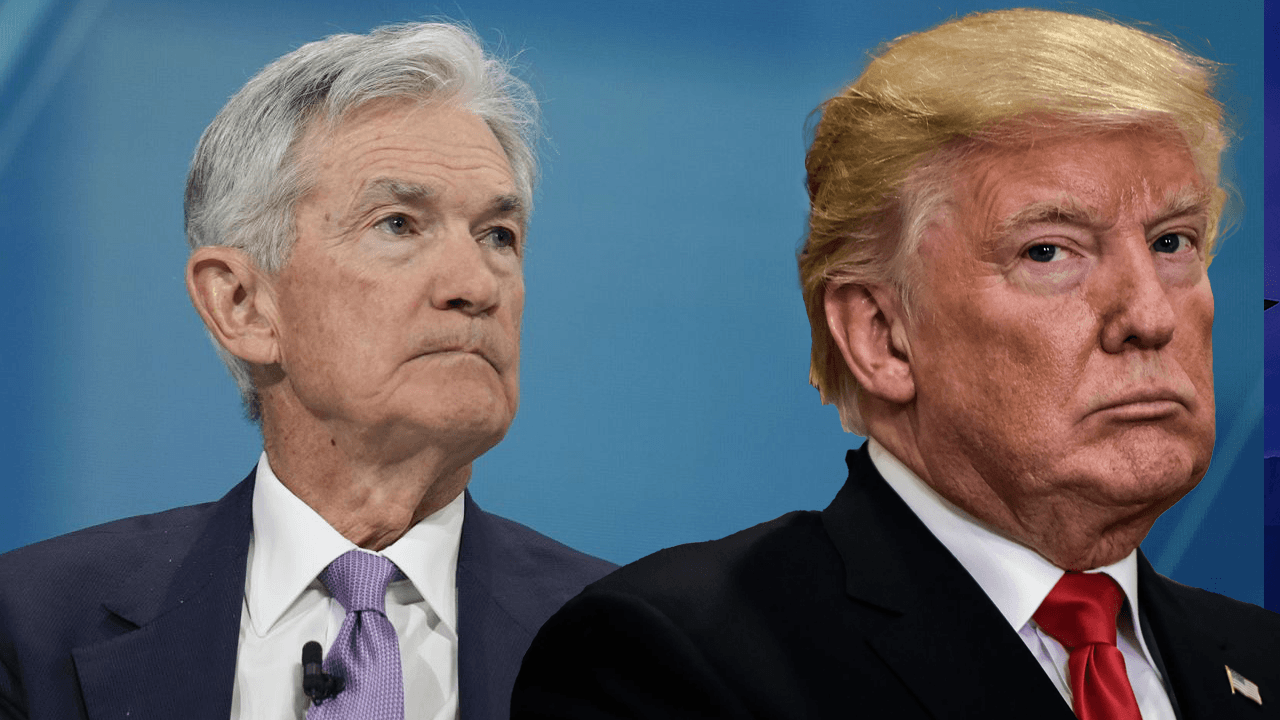

The summer of 2025 presents a fascinating economic landscape in the United States, where the Federal Reserve, President Trump, and financial markets are engaged in a delicate dance over interest rate policy. At the heart of this dynamic is the fading prospect of a July interest rate cut, a development that reflects deeper tensions between monetary policy independence and political pressures. This report examines the factors contributing to the diminished likelihood of a July rate cut, the evolving relationship between the Fed and the Trump administration, and the broader economic implications of this policy stalemate.

Powell’s Data-Dependent Approach and Inflation Challenges

Federal Reserve Chairman Jerome Powell has consistently articulated a data-dependent framework for monetary policy decisions. This approach prioritizes economic indicators such as inflation, employment figures, and GDP growth when determining interest rate adjustments. Powell’s recent testimony before Congress reinforced this stance, emphasizing the need for caution in the face of persistent inflationary pressures.

One of the most significant contributors to inflation in recent months has been the Trump administration’s tariff policies. By raising the cost of imported goods, tariffs have directly impacted consumer prices and business input costs, creating upward pressure on inflation. Powell has acknowledged this connection, noting that the Fed is closely monitoring the inflationary effects of tariffs. The central bank is particularly concerned about the potential for tariffs to create sustained inflation rather than a temporary price shock.

The Fed’s cautious approach is further complicated by the uncertainty surrounding the long-term impact of tariffs. While some economists argue that tariff-induced inflation will be temporary, others warn of more lasting effects on price levels. The Fed is currently in a “moment of truth” regarding tariffs, as it seeks to assess their full impact on inflation. However, July may be too soon to draw definitive conclusions, making a rate cut premature.

Trump’s Advocacy for Immediate Rate Cuts

President Trump has been a vocal proponent of immediate and substantial interest rate reductions. His rationale for lower rates is multifaceted, encompassing political, economic, and market considerations. Trump views a strong economy as essential for his political fortunes, believing that lower interest rates would stimulate growth, boost employment, and support stock market gains ahead of potential elections.

From an economic perspective, Trump argues that lower interest rates would weaken the U.S. dollar, making American exports more competitive and reducing the trade deficit. This aligns with his broader trade agenda, which seeks to rebalance global trade relationships in favor of U.S. industries. However, Trump’s public criticism of the Fed’s policies has raised concerns about political interference in monetary decision-making, potentially undermining the central bank’s independence.

The tension between the Fed and the Trump administration is not new. Throughout his presidency, Trump has frequently clashed with Powell and other Fed officials over monetary policy. These conflicts have intensified market volatility and created uncertainty about the Fed’s ability to operate without political pressure. The current debate over a July rate cut exemplifies this ongoing struggle between economic prudence and political expediency.

Shifting Market Expectations

Market expectations for a July rate cut have undergone a significant shift in recent weeks. Initially, financial markets priced in a relatively high probability of a rate reduction in July, reflecting optimism about the Fed’s willingness to ease policy. However, as Powell and other Fed officials reiterated their commitment to data dependence and inflation control, market sentiment shifted dramatically.

Current market pricing suggests only a 5% chance of a July rate cut, indicating that investors are increasingly aligning with the Fed’s cautious stance. This shift reflects growing recognition of the complexities facing the central bank, including persistent inflation and slowing economic growth. While some analysts remain bullish on the prospects of Trump’s second term, this optimism has not translated into expectations for immediate rate cuts.

The Fed’s challenge is further complicated by mixed economic signals. On the positive side, the labor market remains robust, with unemployment near historic lows and consumer spending holding steady. However, manufacturing activity has weakened, and business investment has been sluggish. These conflicting indicators make it difficult for the Fed to determine the appropriate policy response.

Global Economic Uncertainties and the Fed’s Dilemma

The Fed’s decision-making process is further complicated by global economic uncertainties. Ongoing trade disputes between the U.S. and key trading partners, including China, Canada, and Mexico, have created significant uncertainty. These disputes have the potential to disrupt global supply chains and weigh on economic growth, further complicating the Fed’s policy calculus.

A slowdown in global growth could have spillover effects on the U.S. economy, making the Fed even more cautious about cutting rates. The central bank must balance the risks of premature easing, which could fuel inflation, against the risks of excessive tightening, which could stifle economic growth. This delicate balancing act is central to the Fed’s current dilemma.

Alternative Scenarios and Future Policy Paths

While a July rate cut appears increasingly unlikely, the possibility of easing later in the year remains on the table. The Fed has indicated that it is prepared to adjust its policy stance if economic conditions warrant. If inflation begins to moderate and economic growth slows more significantly, the Fed could consider cutting rates at subsequent meetings. Some analysts predict potential easing in 2025 or beyond, depending on the evolving data.

Another potential scenario is that the Fed could maintain its current policy stance for an extended period. If inflation remains elevated and economic growth remains resilient, the Fed may choose to wait and see how the economy evolves before making further policy changes. This approach would be particularly likely if the Fed believes that the impact of tariffs on inflation is temporary.

The Fed’s Independence and the Political Landscape

The fading prospects of a July rate cut highlight the ongoing tension between political pressures and the Fed’s commitment to data-driven decision-making. As President Trump continues to advocate for lower rates, the Fed faces a critical test of its independence. The central bank must remain steadfast in its commitment to price stability and sustainable economic growth, even in the face of political pressure.

The outcome of this conflict will have significant implications for the U.S. economy. A premature rate cut could fuel inflation and destabilize financial markets, while keeping rates too high could stifle economic growth and lead to a recession. The Fed’s ability to navigate this complex landscape will be crucial for ensuring the long-term health and prosperity of the U.S. economy.

Conclusion: A Delicate Balance Between Policy and Politics

The debate over a July rate cut in 2025 encapsulates the broader challenges facing the Federal Reserve in an era of heightened political scrutiny and economic uncertainty. The Fed’s data-dependent approach, while sound in principle, is complicated by the persistent inflationary effects of tariffs and the mixed signals from the economy. Meanwhile, President Trump’s advocacy for immediate rate cuts reflects a broader political agenda that prioritizes short-term economic gains over long-term stability.

As the Fed navigates this delicate balance, its independence and commitment to economic fundamentals will be tested. The central bank must resist political pressures while carefully assessing the evolving economic landscape. The outcome of this struggle will shape not only the trajectory of U.S. monetary policy but also the broader economic environment in the years to come. Only time will tell whether the Fed can successfully navigate these challenges and maintain its credibility as an independent institution.