The recent closure of Momint, South Africa’s pioneering NFT marketplace, serves as a stark reminder of the turbulent waters of the Web3 landscape. Once heralded as a beacon of innovation in Africa’s burgeoning crypto ecosystem, Momint’s demise highlights the challenges of building sustainable platforms in a space defined by shifting market conditions, limited capital, and the ever-present struggle for user adoption. This analysis delves into the factors contributing to Momint’s shutdown, examining the broader implications for Web3 ventures in emerging markets.

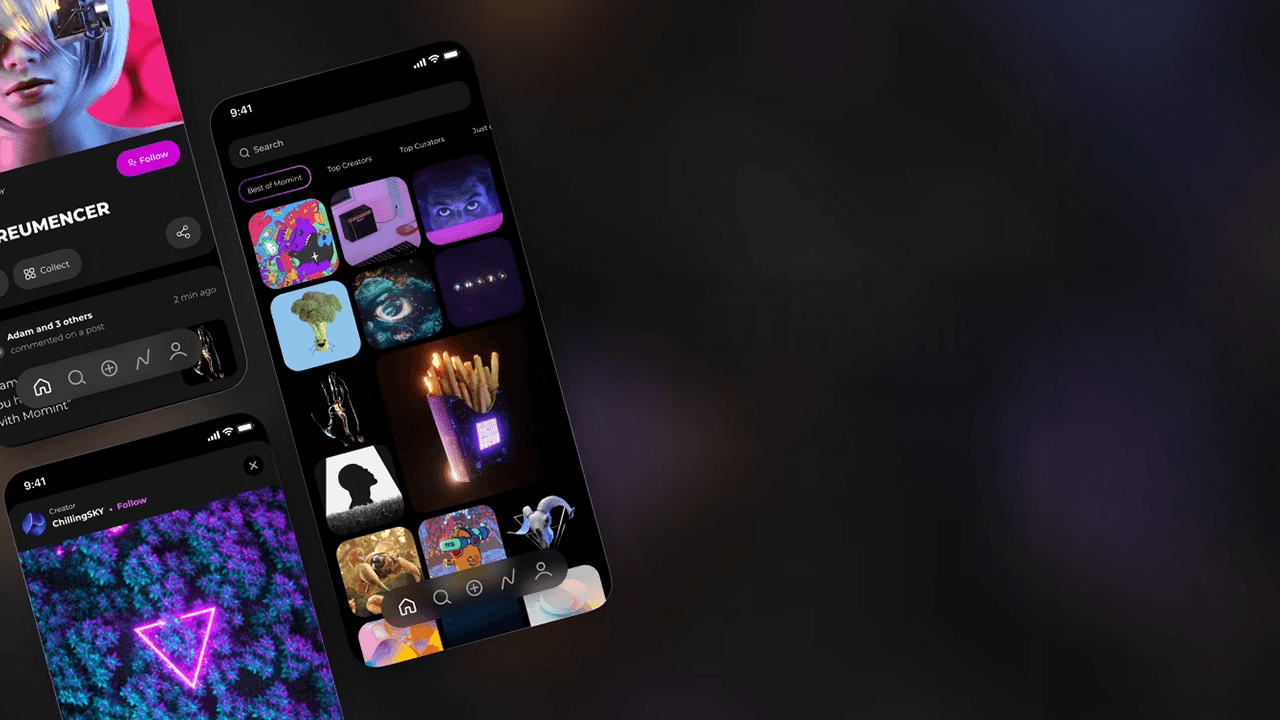

Launched in May 2021, Momint quickly established itself as South Africa’s first NFT marketplace to support transactions in the local currency, Rand. This was a significant step towards making NFTs accessible to a wider audience in the region. Momint capitalized on the growing global interest in NFTs, offering a platform for artists, creators, and collectors to engage with digital assets. The platform garnered significant attention with high-profile sales, including a digital artwork featuring former rugby star Bryan Habana, which fetched over $10,000 during its trial phase. Another notable success was the tokenization of Nelson Mandela’s 1961 arrest warrant, which was auctioned for over $130,000 in early 2022. This sale stands as one of the most significant NFT transactions on the African continent, showcasing the potential of NFTs to preserve and monetize historical artifacts. Furthermore, Momint explored innovative applications of NFTs beyond art and collectibles. They partnered to tokenize R18 million in Krugerrands, offering fractionalized ownership of these valuable coins to a broader range of collectors. They also ventured into using NFTs to support renewable energy projects, allowing investors to purchase NFTs linked to solar cells, which were then leased to institutions.

These early successes fueled optimism about Momint’s future and its potential to drive Web3 adoption in South Africa and beyond. The platform provided a valuable service by bridging the gap between the traditional financial system and the emerging world of digital assets.

Despite its promising start, Momint ultimately succumbed to a confluence of factors that underscore the inherent risks of operating in the Web3 space.

Market Volatility and Declining NFT Volumes

The NFT market, known for its rapid boom-and-bust cycles, experienced a significant downturn in recent times. Trading volumes have plummeted across major NFT marketplaces, with sales down considerably year-over-year. This decline in market activity directly impacted Momint’s revenue and overall sustainability. The platform, like many others in the NFT space, struggled to maintain momentum as the initial hype surrounding NFTs faded. The closure of other NFT platforms, such as X2Y2 and Bybit’s NFT marketplace, further illustrates this industry-wide trend. The NFT market’s volatility is not unique to Momint; it reflects a broader industry challenge. The speculative nature of NFTs, coupled with the broader crypto market’s volatility, creates an unstable environment for platforms like Momint. The lack of a stable user base and consistent transaction volumes makes it difficult for platforms to sustain operations, especially in emerging markets where the crypto ecosystem is still developing.

Limited Capital and Funding Challenges

Web3 startups often face significant challenges in securing funding, particularly in emerging markets like South Africa. Investors may be hesitant to invest in unproven technologies or may lack a deep understanding of the local market dynamics. Momint cited limited capital as a core reason for its closure, indicating that the company struggled to raise sufficient funds to sustain its operations and fuel future growth. The “tough funding environment” mentioned in reports highlights the difficulties faced by Web3 ventures in attracting investment amidst broader economic uncertainties. The lack of venture capital and institutional investment in emerging markets exacerbates the funding challenges. Many investors prefer to allocate capital to more established markets with clearer regulatory frameworks and higher liquidity. This funding gap leaves Web3 startups in emerging markets at a disadvantage, struggling to compete with better-funded counterparts in more developed regions.

Rising Operational Costs and Scalability Issues

Operating a Web3 platform involves significant operational costs, including technology infrastructure, security measures, and marketing expenses. As Momint sought to scale its operations and expand its user base, these costs likely increased, putting further strain on its limited financial resources. The company acknowledged “rising operational costs” as a contributing factor to its demise. Scaling user adoption beyond its initial base also proved challenging, suggesting that the platform struggled to attract and retain a critical mass of users necessary for long-term sustainability. The high costs of maintaining blockchain infrastructure, ensuring cybersecurity, and complying with regulatory requirements can be prohibitive for startups. Additionally, the need for continuous innovation and user acquisition further strains limited resources. The lack of economies of scale in emerging markets makes it difficult for platforms to achieve cost efficiencies, compounding the financial challenges.

Regulatory Uncertainty

The regulatory landscape for cryptocurrencies and NFTs remains uncertain in many jurisdictions, including South Africa. While Momint operated within the existing legal framework, the lack of clear and comprehensive regulations may have created challenges and uncertainties for the platform. Regulatory ambiguity can deter potential investors and users, hindering the growth of Web3 ventures. The company faced liquidity issues and regulatory challenges, ultimately leading to its shutdown. The absence of clear guidelines on NFT taxation, consumer protection, and anti-money laundering (AML) compliance creates a risky environment for platforms. Regulatory uncertainty can lead to sudden policy changes that disrupt operations, as seen in other jurisdictions where crypto regulations have evolved rapidly. This unpredictability makes it difficult for startups to plan for long-term growth and stability.

Momint’s closure offers valuable lessons for Web3 entrepreneurs and investors operating in emerging markets.

Focus on Sustainability and Long-Term Value

Web3 ventures should prioritize building sustainable business models that are not solely reliant on hype and speculation. This requires a focus on creating real-world value and addressing genuine user needs. Platforms should aim to integrate blockchain technology into existing industries, such as finance, real estate, and supply chain management, to create tangible benefits for users. By focusing on practical applications, Web3 ventures can attract a more stable user base and generate consistent revenue streams. Additionally, diversifying revenue sources, such as offering premium services or partnerships with traditional businesses, can enhance financial sustainability.

Adaptability and Innovation

The Web3 space is constantly evolving, so companies must be adaptable and willing to innovate to stay ahead of the curve. This may involve exploring new applications of blockchain technology, developing innovative user experiences, or diversifying revenue streams. For example, platforms can experiment with hybrid models that combine NFTs with traditional assets or explore decentralized finance (DeFi) integrations to offer more financial services. Continuous innovation is crucial to maintaining user interest and staying relevant in a rapidly changing market. By staying agile and responsive to market trends, Web3 ventures can better navigate the challenges of the industry.

Strategic Partnerships

Collaborations with established businesses and organizations can provide Web3 startups with access to resources, expertise, and wider audiences. Partnering with traditional financial institutions, tech companies, or government agencies can enhance credibility and accelerate adoption. For instance, collaborating with local banks or payment processors can facilitate smoother transactions and attract a broader user base. Strategic partnerships can also help Web3 ventures navigate regulatory challenges by leveraging the expertise and influence of established partners. By building strong alliances, startups can create a more robust ecosystem that supports long-term growth.

Community Engagement

Building a strong community is essential for the success of any Web3 venture. Engaging with users, soliciting feedback, and fostering a sense of ownership can help build loyalty and drive adoption. Platforms can create community-driven initiatives, such as governance tokens, user rewards, or exclusive events, to encourage active participation. A vibrant community can provide valuable insights, support, and advocacy, helping the platform navigate challenges and seize opportunities. By prioritizing community engagement, Web3 ventures can create a loyal user base that is invested in the platform’s success.

Navigating Regulatory Landscapes

Web3 companies must proactively engage with regulators and policymakers to shape a favorable regulatory environment. This involves advocating for clear and sensible regulations that promote innovation while protecting consumers. By participating in regulatory discussions and collaborating with policymakers, Web3 ventures can help create a more supportive framework for the industry. Additionally, staying informed about regulatory developments and ensuring compliance can mitigate risks and build trust with users and investors. Proactive engagement with regulators can help shape policies that balance innovation with consumer protection, creating a more stable environment for Web3 ventures.

While Momint’s closure is undoubtedly a setback for the South African Web3 ecosystem, it should not be viewed as a complete failure. The company played a pioneering role in introducing NFTs to the local market and demonstrated the potential of blockchain technology to empower creators and unlock new economic opportunities. Momint’s legacy lies in its contribution to raising awareness about Web3 and its potential applications in Africa. It paved the way for future innovation and inspired other entrepreneurs to explore the possibilities of blockchain technology. The challenges faced by Momint serve as a valuable learning experience for the entire Web3 community. By understanding the factors that contributed to its closure, entrepreneurs can better prepare themselves for the challenges ahead and build more resilient and sustainable Web3 ventures in emerging markets. Although Momint’s journey has ended, the seeds of innovation it sowed will undoubtedly contribute to the future growth and development of the African Web3 ecosystem. The spirit of innovation and the pursuit of groundbreaking solutions will continue to drive entrepreneurs forward, ensuring that the promise of Web3 in Africa remains alive and well.