The Gathering Storm: Analyzing Senator Lummis’s Call for Powell’s Resignation

Introduction

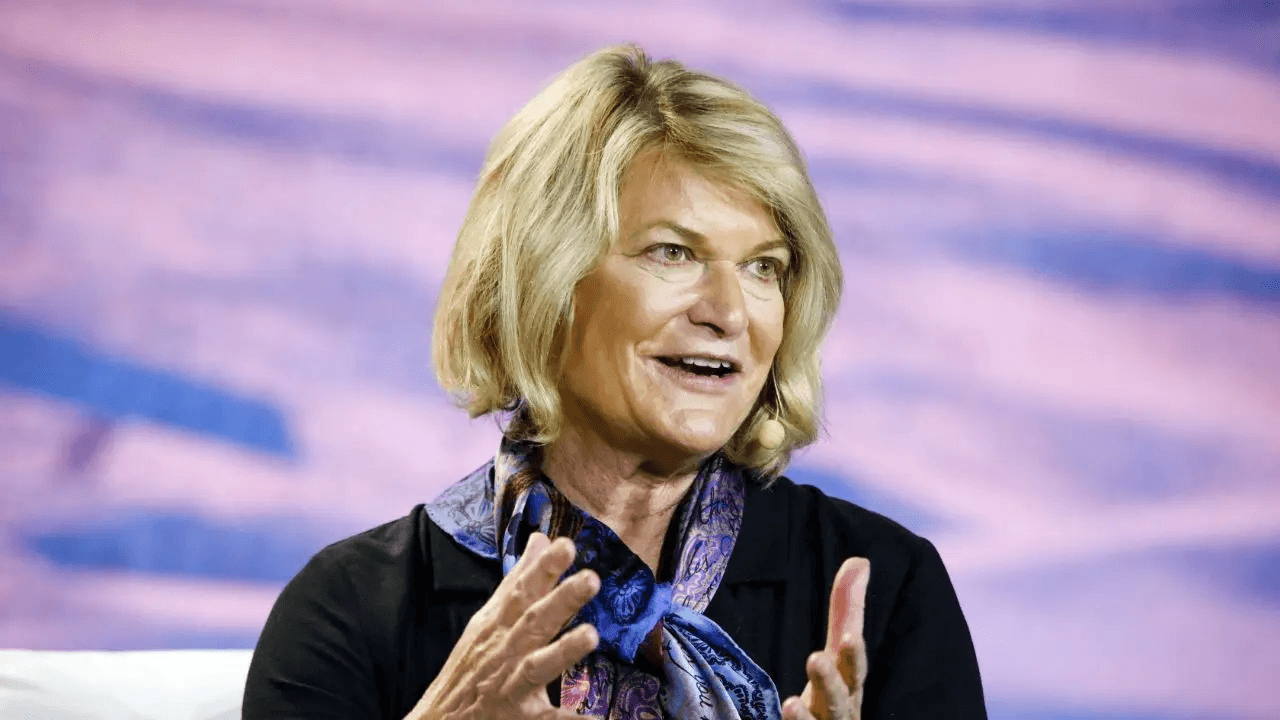

The political landscape is rarely static, but when calls for the resignation of a figure as prominent as the Federal Reserve Chair emerge from within the Senate, it signals a potentially significant shift in the power dynamics and policy debates shaping the nation’s economic future. Senator Cynthia Lummis’s public demand for Jerome Powell’s resignation is not merely a fleeting criticism; it is a calculated move, laden with implications for the Fed’s independence, the future of monetary policy, and the broader acceptance of digital assets. This report delves into the underlying reasons for Lummis’s stance, the potential consequences of Powell’s departure, and the wider context of political pressures mounting on the Federal Reserve.

The Catalyst: A Convergence of Grievances

Senator Lummis’s call for Powell’s resignation isn’t a singular event but the culmination of a series of disagreements and growing dissatisfaction. Her publicly stated reasons center around several key areas: Powell’s perceived mishandling of the economy, his alleged role in policies that stifle the digital asset industry, and a more general concern about the Fed’s direction under his leadership.

Inflation and Monetary Policy

One of the primary drivers behind Lummis’s discontent appears to be her belief that Powell’s monetary policies have failed to adequately address persistent inflation. The senator, known for her fiscal conservatism, likely views the Fed’s response to rising prices as insufficient or misdirected, arguing that current strategies are not effectively curbing inflation. This critique resonates with broader Republican concerns about the potential for excessive government spending and inflationary policies.

Digital Asset Industry

Beyond general economic concerns, Lummis has specifically accused Powell of enabling “Operation Chokepoint 2.0,” a policy that she argues is crippling the U.S. digital asset industry. This accusation suggests a belief that the Fed, under Powell’s leadership, is actively working to marginalize or suppress the growth of cryptocurrencies and related businesses. Given Lummis’s well-known advocacy for Bitcoin and digital assets, this issue likely represents a significant point of contention.

Leadership and Communication

Furthermore, Lummis has criticized Powell’s preparedness and accuracy during congressional testimony, suggesting a lack of attention to detail or a failure to fully grasp the implications of his policies. This criticism touches on Powell’s leadership capabilities and his ability to effectively communicate the Fed’s actions and intentions to Congress and the public.

The Ripple Effect: Potential Consequences of Powell’s Departure

The resignation of a Federal Reserve Chair is a momentous event with far-reaching consequences. Powell’s departure, particularly under pressure from a sitting senator, could trigger a cascade of effects, impacting the Fed’s credibility, monetary policy, and the overall economic climate.

Political Interference

One of the most immediate concerns would be the potential for increased political interference in the Fed’s operations. The Fed is designed to be an independent body, insulated from short-term political pressures, allowing it to make decisions based on long-term economic considerations. If Powell were to resign under pressure, it could set a precedent for future administrations or lawmakers to exert undue influence on the central bank, potentially compromising its independence and credibility.

Monetary Policy Shifts

A change in leadership at the Fed could also lead to a shift in monetary policy. A new Chair might have different priorities and approaches to managing inflation, unemployment, and economic growth. This could result in changes to interest rates, quantitative easing policies, and other key tools used by the Fed to influence the economy. Such policy shifts could have significant implications for businesses, consumers, and investors.

Market Volatility

Furthermore, Powell’s resignation could create uncertainty in financial markets. The Fed’s actions are closely watched by investors around the world, and any sudden change in leadership could trigger volatility and instability. Investors might become more cautious, leading to a decline in stock prices and other asset values.

Digital Asset Industry

Finally, Powell’s departure could have a chilling effect on the digital asset industry. If Lummis’s accusations of “Operation Chokepoint 2.0” are accurate, a new Chair might be more receptive to the concerns of the cryptocurrency community and less inclined to pursue policies that stifle innovation in this space. Conversely, a new Chair could also take an even more cautious or restrictive approach to digital assets, depending on their views and priorities.

The Broader Context: Political Pressures and the Future of the Fed

Senator Lummis’s call for Powell’s resignation is not an isolated incident but part of a broader trend of increasing political scrutiny and pressure on the Federal Reserve. In recent years, the Fed has faced criticism from both sides of the political spectrum, with Republicans often accusing it of being too dovish on inflation and Democrats pushing for policies that prioritize employment and social equity.

Increasing Politicization

The increasing politicization of the Fed reflects a growing recognition of the central bank’s immense power and influence over the economy. As the Fed’s role has expanded in the wake of financial crises and economic downturns, lawmakers and the public have become more aware of its ability to shape economic outcomes and impact people’s lives.

Calls for Reform

This increased awareness has led to calls for greater accountability and transparency at the Fed. Some lawmakers have proposed reforms to the Fed’s governance structure, seeking to make it more representative and responsive to the needs of the public. Others have called for greater transparency in the Fed’s decision-making process, arguing that the public has a right to know how the central bank is using its power.

Navigating Competing Pressures

The future of the Federal Reserve will likely depend on how it navigates these competing pressures. The Fed must maintain its independence and credibility while also being responsive to the needs of the economy and the concerns of the public. This will require strong leadership, clear communication, and a willingness to engage in dialogue with lawmakers and other stakeholders.

A Fork in the Road: Navigating Economic and Political Turbulence

Senator Lummis’s challenge to Jerome Powell represents more than just a personal disagreement. It highlights the deep-seated tensions surrounding monetary policy, the rise of digital assets, and the appropriate role of the Federal Reserve in a rapidly changing world. Whether Powell ultimately resigns or weathers this storm, the episode serves as a stark reminder of the political pressures facing the Fed and the need for a thoughtful and balanced approach to navigating the complex economic challenges ahead. The coming months will undoubtedly be a period of intense scrutiny and debate, with the future of the Fed, and perhaps the broader economy, hanging in the balance.