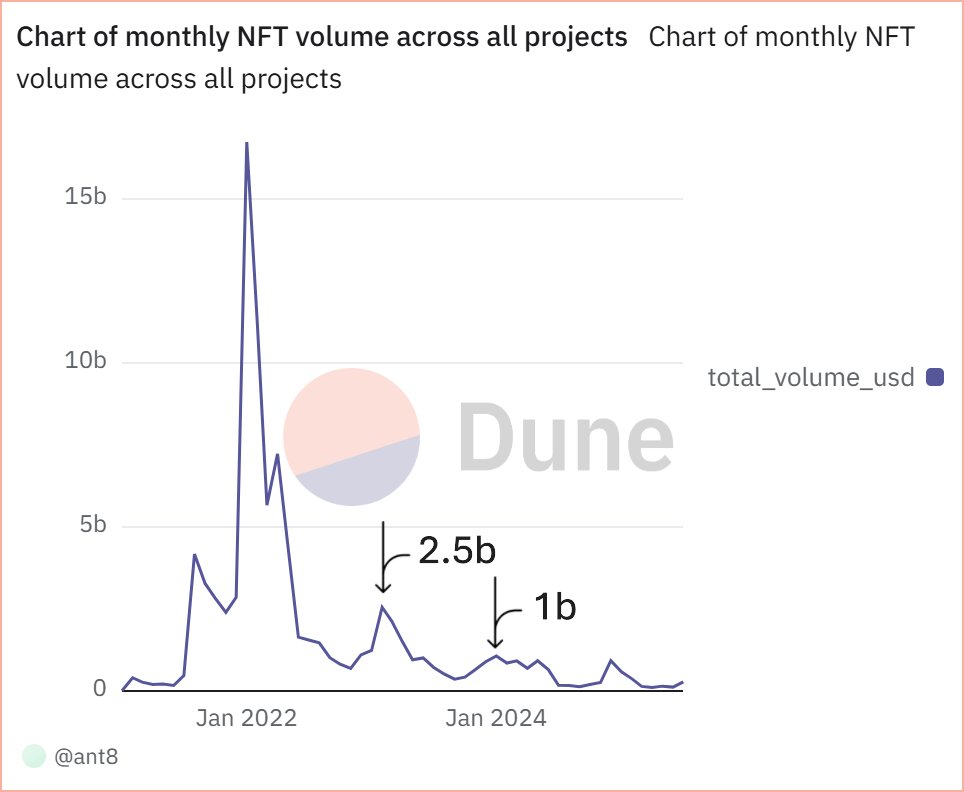

1. Monthly NFT Volume: A Tale of Boom and Bust

The Bull Run of 2022

The NFT market experienced a meteoric rise in early 2022, with trading volumes surging to unprecedented levels. This period, often referred to as the “bull peak,” saw massive interest from both retail and institutional investors. The hype was fueled by high-profile sales, celebrity endorsements, and the perception of NFTs as digital assets with long-term value.

However, this euphoria was short-lived. By mid-2022, trading volumes began to decline sharply, a trend that continued into 2023 and 2024. The decline was gradual but steady, reflecting a market correction after the initial frenzy.

The Current State: A Gradual Recovery?

Despite the downturn, there are signs of resilience. Some collections have maintained strong holder retention, suggesting that a core group of investors remains bullish on NFTs. Additionally, new projects and innovations in the space could reignite interest, potentially leading to another wave of growth.

—

2. Whale Behavior: A Key Indicator of Market Sentiment

The “Purt the Adventure” Whale

One of the most telling signs of a potential NFT pump is the behavior of large holders, or “whales.” A recent analysis revealed that a single wallet holds 1,518 tokens of the “Purt the Adventure” collection, created by @Red_Planet_Dao. What’s particularly interesting is that this whale has not sold a single token and, in fact, bought more recently.

This behavior suggests strong confidence in the project’s future value. If whales are accumulating rather than selling, it could indicate an impending price surge.

The “Chimpers” Phenomenon

Another fascinating case is the Chimpers NFT collection. Out of 6,936 wallets that have ever held a Chimpers NFT, 1,822 have never sold—a staggering 26.2% of all holders. This level of loyalty is rare in the NFT space and suggests that these holders see long-term value in the project.

—

3. Emerging Trends and Future Outlook

Advanced Token Analysis and New Chain Support

The NFT ecosystem is evolving rapidly, with new tools and platforms enhancing user experience. Bitlock Wallet, for instance, is introducing advanced token analysis, new chain support, and a trending tokens section, along with NFT and referral system integrations. These developments could make NFT trading more accessible and attractive to a broader audience.

The Role of Data in Shaping the Market

Data-driven analysis is becoming increasingly important in the NFT space. Platforms like The Ant Academy provide deep insights into trading volumes, holder behavior, and market trends. This transparency helps investors make more informed decisions, reducing speculation and fostering a more stable market.

—

Conclusion: A Market in Transition

The NFT market is far from dead—it’s in a state of transition. While trading volumes have declined from their peak, the behavior of whales and loyal holders suggests that certain projects still hold significant value. With new tools, better data analysis, and a growing emphasis on utility, the NFT space could be on the cusp of another wave of growth.

The key takeaway? The market is maturing, and those who understand its nuances will be best positioned to capitalize on its future potential.

—

Sources: