The European Central Bank’s (ECB) recent proposal to redirect retail savings into capital markets has ignited a fierce debate, with some critics even labeling it as “Marxist.” This initiative, however, is rooted in a pragmatic response to structural economic challenges rather than ideological extremism. By examining the motivations, mechanisms, and implications of this proposal, we can better understand its potential impact on savers, capital markets, and the broader European economy.

The Rationale Behind the ECB’s Proposal

The ECB’s proposal emerges from a confluence of economic pressures and opportunities. Europe’s capital markets have long lagged behind those of the United States, limiting the availability of funding for businesses and innovation. Meanwhile, the prolonged low-interest-rate environment has eroded the returns on traditional savings accounts, leaving many savers frustrated and seeking alternatives. Additionally, the European Union (EU) faces significant financing needs for infrastructure, green transition, and digitalization—goals that cannot be met by public funds alone.

By encouraging retail savers to invest in capital markets, the ECB aims to address these challenges simultaneously. The proposal seeks to deepen Europe’s capital markets, stimulate economic growth, and improve long-term returns for savers. This approach aligns with broader EU priorities, such as the European Green Deal and the Digital Europe program, which require substantial private investment to succeed.

Mechanisms for Redirection: Standardized Savings Products

The ECB’s proposal centers on the creation of new, standardized savings products designed to attract retail investors. These products would be structured to balance risk and return, ensuring they appeal to a wide range of savers. Key features include:

– Standardization: Harmonizing product features across the EU to ensure transparency, comparability, and consumer protection. This would help savers make informed decisions and reduce the complexity of navigating different national markets.

– Risk Diversification: Combining bonds, equities, and other assets to create a balanced portfolio tailored to different risk profiles. This approach would allow savers to participate in capital markets without overexposing themselves to volatility.

– Ease of Access and Liquidity: Ensuring these products are easily purchasable and offer reasonable liquidity to avoid alienating risk-averse individuals. This would help build trust and encourage wider adoption.

– Regulatory Framework: Coordinated regulations to build trust and safety, addressing the fragmented landscape across member states. A robust regulatory framework would protect investors and ensure the stability of these new products.

By offering these standardized products, the ECB aims to bridge the gap between traditional savings accounts and more dynamic, risk-exposed investments. This would not only benefit savers but also provide businesses with a more stable source of capital.

Potential Economic and Social Impacts

The ECB’s proposal has the potential to bring significant benefits to both savers and capital markets. For savers, investing in capital markets could lead to higher returns and greater wealth accumulation over the long term. Additionally, access to a broader array of investment vehicles would allow individuals to diversify their savings, spreading risk and potentially improving their financial security.

For capital markets, increased retail participation would deepen liquidity, stabilize markets, and provide companies with more stable capital sources. This could, in turn, fuel innovation and support the EU’s strategic priorities, such as the green transition and digitalization. Furthermore, by channeling capital into productive investments, the proposal could help address Europe’s financing gap and promote economic growth.

However, the proposal also carries risks and concerns. Retail investors unfamiliar with capital markets may face losses, especially during periods of volatility. To mitigate this risk, the ECB would need to ensure that these products are designed with appropriate safeguards and that investors are adequately educated about the risks involved. Additionally, the proposal could face political backlash and ideological opposition, as some critics may view it as an infringement on personal freedom or a step toward greater economic centralization.

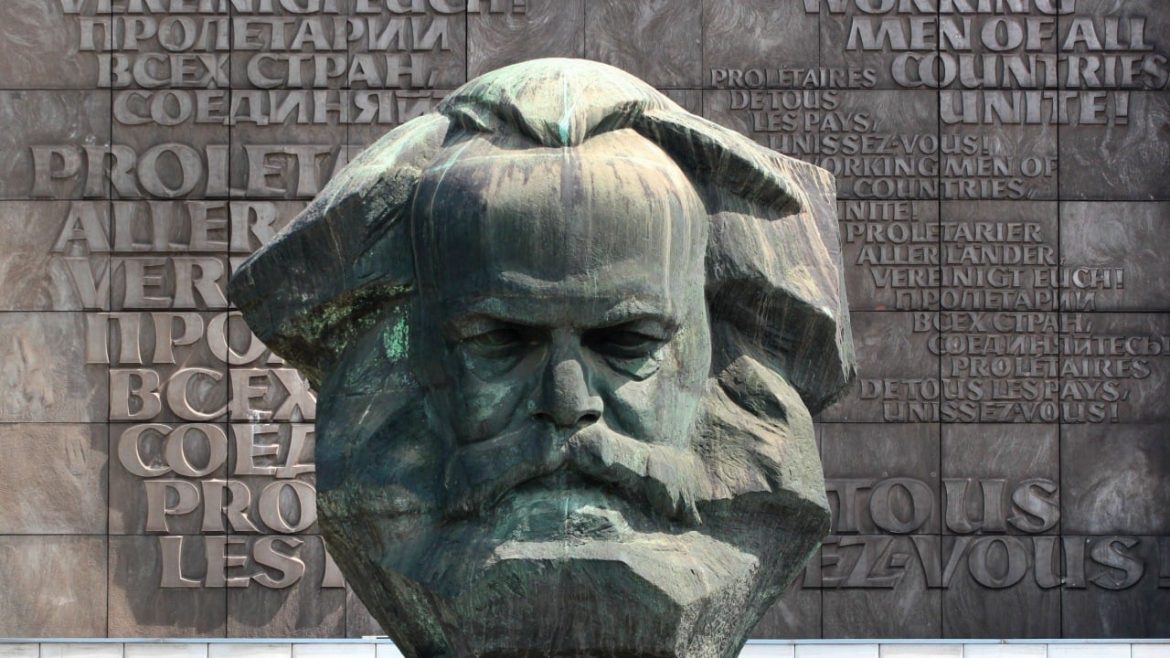

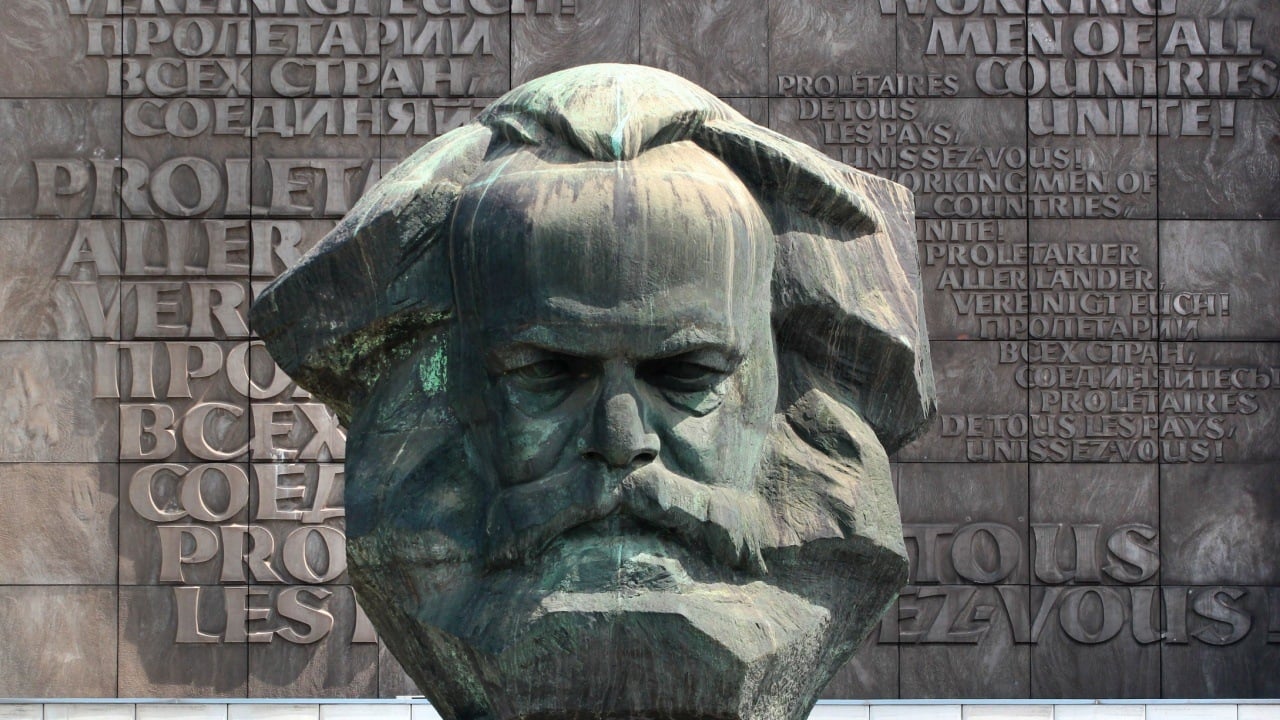

The “Marxism” Label: A Misinterpretation of the Proposal

The characterization of the ECB’s proposal as “Marxist” stems from a misunderstanding of its objectives. Critics who label the initiative as such often interpret the ECB’s intent to direct private savings toward public or collective economic goals as a form of “planned” or “controlled” capital allocation. This reaction reflects deeper tensions between those who advocate for greater state-guided economic coordination and those who favor purely free markets.

In reality, the ECB’s proposal is not about dismantling property rights or free market mechanisms. Instead, it is a pragmatic attempt to address structural shortcomings in Europe’s financial ecosystem. By creating standardized savings products that channel retail savings into capital markets, the ECB aims to improve market efficiency and mobilize private resources for mutual benefit. This approach is consistent with the EU’s broader goal of fostering a more integrated and competitive financial system.

Contextualizing with Cryptocurrency and Alternative Money Systems

The rise of cryptocurrencies like Bitcoin has challenged traditional monetary and capital market systems. While some view cryptocurrencies as a decentralized alternative to centralized financial institutions, others warn about their speculative nature and limited “real economic need.” The ECB’s proposal to channel retail savings into regulated capital markets offers a counterbalance to this trend, providing savers with a route toward productive investment within a safer, controlled framework.

This contrast highlights a larger financial evolution: while decentralized digital assets appeal to those distrustful of centralized authorities, regulated financial innovations seek to harness capital effectively for broad economic development. The ECB’s approach reflects confidence in structured markets while acknowledging the risks and the need for regulatory oversight.

Conclusion: Balancing Innovation and Stability

The ECB’s proposal to redirect retail savings into capital markets represents a bold, strategic move to deepen Europe’s financial markets and support economic priorities. While not without risks and political sensitivities, it addresses fundamental economic challenges, from boosting savers’ returns to financing innovation and sustainability.

Far from being “Marxist,” this initiative exemplifies pragmatic policymaking aimed at balancing individual investor protection with systemic growth imperatives. The success of such efforts hinges on effective regulation, investor education, and transparent communication to build trust. As Europe navigates the intersections of traditional finance and disruptive technologies, the marriage of policy innovation and market development will be critical to enhancing prosperity across the region. By embracing this approach, the EU can position itself for long-term economic success while ensuring that the benefits of growth are widely shared.