A New Dawn for Digital Assets: Analyzing the GENIUS Act and its Impact

Introduction

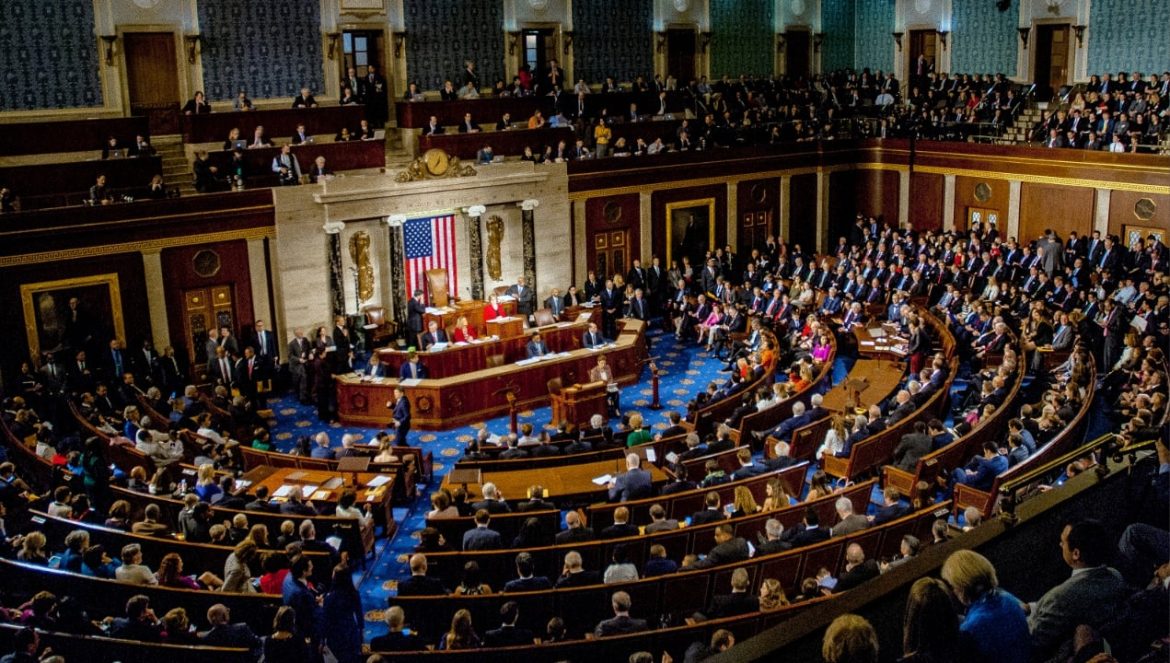

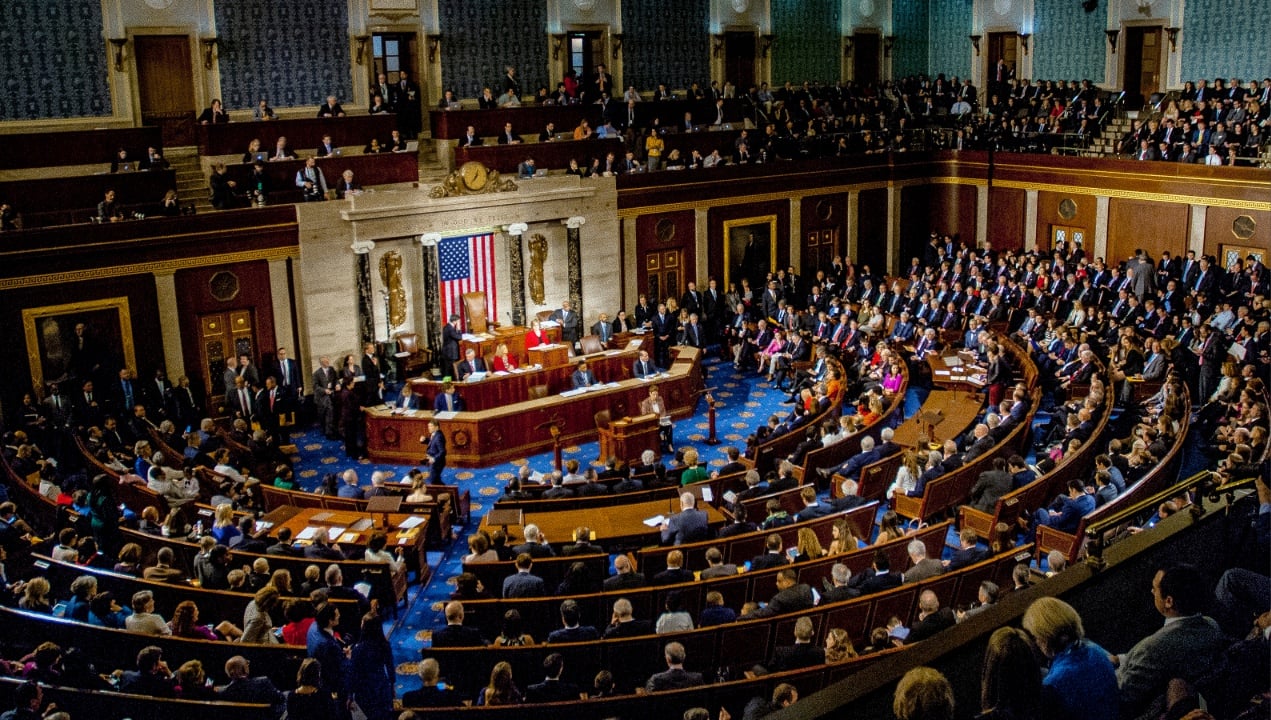

The cryptocurrency landscape has long been characterized by rapid innovation and regulatory ambiguity. However, recent developments indicate a significant shift towards stability and maturity. The passage of the Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act by the U.S. House of Representatives, followed by its signing into law, marks a pivotal moment for the industry. Coupled with Ethereum’s impressive surge against Bitcoin and XRP’s resurgence, these events suggest a new era of growth and legitimacy for digital assets. This report delves into the details of these developments and explores their broader implications.

The GENIUS Act: A Framework for Stablecoin Regulation

The GENIUS Act represents the first major crypto legislation passed by Congress, aiming to establish a clear regulatory framework for stablecoins in the United States. Stablecoins, which are pegged to stable assets like the U.S. dollar, serve as a bridge between traditional finance and the decentralized world of cryptocurrencies. They provide stability and efficiency for transactions, making them essential for trading, lending, and payments.

Key Provisions and Objectives

The GENIUS Act is designed to achieve several critical objectives:

The passage of the GENIUS Act has been met with widespread approval from industry leaders and experts, who believe it will legitimize the stablecoin market and unlock its full potential.

Ethereum’s Ascendancy: A Challenge to Bitcoin Dominance?

While the GENIUS Act sets the stage for regulatory clarity, another significant trend is emerging in the cryptocurrency market: Ethereum’s remarkable surge against Bitcoin. The ETH/BTC pair has seen an increase of over 50%, fueling speculation about a potential shift in market dominance.

Factors Driving Ethereum’s Growth

Several factors contribute to Ethereum’s recent outperformance:

While Bitcoin remains the largest cryptocurrency by market capitalization, Ethereum’s recent gains suggest that it is becoming an increasingly important player in the digital asset space. Some analysts predict that Ethereum could eventually surpass Bitcoin in market cap, a phenomenon known as “the flippening.”

XRP’s Resurgence: A Comeback Story

Adding another layer of complexity to the crypto narrative is XRP’s recent resurgence. After facing legal challenges and regulatory scrutiny, XRP briefly reclaimed its all-time high of $3.40, demonstrating resilience and renewed investor confidence.

Factors Contributing to XRP’s Recovery

Several factors have contributed to XRP’s recovery:

XRP’s resurgence highlights the potential for even established cryptocurrencies to overcome challenges and regain market share.

Beyond the Headlines: The Broader Implications

The GENIUS Act, Ethereum’s surge, and XRP’s recovery are not isolated events. They are part of a broader trend toward greater maturity, regulation, and diversification in the cryptocurrency market.

Impact on the Financial Landscape

These developments have several important implications for the broader financial landscape:

A Cautiously Optimistic Future

The cryptocurrency market is still relatively young and volatile, and significant challenges remain. However, the passage of the GENIUS Act, Ethereum’s surge, and XRP’s recovery suggest that the industry is maturing and moving toward a more sustainable future.

Navigating the Road Ahead

To ensure the long-term success of the cryptocurrency industry, several key steps are necessary:

A Transformative Era

The confluence of regulatory advancements, technological innovation, and market dynamics suggests that we are entering a transformative era for digital assets. The GENIUS Act provides a foundation for stablecoin regulation, Ethereum challenges Bitcoin’s dominance, and XRP stages a remarkable comeback. These developments signal a future where cryptocurrencies play an increasingly important role in the global financial system. As the industry matures and overcomes its remaining challenges, the potential for digital assets to revolutionize finance and empower individuals around the world is immense.