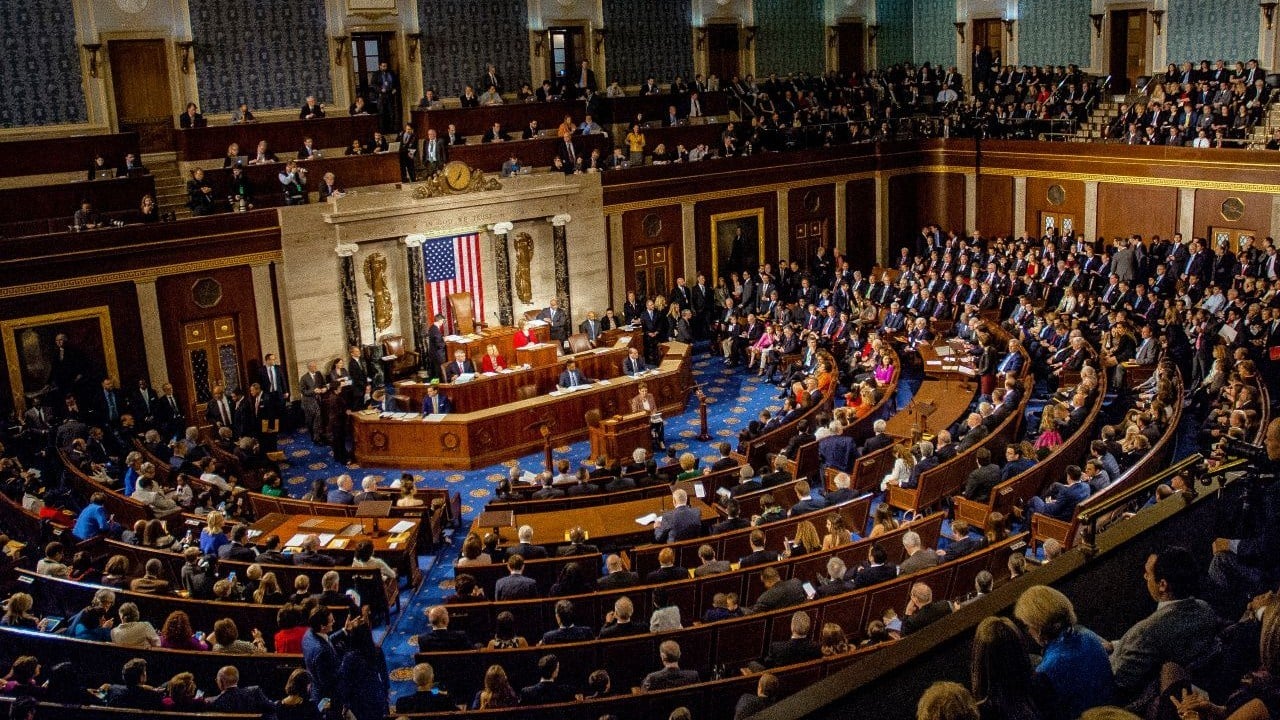

The digital asset landscape in the United States is on the brink of a transformative period. The US House of Representatives has designated the week of July 14th as “Crypto Week,” signaling an unprecedented legislative push to address the regulatory ambiguities surrounding cryptocurrencies and blockchain technologies. This initiative, led by Republican House leaders, aims to establish a clear framework for digital assets, protect against government overreach, and foster innovation. However, the journey toward comprehensive crypto legislation is fraught with political and technical challenges that could shape the future of the industry in the US.

The Legislative Framework: Three Key Bills

The cornerstone of “Crypto Week” is a trio of bills designed to tackle critical issues in the crypto ecosystem. Each bill addresses a distinct challenge, from regulatory clarity to consumer protection and technological innovation.

The CLARITY Act: Resolving Regulatory Ambiguity

The CLARITY Act, or “Creating Legal Accountability for Rigid Terms Involving crypto assets and Innovative Technologies Act,” seeks to resolve the long-standing debate over the classification of digital assets. Currently, the crypto industry operates in a regulatory gray area, with the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) often at odds over jurisdiction. The CLARITY Act proposes a framework to determine whether a digital asset should be classified as a security or a commodity, considering factors such as decentralization, use case, and ownership rights. This clarity could unlock billions in investment and innovation, as businesses gain confidence in compliance requirements.

The Anti-CBDC Surveillance State Act: Safeguarding Financial Privacy

The Anti-CBDC Surveillance State Act addresses concerns about central bank digital currencies (CBDCs) and their potential for government surveillance. While CBDCs could streamline financial transactions, critics warn of the risks of financial tracking and control. This legislation aims to prevent the Federal Reserve from issuing a CBDC without explicit congressional approval and includes provisions to protect user privacy. The bill reflects a growing bipartisan concern about the balance between financial innovation and individual liberties.

The GENIUS Act: Fostering Innovation

The GENIUS Act, though details are scarce, is expected to focus on promoting technological advancements in the crypto space. Likely provisions include regulatory sandboxes, tax incentives for blockchain development, and measures to position the US as a global leader in digital asset innovation. By reducing regulatory barriers, the GENIUS Act could accelerate the adoption of blockchain technology across industries, from finance to supply chain management.

Political Dynamics: A Delicate Balancing Act

The legislative process is never straightforward, and “Crypto Week” is no exception. Political divides, regulatory turf wars, and shifting alliances could influence the outcome of these bills.

Republican Leadership vs. Democratic Skepticism

House Republicans are driving the legislative agenda, reflecting a broader recognition of crypto’s economic potential. However, Democrats remain cautious, citing concerns about consumer protection, financial stability, and illicit finance. This partisan divide could lead to amendments or delays in passing the proposed bills, particularly if Democrats perceive the legislation as insufficiently protective of consumers.

The Trump Factor: A Polarizing Influence

Former President Donald Trump’s growing interest in crypto adds another layer of complexity. While his support could mobilize Republican voters in favor of crypto-friendly policies, it may also alienate Democrats wary of aligning with Trump. Additionally, reports of Trump’s financial ties to crypto ventures could fuel debates about conflicts of interest, further polarizing the discussion.

The SEC-CFTC Jurisdictional Conflict

The ongoing rivalry between the SEC and the CFTC over regulatory jurisdiction poses a significant hurdle. Both agencies claim authority over different aspects of the crypto market, creating confusion for businesses. Resolving this jurisdictional ambiguity is critical for establishing a cohesive regulatory framework. The CLARITY Act could play a pivotal role in defining the boundaries between the two agencies, but reaching a consensus will require careful negotiation.

Broader Implications for the Crypto Ecosystem

The outcome of “Crypto Week” will have far-reaching consequences for the crypto industry, influencing innovation, investment, and consumer trust.

Impact on Innovation and Investment

A clear regulatory framework could attract significant investment and spur innovation. The CLARITY Act, in particular, could provide the certainty needed for startups and established firms to develop new products and services. Conversely, a lack of clarity could deter investment, pushing businesses to more crypto-friendly jurisdictions like Singapore or Switzerland.

Consumer Protection and Market Stability

Consumer protection is a top priority for policymakers, especially after the collapse of major crypto firms like FTX and Celsius. The proposed legislation may include measures to safeguard investors from fraud and market manipulation. However, balancing innovation with consumer protection will be a delicate task, as overly restrictive regulations could stifle growth.

The Future of CBDCs in the US

The Anti-CBDC Surveillance State Act could significantly impact the future of CBDCs in the US. If passed, the bill would require congressional approval before the Federal Reserve could issue a CBDC, ensuring that any such currency prioritizes privacy and financial freedom. This legislation reflects a broader debate about the role of government in the digital economy.

Effects on Bitcoin and Altcoins

The CLARITY Act’s definitions will directly affect Bitcoin and altcoins. A clear classification of these assets could encourage further development and adoption. For example, if Bitcoin is definitively classified as a commodity, it may benefit from the CFTC’s more flexible regulatory approach compared to the SEC’s stricter securities framework. Similarly, altcoins could see increased innovation if their regulatory status is clarified.

Conclusion: A Defining Moment for US Crypto Policy

“Crypto Week” represents a defining moment for US crypto policy. The legislation under consideration has the potential to provide much-needed clarity, protect financial privacy, and foster innovation. However, the path forward is uncertain, as political divides and regulatory complexities could delay or alter the proposed bills. The decisions made during this week will shape the future of the crypto industry in the US, determining whether the country remains a leader in digital asset innovation or falls behind other nations. As the House of Representatives debates these critical issues, the crypto community and policymakers alike will be watching closely to see how this legislative push unfolds.