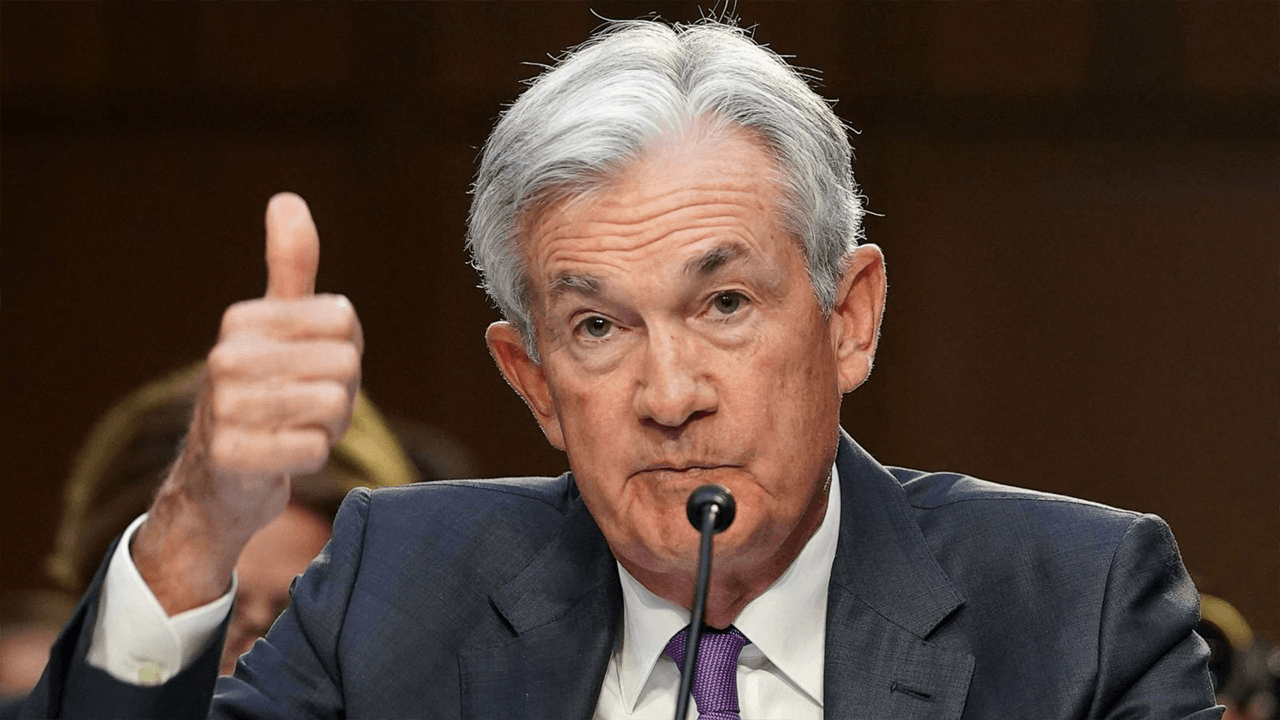

The upcoming transition at the Federal Reserve, as Jerome Powell’s term nears its end in May 2026, has sparked intense speculation and strategic maneuvering within the White House and financial markets. At the center of this high-stakes process is Treasury Secretary Scott Bessent, whose background and current role position him as a leading contender to succeed Powell. This transition is not merely a routine leadership change; it represents a critical juncture that will shape U.S. monetary policy, financial stability, and global economic perceptions for years to come.

The Federal Reserve Chair holds immense power over the U.S. economy, influencing interest rates, regulatory frameworks, and broader monetary policy. The Chair’s four-year term places them at the helm of the Federal Open Market Committee (FOMC), which sets the federal funds rate—a benchmark that affects everything from consumer borrowing costs to inflation and employment. The Fed’s independence is a cornerstone of its credibility, designed to shield monetary policy from short-term political pressures and ensure decisions prioritize long-term economic health. However, the selection process for the next Chair is inherently political, blending economic expertise with the administration’s priorities.

Scott Bessent, a former hedge fund manager turned Treasury Secretary under the Trump administration, has emerged as a key figure in this process. His unique background—combining private-sector experience with public service—makes him a compelling candidate. Bessent’s role in the Fed chair search, traditionally handled by the Treasury Secretary, places him at the heart of discussions. He has acknowledged the considerations surrounding the transition, even expressing openness to the position if President Trump requests it. However, he has also indicated a preference to remain Treasury Secretary through Trump’s term until 2029, suggesting a pragmatic approach to his career trajectory. This duality—willingness to serve while prioritizing his current role—highlights the delicate balance between ambition and institutional responsibility.

The political dynamics surrounding this transition are particularly charged. President Trump has been vocal about his dissatisfaction with the Federal Reserve’s interest rate policies under Powell, frequently urging rate cuts through public statements and social media. This has raised concerns about the Fed’s independence, as appointing a Chair closely aligned with the President’s economic agenda could risk politicizing the institution. Bessent, viewed as part of Trump’s inner circle, has emphasized the importance of stability during this transition, signaling a cautious approach amid political pressures. His acknowledgment that “people already at the Fed” are under consideration also suggests a preference for continuity rather than abrupt change.

Financial markets have already reacted to rumors and news of the Chair’s potential replacement, with the U.S. dollar experiencing volatility on some reports. This sensitivity underscores the market’s awareness that Fed leadership is crucial for policy predictability, especially in a post-pandemic economy grappling with inflationary pressures and geopolitical uncertainties. The prospect of a leadership change introduces uncertainty, which can trigger market volatility as investors react to perceived shifts in policy stance. A well-chosen Chair could reinforce the Fed’s credibility, smooth the path toward economic recovery, and help navigate challenges like inflation control, labor market normalization, and international economic tensions.

Beyond Bessent, other potential contenders for the Fed Chair position include former Fed Governor Kevin Warsh. Warsh, with an established track record at the Fed, represents the traditional choice rooted in the institution itself, potentially ensuring a smoother transition without drastic policy shifts. The White House has begun interviewing candidates as early as fall preceding the term’s end, reflecting a desire to ensure continuity and minimize uncertainty. The range of candidates spans current Fed officials and external candidates, balancing the need for expertise, credibility, and political palatability.

The appointment of the next Fed Chair carries significant risks that must be carefully managed. One major risk is the potential politicization of the Fed, which could undermine its reputation for independence and raise market concerns about monetary policy being guided by electoral or political cycles. Market volatility is another risk, as uncertainty surrounding leadership transitions often triggers fluctuations in financial markets. Additionally, the policy direction of the next Chair—whether dovish or hawkish—could substantially alter the trajectory of U.S. monetary policy, affecting everything from inflation control to employment rates.

If Bessent were to be appointed, his background suggests a focus on blending market-savvy with public service objectives. His hedge fund roots might translate to a nuanced understanding of global capital flows, currency dynamics, and risk management, potentially fostering policies that emphasize market stability. However, this dual experience also invites scrutiny regarding his ties to financial markets and the risk of regulatory capture. Critics could question whether a former hedge fund manager would prioritize market interests at the expense of broader economic equity or long-term sustainability. Yet, his engagement in the search process and expressed willingness to prioritize presidential requests indicate a pragmatic and possibly cooperative leadership style, aiming to balance presidential directives with institutional norms.

The upcoming selection of the next Federal Reserve Chair is a defining moment that transcends a mere administrative appointment. Scott Bessent’s emergence as a front-runner encapsulates the intersection of political influence, economic expertise, and institutional tradition. How the White House navigates this delicate process will send powerful signals domestically and abroad about the future of U.S. economic policy. Balancing the need for continuity with evolving economic challenges, maintaining the Fed’s independence while accommodating political realities, and managing market expectations will be the tightrope walk that defines this transition. As the fall approaches and interviews commence, observers should watch closely how Bessent and other candidates present their vision for the nation’s most critical economic institution—an institution whose decisions ripple across every pocket and corner of the global economy.