The Transformative Potential of Square’s Bitcoin Integration

Introduction: A Paradigm Shift in Digital Payments

The intersection of traditional finance and cryptocurrency has long been a topic of intrigue and speculation. Square, the financial services and digital payments company, has taken a bold step into this realm by enabling Bitcoin payments through its point-of-sale (POS) systems. This move, powered by the Lightning Network, is not just a technological upgrade but a strategic pivot that could redefine the landscape of digital payments. The integration of Bitcoin into Square’s ecosystem is a testament to the growing acceptance of cryptocurrencies as a viable medium of exchange. This report explores the nuances of this development, its implications for merchants and consumers, and the broader impact on the financial ecosystem.

The Lightning Network: A Catalyst for Bitcoin Adoption

The Lightning Network is a layer-two solution designed to address the scalability issues of the Bitcoin blockchain. It operates by creating payment channels between users, allowing for off-chain transactions that are settled on the main blockchain only when the channel is closed. This approach significantly reduces transaction fees and speeds up processing times, making Bitcoin a practical option for everyday transactions.

For Square, the Lightning Network is a game-changer. It enables merchants to accept Bitcoin payments without the delays and high fees that have historically been associated with Bitcoin transactions. This is particularly important for small businesses, where transaction costs can significantly impact profitability. By leveraging the Lightning Network, Square is not only enhancing the user experience but also addressing one of the most significant barriers to Bitcoin adoption.

Square’s Strategic Approach to Bitcoin Integration

Square’s approach to Bitcoin integration is comprehensive and multifaceted. It goes beyond merely enabling Bitcoin payments; it aims to create an ecosystem that makes Bitcoin accessible and useful for both merchants and consumers. Here are the key components of Square’s strategy:

Bitcoin Payments via Lightning Network

The core of Square’s Bitcoin strategy is the integration of the Lightning Network into its POS systems. This allows merchants to accept Bitcoin payments with near-instantaneous settlement and minimal fees. The Lightning Network’s ability to handle microtransactions makes it ideal for everyday purchases, from coffee to groceries.

Bitcoin Conversion Program

Square is piloting a program that allows merchants to automatically convert a percentage of their daily sales into Bitcoin. This feature is particularly beneficial for merchants who want to accumulate Bitcoin as part of their business operations without actively purchasing it. It serves as a form of micro-investing, enabling merchants to build their Bitcoin holdings gradually.

Bitkey Integration

Bitkey, Square’s self-custody Bitcoin wallet, is another critical component of the ecosystem. By integrating Bitkey with Square’s POS systems, the company aims to provide users with a seamless experience for managing and spending their Bitcoin. This integration promotes self-custody, empowering users to take control of their digital assets.

Focus on Bitcoin Mining

Square’s investment in Bitcoin mining reflects its broader commitment to the Bitcoin ecosystem. By contributing to the security and sustainability of the Bitcoin network, Square is positioning itself as a key player in the cryptocurrency space. This investment also aligns with the company’s vision of a decentralized financial system.

The Impact on Merchants: Opportunities and Challenges

For merchants, the integration of Bitcoin payments through Square presents a range of opportunities and challenges.

Opportunities

- Attracting New Customers: Accepting Bitcoin can attract a new segment of customers who are passionate about cryptocurrency. These customers are often early adopters and tech enthusiasts who actively seek businesses that accept Bitcoin.

- Lower Transaction Fees: Bitcoin transactions via the Lightning Network can be significantly cheaper than traditional credit card processing fees. This can translate into substantial cost savings for merchants, especially those with high transaction volumes.

- Enhanced Security: Bitcoin transactions are cryptographically secure, reducing the risk of fraud and chargebacks. This can provide merchants with greater peace of mind and reduce administrative overhead.

- Global Reach: Bitcoin is a global currency, meaning that merchants can accept payments from customers anywhere in the world without worrying about currency conversion fees or cross-border transaction restrictions.

Challenges

- Bitcoin Volatility: The price of Bitcoin can fluctuate significantly, making it challenging for merchants to manage their Bitcoin holdings. However, Square’s conversion program can mitigate this risk by allowing merchants to immediately convert their Bitcoin payments into fiat currency.

- Regulatory Uncertainty: The regulatory landscape for Bitcoin is still evolving, which can create uncertainty for merchants. It’s important for merchants to stay informed about the latest regulations and ensure that they are compliant.

- Customer Education: Some customers may be unfamiliar with Bitcoin and the Lightning Network. Merchants may need to provide education and support to help customers understand how to use Bitcoin for payments.

Broader Implications: Accelerating Mainstream Adoption

Square’s Bitcoin integration has the potential to accelerate the mainstream adoption of cryptocurrency. By making it easier for merchants to accept Bitcoin payments, Square is lowering the barriers to entry for both businesses and consumers. This could lead to a significant increase in the number of people using Bitcoin for everyday transactions.

Furthermore, Square’s initiatives could have a profound impact on the future of finance. By promoting self-custody and empowering users to take control of their digital assets, Square is challenging the traditional banking system. This could lead to a more decentralized and accessible financial system, where individuals have greater control over their money.

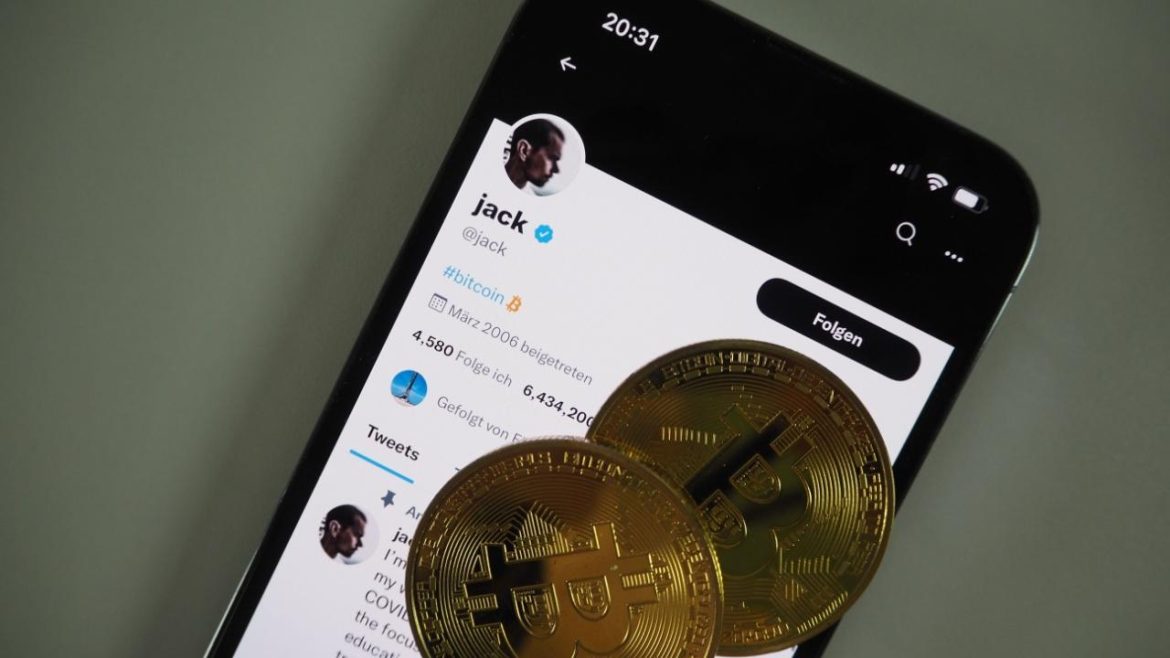

Jack Dorsey’s vision of Bitcoin as the “currency of the internet” may be closer than ever before. Square’s Bitcoin integration is a major step towards realizing this vision. As more merchants and consumers adopt Bitcoin, it could become an increasingly important part of the global economy.

Concerns and Criticisms: Addressing the Elephants in the Room

Despite the potential benefits, Square’s Bitcoin initiative is not without its critics. Concerns about Bitcoin’s volatility remain a key point of contention. The price of Bitcoin can fluctuate wildly, which could make it risky for merchants to hold Bitcoin for extended periods. While Square’s conversion program mitigates this risk, it also means that merchants may not fully benefit from potential Bitcoin price appreciation.

Another concern is the potential for centralization. While Bitcoin itself is decentralized, Square is a centralized company. Some critics worry that Square’s dominance in the POS market could give it undue influence over the Bitcoin ecosystem. If Square becomes the primary gateway for Bitcoin payments, it could potentially censor transactions or impose its own rules on the network.

However, it’s important to note that Square is not the only company working on Bitcoin payment solutions. There are many other companies and developers building innovative tools and services that promote decentralization and user autonomy. The competitive landscape ensures that no single entity can monopolize the Bitcoin ecosystem.

Conclusion: A New Era for Digital Payments

Square’s rollout of Bitcoin payments represents a pivotal moment for the cryptocurrency. By leveraging the Lightning Network and integrating Bitcoin into its popular POS system, Square is making Bitcoin more accessible and usable for millions of merchants and consumers. While challenges remain, the potential benefits are undeniable. This initiative could accelerate the mainstream adoption of Bitcoin and pave the way for a more decentralized and accessible financial system. Only time will tell if Square’s Bitcoin bet will pay off, but one thing is certain: the future of payments is being reshaped before our eyes. The question isn’t whether Bitcoin will have a place, but how big that place will be. As the world watches, Square’s bold move could very well be the catalyst that propels Bitcoin into the mainstream, heralding a new era for digital payments.