Solana’s NFT Market: A Resilient Recovery and Growing Adoption

Introduction: A Glimpse into Solana’s NFT Renaissance

The cryptocurrency and NFT markets are known for their volatility, but recent trends suggest that Solana’s NFT ecosystem is experiencing a strong recovery. With increased bidding activity and growing adoption, the network is proving its resilience despite past challenges. This report explores the factors driving Solana’s NFT resurgence, the role of smart money in the market, and the broader implications for blockchain adoption.

—

Solana’s NFT Volume: A Strong Recovery

1. Increased Bidding Activity in Top Collections

Recent data indicates that Solana’s NFT trading volume has rebounded significantly. Top collections are seeing heightened bidding activity, suggesting renewed investor interest. This recovery aligns with broader market trends where NFTs are regaining traction as digital assets with long-term value.

2. Network Adoption Driven by Speed and Low Fees

Solana’s appeal lies in its fast transaction times and low fees, making it an attractive alternative to Ethereum and other high-cost networks. As more users and developers recognize these advantages, adoption continues to grow, further fueling NFT trading activity.

—

Smart Money Moves: The Role of Institutional Investors

1. The $GOB Goblin NFT Club: A Smart Money Play

A recent alert highlighted the $GOB Goblin NFT Club as a potential smart money opportunity. Smart money—typically institutional investors or well-informed traders—often signals market trends before broader participation. The Goblin NFT Club’s analysis suggests that early investors are positioning themselves for future gains, indicating confidence in the project’s long-term potential.

2. Exclusive Insights and Private Channels

Smart money often operates in private channels, sharing exclusive insights before public disclosure. This trend underscores the importance of staying informed through trusted sources, as early access to information can provide a competitive edge in the NFT market.

—

On-Chain Analysis: Uncovering Hidden Trends

1. The NFT Torch Phenomenon

An intriguing on-chain analysis revealed that the NFT torch—a symbolic digital asset—had two test deployments before its official launch. Additionally, the first torchbearer received an already-lit torch, meaning the NFT was minted before the official event. This highlights how on-chain data can uncover hidden narratives and strategic moves within NFT projects.

2. The Importance of On-Chain Transparency

On-chain analysis provides transparency, allowing investors to track NFT movements, smart contract interactions, and market trends. This level of visibility is crucial for making informed decisions in a decentralized ecosystem.

—

Educational Initiatives: Bridging Knowledge Gaps

1. The Nordic Model: Socialist or Capitalist?

An upcoming educational session will analyze the “Nordic model,” exploring whether it leans more toward socialism or capitalism. This discussion is relevant in the context of decentralized finance (DeFi) and blockchain governance, where economic models influence project structures and community engagement.

2. The Role of Education in Web3 Adoption

As blockchain technology evolves, education remains a critical factor in driving adoption. Initiatives like these help demystify complex concepts, making Web3 more accessible to a broader audience.

—

ZORA Token: A SocialFi Hub with Instant Liquidity

1. ZORA’s Evolution from NFT Marketplace to SocialFi Hub

ZORA, initially an NFT marketplace, has evolved into a SocialFi (social finance) hub. The platform tokenizes content as tradable ERC-20 “Content Coins,” offering instant liquidity. This innovation bridges the gap between digital content creation and financial markets, creating new opportunities for creators and investors.

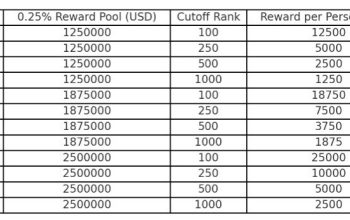

2. Tokenomics and Market Potential

With a max supply of 10 billion and 3.21 billion tokens already in circulation, ZORA’s tokenomics suggest a balanced approach to supply and demand. The project’s focus on social engagement and content monetization positions it as a key player in the evolving NFT and DeFi landscape.

—

Bitcoin’s Consolidation: A Potential Breakout Ahead

1. Bitcoin’s Descending Triangle Pattern

Bitcoin is currently consolidating within a descending triangle pattern, a technical formation that often precedes a breakout. A decisive move could signal the next major trend, whether bullish or bearish. Traders are closely monitoring price action to gauge the next directional shift.

2. Implications for the Broader Crypto Market

Bitcoin’s movements often influence altcoins and NFT markets. A bullish breakout could reignite interest in Solana and other blockchain projects, while a breakdown might lead to short-term corrections. Understanding these dynamics is essential for navigating the volatile crypto landscape.

—

Conclusion: The Future of Solana and NFTs

Solana’s NFT market is showing strong signs of recovery, driven by increased adoption, smart money activity, and innovative projects like ZORA. While Bitcoin’s consolidation adds uncertainty, the broader trends suggest a resilient and evolving ecosystem.

As blockchain technology continues to mature, education, on-chain transparency, and smart investment strategies will play pivotal roles in shaping the future of digital assets. The key takeaway? Stay informed, remain adaptable, and leverage data-driven insights to navigate the ever-changing crypto landscape.

—

Sources