“`html

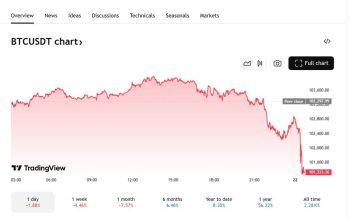

Bitcoin Rollercoaster: A Thrilling Ride Through Market Turbulence

Hold on tight as we dive into the recent Bitcoin market rollercoaster, where exhilarating highs have given way to stomach-churning lows. Let’s explore the twists and turns caused by a wild blend of economic uncertainties, market fears, and massive investor shifts.

Jolting Market Conditions

Bitcoin has taken a nose-dive, plunging below $80,000, sending shockwaves through the crypto realm. The Crypto Fear and Greed Index has hit rock bottom, echoing a symphony of fear among traders, while global skirmishes, like President Trump’s tariff showdown, have only added fuel to the fire.

Realized Losses: A Bumpy Ride

In recent days, Bitcoin traders bore witness to staggering tangible losses, surpassing $3 billion, with short-term holders feeling the sting the most. Between February 25 and 27, a whopping $2.16 billion slipped through traders’ fingers, with $927 million evaporated in a single heart-stopping day. The intense selling frenzy and bearish vibes linger heavy in the air.

Unrealized Losses: The Invisible Nemesis

Sailing alongside the stark realized losses are the silent yet mammoth unrealized losses, unseen since the FTX chaos. These losses wallow around -18.86%, revealing many investors clenching Bitcoin above its market worth. This unseen threat could trigger a fresh wave of selling, pulling the market into deeper depths.

Rides Fueling the Sell-Off

- Economic Rollercoasters: Worldwide jitters over inflation and interest rates have cast a shadow on risk-takers like Bitcoin.

- Gloomy Tales and Vibes: Recent hacks and grim forecasts have cast a dark cloud over market moods.

- Whale Ballet: Behemoth investors, the whales, have orchestrated a price symphony by offloading their stakes.

Potential for a Bounceback: Buckle Up!

Amidst the stormy weather, signs of a potential upswing loom on the horizon. Historically, rollercoaster plunges often pave the way for exhilarating Bitcoin rallies. Moreover, easing macroeconomic waves, with a wobbling dollar and dwindling bond yields, hint at a resurgence of market juices.

End of the Ride: Will It Soar or Plummet?

As the Bitcoin rollercoaster careens through a whirlwind of selling drama, investors brace for a tumultuous journey clouded by substantial losses. While gloomy skies prevail, historical trends and emerging macroeconomic signals hint at the possibility of a market revival. Riders are advised to stay vigilant but also ready for a potential shift in market winds.

References

[FXStreet: Crypto Fear and Greed Index Hits Three-Year Low](https://www.fxstreet.com/cryptocurrencies/news/crypto-fear-and-greed-index-hits-three-year-low-as-sell-off-from-recent-buyers-weighs-on-bitcoin-202502272230)

[Bitcoin World: Bitcoin Traders Face Steepest Unrealized Losses Since FTX Disaster](https://bitcoinworld.co.in/bitcoin-traders-face-losses-ftx/)

[Cryptonomist: Bitcoin Faces a Brutal Correction, But There Is Still Hope for the Bull](https://en.cryptonomist.ch/2025/03/01/bitcoin-faces-a-brutal-correction-but-there-is-still-hope-for-the-bull/)

[BeInCrypto: Bitcoin Price Falls After Facing Selling](https://beincrypto.com/bitcoin-price-falls-after-facing-selling/)

[Bitcoinist: Financial Conditions Signal Bitcoin’s Next Move — Is A Rebound Incoming?](https://bitcoinist.com/financial-conditions-bitcoins-next-rebound-incoming/)

“`

Related sources:

[1] www.fxstreet.com

[4] beincrypto.com

[5] bitcoinist.com