Cryptocurrency Market Dynamics: A Deep Dive into August 2025 Trends

Introduction: The Ever-Evolving Crypto Landscape

The cryptocurrency market remains one of the most volatile and dynamic financial ecosystems, where price movements, regulatory shifts, and technological advancements shape investor sentiment. As of August 2025, Bitcoin (BTC) has seen fluctuations, Ethereum (ETH) is rebounding, and altcoins are gaining traction. This report analyzes key market trends, technical insights, and strategic developments influencing the crypto space.

—

Bitcoin’s Historical Performance: A Mixed August Track Record

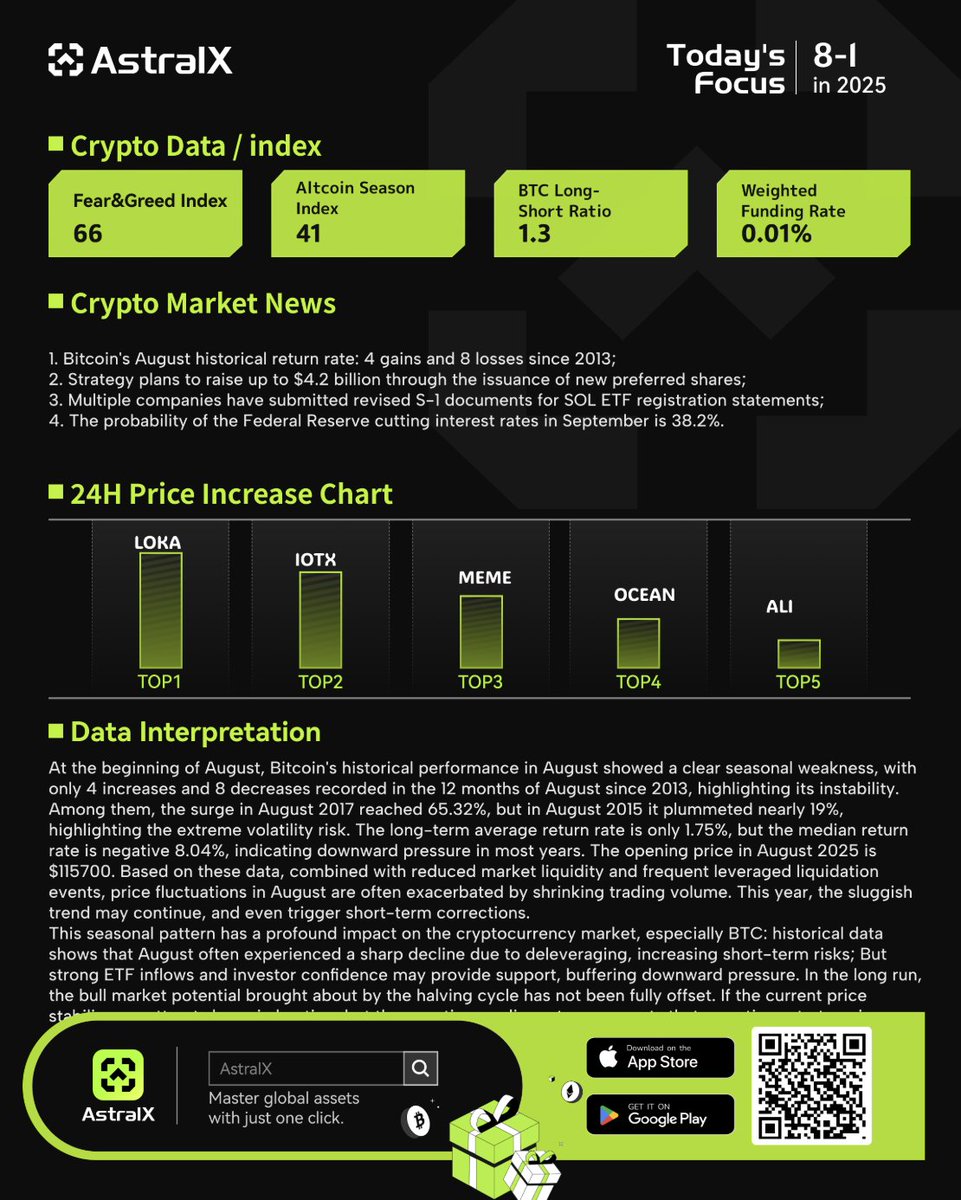

Bitcoin’s performance in August has historically been unpredictable. Since 2013, Bitcoin has experienced 4 gains and 8 losses in August, indicating a slight bearish bias for the month [1]. Despite this, Bitcoin remains a dominant force in the market, with its price movements often setting the tone for altcoins.

Recently, Bitcoin dipped below the $115,000 mark, sparking discussions about whether this is a temporary correction or the beginning of a larger downward trend [2]. Investors are closely monitoring key support levels, with many anticipating a potential rebound if institutional demand remains strong.

—

Ethereum’s Resurgence: A Bullish Momentum Shift

Ethereum (ETH) has shown resilience, climbing back to levels near its March 2024 high of $3,980 [3]. This rebound comes amid increased trading activity in altcoins, suggesting renewed investor confidence in the Ethereum ecosystem. The recent upgrades and DeFi innovations have further strengthened ETH’s position as a leading smart contract platform.

Technical analysts are watching for a potential breakout above $4,000, which could signal a new bullish cycle. However, traders remain cautious, as Ethereum’s price is still influenced by broader market sentiment and macroeconomic factors.

—

Altcoin Spotlight: Lista DAO (LISTA) and Polymesh (POLYX)

Lista DAO (LISTA) – A Strong Uptrend

Lista DAO (LISTA) has seen impressive gains, with a 41.05% increase over 60 days and 62.63% over 90 days [4]. Trading at approximately $0.2757, LISTA is attracting attention due to its decentralized governance model and utility within the DeFi space.

Polymesh (POLYX) – Volatility and Recovery

Polymesh (POLYX), currently trading at $0.1464, has experienced significant volatility, with a YTD decline of 47.02% [5]. However, over the past 60 days, it has shown a positive trend, indicating potential recovery. Investors are watching for further developments in its regulatory-compliant blockchain solutions.

—

Market Strategies and Institutional Moves

Strategy’s $4.2 Billion Fundraising Plan

Strategy, a major player in the crypto space, is planning to raise up to $4.2 billion through the issuance of new preferred shares [6]. This move suggests confidence in the long-term growth of digital assets, despite short-term market fluctuations.

VAPE’s BNB Treasury Program

VAPE has launched the world’s largest BNB treasury program, creating structured arbitrage opportunities in the cryptocurrency market [7]. This initiative could further stabilize BNB’s price while providing liquidity benefits to traders.

—

Trading Insights: Execution Over Analysis

A recent trader’s experience highlights a critical lesson in crypto trading: execution matters more than analysis [8]. Despite a well-researched strategy, a misplaced stop-limit order led to an early exit, missing out on a profitable trade. This underscores the importance of precision in trade execution, even when technical analysis is sound.

—

Crypto Resources and Tools for Traders

For those looking to stay informed, several top crypto podcasts and resources provide in-depth analysis, market insights, and expert interviews [9]. Platforms like CoinDesk, The Pomp Podcast, and Unchained are valuable for traders seeking a competitive edge.

Additionally, automated trading tools are becoming essential for maximizing profits, offering real-time market insights and streamlined analysis [10]. These tools help traders make faster, more informed decisions in a fast-moving market.

—

Conclusion: Navigating the Crypto Market in 2025

The cryptocurrency market in August 2025 presents both opportunities and challenges. Bitcoin’s historical trends suggest caution, while Ethereum’s rebound indicates bullish potential. Altcoins like LISTA and POLYX are showing promising movements, and institutional strategies are shaping market dynamics.

For traders, the key takeaway is to balance analysis with execution precision. Whether through automated tools, expert insights, or disciplined trading strategies, staying adaptable in this volatile market is crucial.

As the crypto landscape continues to evolve, investors must remain vigilant, leveraging both technical and fundamental analysis to navigate the ever-changing digital asset ecosystem.

—

References