The Intricate Dance of Bitcoin

In the dynamic world of cryptocurrency, Bitcoin remains the undisputed king, capturing the attention of investors and analysts worldwide. As of June 17, 2025, Bitcoin stands at a pivotal moment, with market sentiments and technical indicators providing a complex tapestry of signals. Let’s explore the current landscape of Bitcoin, delving into the interplay of market emotions and technical analysis that drive its trajectory.

The Emotional Rollercoaster

Greed and Fear: The Dual Forces

Cryptocurrency markets are infamous for their volatility, largely driven by the emotions of greed and fear. Greed can push prices to unsustainable heights as traders and investors chase profits, convinced that the upward trend will continue indefinitely. Conversely, fear can trigger sudden sell-offs, leading to sharp price declines as panic sets in.

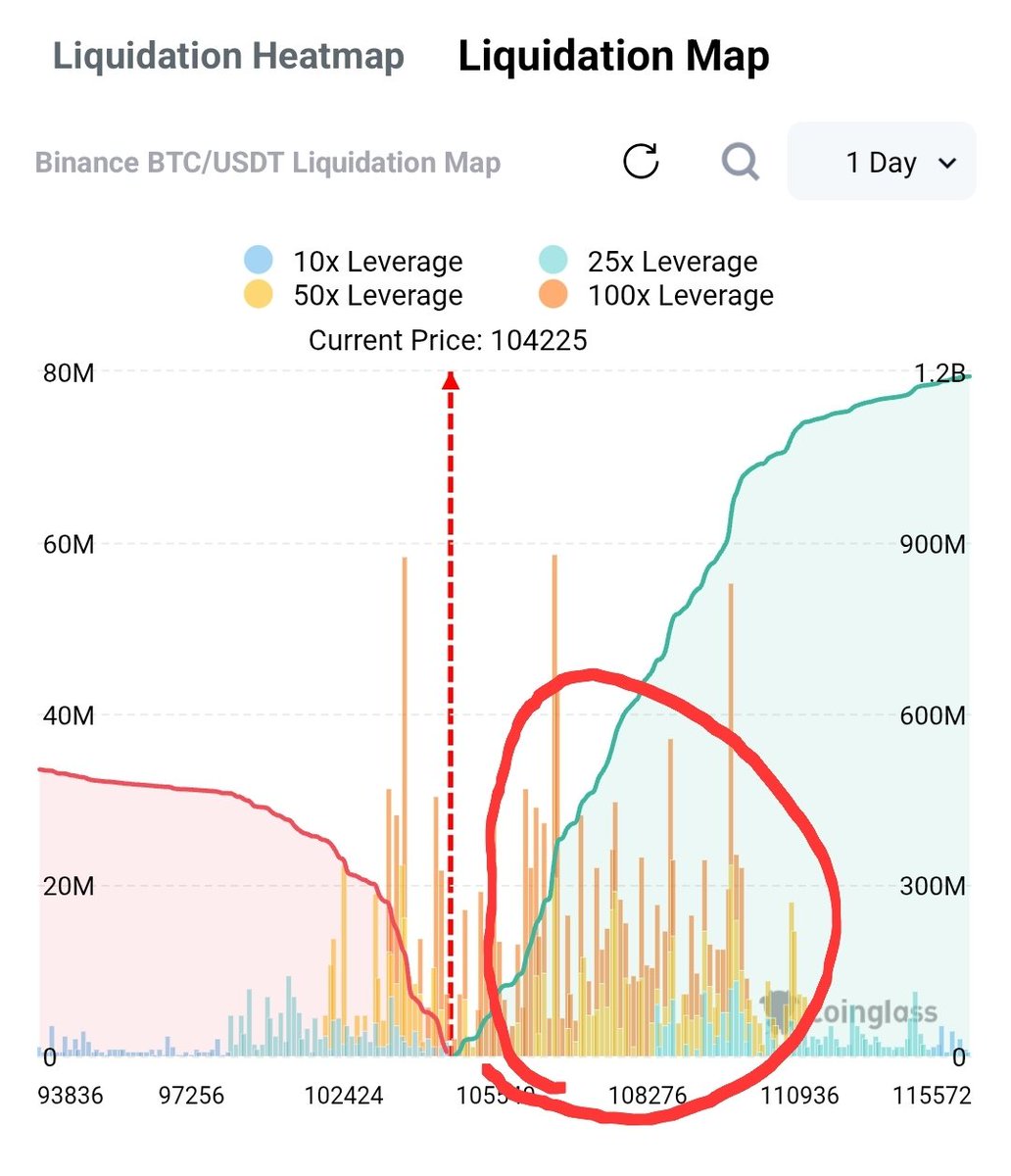

Bitcoin’s recent price movements exemplify this emotional tug-of-war. The price has oscillated around the $106,000 mark, with technical indicators offering mixed signals. The Relative Strength Index (RSI) hitting oversold levels suggests a potential bounce, while bearish divergence indicates ongoing selling pressure.

The Role of AI in Trading

In this emotional turmoil, artificial intelligence (AI) has emerged as a beacon of rationality. AI-driven trading platforms, such as Scorehood Bull::Bear Analysis App, offer a data-driven approach to navigating the volatile crypto landscape. By leveraging AI, traders can mitigate the impact of emotions, making more informed and strategic decisions. This shift towards AI trading is not just a trend but a necessity in an increasingly complex and fast-paced market.

Technical Analysis: Deciphering the Charts

Bollinger Bands and RSI

One of the key tools in a trader’s arsenal is the Bollinger Band, which helps identify volatility and potential reversal points. Bitcoin’s recent interaction with the lower Bollinger Band, coupled with the RSI hitting oversold levels, has sparked debates about an imminent bounce. The $106,000 zone is under close watch, as a break above this level could signal a bullish reversal.

The RSI, a momentum oscillator, provides further insights. When the RSI is below 30, it indicates oversold conditions, suggesting a potential upward correction. However, the presence of bearish divergence, where the price makes higher highs but the RSI makes lower highs, complicates the picture. This mixed signal underscores the need for a nuanced approach to technical analysis.

Moving Averages and Volume

Moving averages (MAs) are another crucial component of technical analysis. Bitcoin’s interaction with the Exponential Moving Average (EMA) 9 support level is a critical factor to consider. A failure to hold this support could lead to further downside, while a bounce off this level could indicate a bullish reversal.

Volume analysis adds another layer of complexity. Increasing sell volume, as observed in recent weeks, suggests bearish sentiment. This, combined with bearish divergence, paints a cautious picture for Bitcoin’s near-term prospects. However, volume spikes can also signal the end of a downtrend, as selling pressure is exhausted.

The Broader Market Context

Federal Reserve’s Influence

The cryptocurrency market does not operate in a vacuum. External factors, such as the Federal Reserve’s monetary policy, significantly impact Bitcoin’s price movements. The upcoming Fed rate announcement is a critical event, with the potential to either bolster or undermine Bitcoin’s price. Analysts are closely monitoring the no-hype, data-driven signals to gauge the market’s reaction.

Altcoins and Market Sentiment

Altcoins, or alternative cryptocurrencies, often move in tandem with Bitcoin. However, there are instances where altcoins outperform or underperform Bitcoin, driven by their unique fundamentals and market sentiment. For example, the migration of $MATIC to $POL has been a topic of debate, with some analysts questioning the accuracy of Dune analytics.

Conclusion: Navigating the Uncertainty

Bitcoin’s current state is a testament to the intricate dance of emotions, technical indicators, and external factors that drive the cryptocurrency market. As we stand on the cusp of a potential breakout or breakdown, it is crucial to adopt a balanced and informed approach.

The use of AI in trading offers a promising solution to the emotional rollercoaster that characterizes the crypto market. By leveraging data-driven insights, traders can make more rational decisions, reducing the impact of greed and fear.

As we look ahead, the key takeaway is the need for vigilance and adaptability. The cryptocurrency market is in a constant state of flux, and those who can navigate its complexities with a clear mind and a strategic approach are more likely to succeed. Whether Bitcoin bounces back or continues its downward trajectory, one thing is certain: the journey is far from over.