Bitcoin and Nvidia: A Tale of Two Titans

The financial and technological landscapes are in a constant state of flux, with new leaders emerging and established players adapting to changing market dynamics. Two entities that have captured global attention are Bitcoin, the pioneering cryptocurrency, and Nvidia, the semiconductor giant at the forefront of the artificial intelligence (AI) revolution. Both have experienced remarkable growth, albeit in vastly different sectors, and their trajectories offer valuable insights into the shifting sands of market dominance.

Bitcoin’s Persistent Climb: Resilience and Market Dynamics

Bitcoin has consistently demonstrated its resilience, navigating regulatory hurdles, market volatility, and macroeconomic uncertainties. Despite these challenges, the cryptocurrency has not only maintained its position as the leading digital asset but has also achieved significant milestones.

Price Surges and Market Capitalization

Bitcoin has experienced notable price surges, driven by factors such as institutional adoption, increased retail interest, and its perceived role as a hedge against inflation. Recent reports indicate that Bitcoin has surpassed $90,000 and is approaching $100,000, with some analysts predicting further upside potential. This surge has propelled Bitcoin’s market capitalization to over $2 trillion, solidifying its dominance in the crypto market.

The cryptocurrency’s price movements are influenced by a variety of factors, including macroeconomic conditions, regulatory developments, and technological advancements. For instance, the U.S. Federal Reserve’s monetary policy decisions can significantly impact Bitcoin’s price, as investors often turn to the digital asset as a hedge against inflation or currency devaluation.

Whale Transactions and Market Activity

The increase in large-volume transactions, often referred to as “whale” transactions, suggests growing confidence among institutional investors and high-net-worth individuals. These transactions can have a significant impact on market dynamics, influencing price movements and overall sentiment.

Whale transactions are particularly noteworthy because they can signal shifts in market sentiment or the accumulation of large positions by institutional investors. For example, a single whale transaction can move the market significantly, especially in less liquid markets. The transparency of blockchain technology allows for the tracking of these transactions, providing valuable insights into market activity.

Mining Sector Dynamics

While Bitcoin’s price gains have been positive for the overall market, the impact on mining companies has been mixed. The increasing difficulty of mining, coupled with energy consumption concerns, has led to challenges for some players in the sector. However, innovative solutions, such as renewable energy-powered mining operations, are emerging to address these concerns.

The mining sector is a critical component of the Bitcoin ecosystem, as it ensures the security and decentralization of the network. However, the sector faces challenges related to energy consumption and environmental impact. As a result, there is a growing trend toward sustainable mining practices, with some companies investing in renewable energy sources to power their operations.

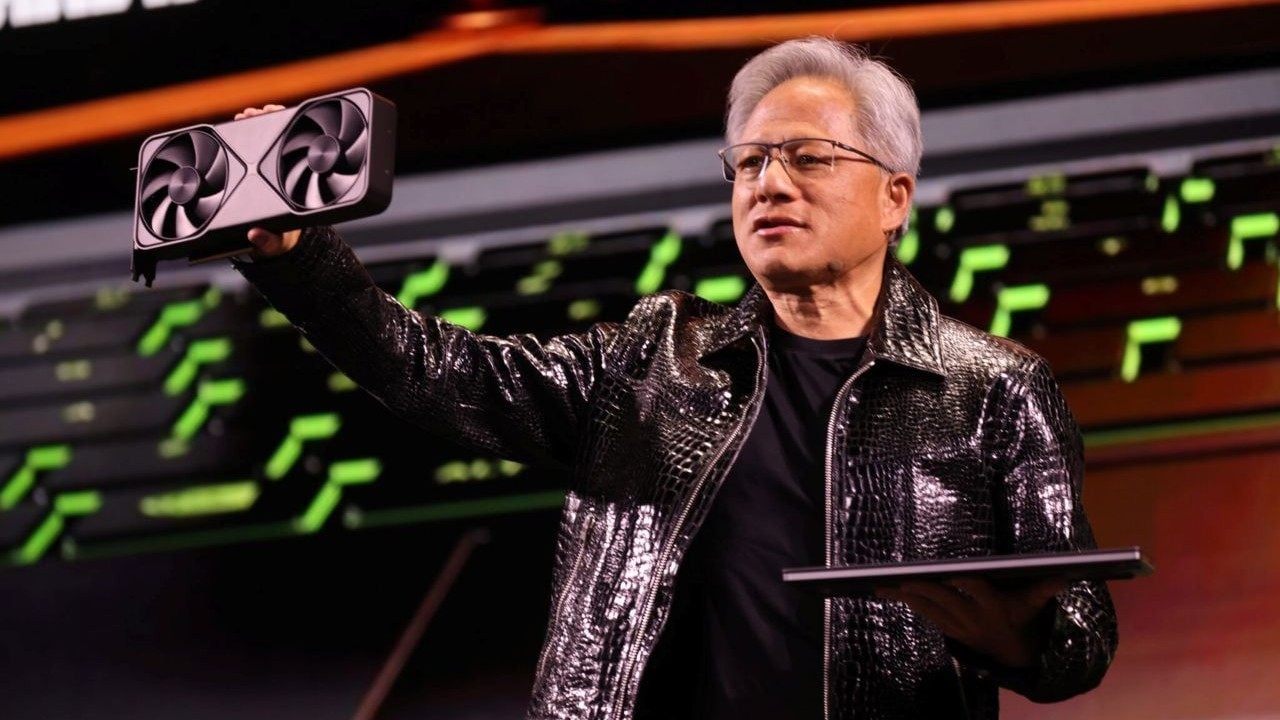

Nvidia’s AI-Fueled Ascent: A New Era of Tech Supremacy

Nvidia’s rise to prominence has been nothing short of meteoric, fueled by the explosive growth of artificial intelligence and its crucial role in powering AI applications. The company’s graphics processing units (GPUs) have become indispensable for training complex AI models, driving demand and propelling its market value to unprecedented heights.

Market Capitalization Milestone

Nvidia has achieved a historic milestone by becoming the first company to reach a $4 trillion market capitalization. This achievement underscores its dominance in the AI chip market and reflects the immense value investors place on its future growth potential.

The company’s market capitalization is a testament to its strong financial performance and growth prospects. Nvidia’s revenue has been growing at a rapid pace, driven by the increasing demand for its GPUs in data centers, gaming, and AI applications. The company’s profitability has also been impressive, with strong margins and cash flow generation.

AI Data Center Designer

Nvidia is taking an added role amid the AI craze: Data-Center Designer. The company is seeking to try to gain ground on Nvidia.

Nvidia’s expansion into data center design is a strategic move that positions the company to capture a larger share of the AI market. By offering end-to-end solutions, including hardware, software, and services, Nvidia can provide a more comprehensive and integrated offering to its customers. This approach can help the company differentiate itself from competitors and drive long-term growth.

Strong Market Position

Despite increasing competition, Nvidia has maintained a strong market position, leveraging its technological advantages and strategic partnerships to stay ahead of the curve. The company’s ability to innovate and adapt to evolving market demands has been key to its success.

Nvidia’s strong market position is underpinned by its technological leadership, with the company investing heavily in research and development to maintain its edge. The company’s strategic partnerships with leading technology companies and cloud providers further strengthen its position in the market.

Beyond Gaming: Expanding Applications

While Nvidia has traditionally been known for its gaming GPUs, the company has successfully diversified its business, with AI and data center applications now representing a significant portion of its revenue. This diversification has reduced its reliance on the cyclical gaming market and positioned it for long-term growth.

Nvidia’s expansion into AI and data center applications has been a key driver of its growth. The company’s GPUs are widely used in data centers for AI training and inference, as well as for high-performance computing (HPC) applications. The growing demand for AI and HPC applications is expected to drive continued growth in these segments.

Billionaires Dumping Nvidia?

Despite Nvidia’s explosive growth, there are reports that some billionaires are shifting their investments away from the company, raising questions about its future prospects. However, analysts remain largely bullish on Nvidia, citing its strong fundamentals and growth potential.

The reports of billionaires dumping Nvidia stocks should be viewed in the context of broader market trends and individual investment strategies. While some investors may be taking profits or reallocating their portfolios, the overall sentiment remains positive, with many analysts maintaining a bullish outlook on the company.

The Interplay Between Bitcoin and Nvidia: A Symbiotic or Competitive Relationship?

The relationship between Bitcoin and Nvidia is complex and multifaceted, characterized by both symbiotic elements and competitive dynamics.

Technological Convergence

Both Bitcoin and Nvidia operate in the realm of cutting-edge technology, albeit in different domains. Bitcoin relies on advanced cryptography and distributed ledger technology, while Nvidia specializes in high-performance computing and AI. The convergence of these technologies could lead to new innovations and opportunities, such as AI-powered crypto trading platforms or blockchain-based data marketplaces for AI training.

The intersection of blockchain and AI technologies presents exciting opportunities for innovation. For example, AI can be used to enhance the security and efficiency of blockchain networks, while blockchain can provide a decentralized and transparent platform for AI data sharing and collaboration.

Market Sentiment and Investor Flows

Market sentiment can play a significant role in influencing the performance of both Bitcoin and Nvidia. Positive news or developments in one sector can often spill over into the other, driving investor interest and capital flows. Conversely, negative news or regulatory concerns can have a dampening effect on both markets.

The interconnectedness of financial markets means that developments in one sector can have ripple effects on others. For instance, positive news about AI advancements can boost investor confidence in Nvidia, while regulatory clarity in the crypto space can drive Bitcoin prices higher.

Competition for Capital

While Bitcoin and Nvidia operate in different industries, they both compete for investor capital. Investors may choose to allocate funds to either Bitcoin or Nvidia based on their risk tolerance, investment objectives, and perceived growth potential. This competition can lead to shifts in market dominance and relative performance.

The competition for capital is a natural aspect of financial markets, with investors constantly evaluating opportunities and reallocating their portfolios. The relative performance of Bitcoin and Nvidia will depend on their ability to deliver strong returns and meet investor expectations.

Nvidia Impact

Bitcoin prices ease below $62,000 after spiking on Fed Chair Powell’s Friday speech. Nvidia to report, influencing stocks and cryptos.

The interplay between Bitcoin and Nvidia is evident in their market movements, with developments in one sector often influencing the other. For example, Nvidia’s earnings reports can impact investor sentiment in the broader tech sector, which can in turn affect Bitcoin prices.

Bitcoin Surges Amid Nvidia Slump

Bitcoin gains momentum as Nvidia’s slump and upcoming crypto IPOs create opportunities for higher valuations and growth.

The relative performance of Bitcoin and Nvidia can vary based on market conditions and investor sentiment. For instance, during periods of market volatility, investors may turn to Bitcoin as a hedge, while during periods of strong economic growth, they may favor Nvidia’s growth prospects.

Factors Influencing Future Performance

Looking ahead, the future performance of Bitcoin and Nvidia will be influenced by a variety of factors.

Technological Innovation

Continued innovation in both the cryptocurrency and AI sectors will be critical for driving growth and maintaining competitiveness. Bitcoin developers are working on scaling solutions and privacy enhancements, while Nvidia is investing heavily in next-generation GPUs and AI software platforms.

Technological innovation is a key driver of growth in both sectors. For Bitcoin, advancements in scaling solutions and privacy features can enhance its usability and adoption. For Nvidia, investments in next-generation GPUs and AI software platforms can position the company for long-term growth.

Regulatory Landscape

Regulatory developments will continue to play a significant role in shaping the trajectory of Bitcoin and other cryptocurrencies. Clarity on issues such as taxation, security classification, and anti-money laundering compliance will be essential for fostering mainstream adoption.

The regulatory landscape for cryptocurrencies is evolving, with different jurisdictions taking varying approaches. Clear and favorable regulations can foster innovation and adoption, while restrictive regulations can hinder growth.

Macroeconomic Conditions

Macroeconomic factors, such as inflation, interest rates, and economic growth, can impact investor sentiment and risk appetite, influencing the performance of both Bitcoin and Nvidia.

Macroeconomic conditions play a crucial role in shaping market dynamics. For instance, during periods of high inflation, investors may turn to Bitcoin as a hedge, while during periods of strong economic growth, they may favor Nvidia’s growth prospects.

Adoption and Use Cases

The broader adoption of Bitcoin as a medium of exchange and store of value will be crucial for its long-term success. Similarly, the expansion of AI applications across various industries will drive demand for Nvidia’s products and services.

Adoption and use cases are critical for the long-term success of both Bitcoin and Nvidia. For Bitcoin, broader adoption as a medium of exchange and store of value can drive demand and price appreciation. For Nvidia, the expansion of AI applications across industries can drive demand for its GPUs and other products.

Competition

The competitive landscape in both the cryptocurrency and AI sectors is becoming increasingly crowded. New entrants and established players are vying for market share, which could put pressure on profit margins and growth rates.

Competition is a natural aspect of financial markets, with new entrants and established players constantly vying for market share. For Bitcoin, competition from other cryptocurrencies and blockchain projects can impact its dominance. For Nvidia, competition from other semiconductor companies can impact its market share and profitability.

Conclusion

The contrasting but intertwined narratives of Bitcoin and Nvidia highlight the dynamic and ever-changing nature of the financial and technological landscapes. While Bitcoin continues its journey toward mainstream acceptance and higher valuations, Nvidia has emerged as a dominant force in the AI revolution, captivating investors with its growth potential. As both titans navigate the complexities of their respective markets, their success will depend on their ability to innovate, adapt, and capitalize on emerging opportunities. The future promises to be an exciting chapter in the ongoing saga of Bitcoin and Nvidia, with profound implications for the global economy and the future of technology.