The Rise of AI in Cryptocurrency: Transforming Research, Trading, and Market Understanding

In the dynamic world of cryptocurrency, where every second can spell a drastic market shift, artificial intelligence (AI) has emerged as a game-changer. As we move through 2025, AI’s integration into the crypto landscape is not just enhancing data analysis—it is fundamentally reshaping how investors, traders, and analysts engage with the markets. This report unpacks the evolving role of AI in the cryptocurrency arena, highlighting its impact on research capabilities, trading strategies, technical analysis, and community sentiment interpretation.

Unlocking the Power of AI-Driven Crypto Research

Cryptocurrency markets generate vast amounts of data daily—from price movements and transaction volumes to social media chatter and regulatory news. Traditional methods of parsing this flood of information have struggled to keep pace, often leaving traders overwhelmed or reliant on repetitive, manual analysis.

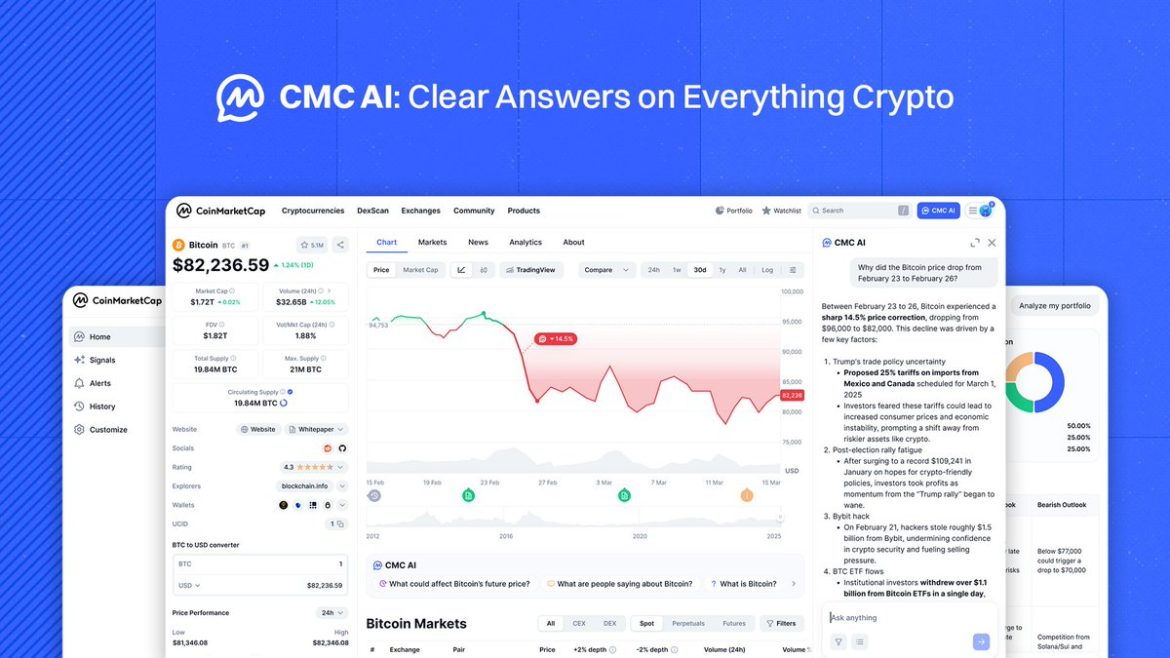

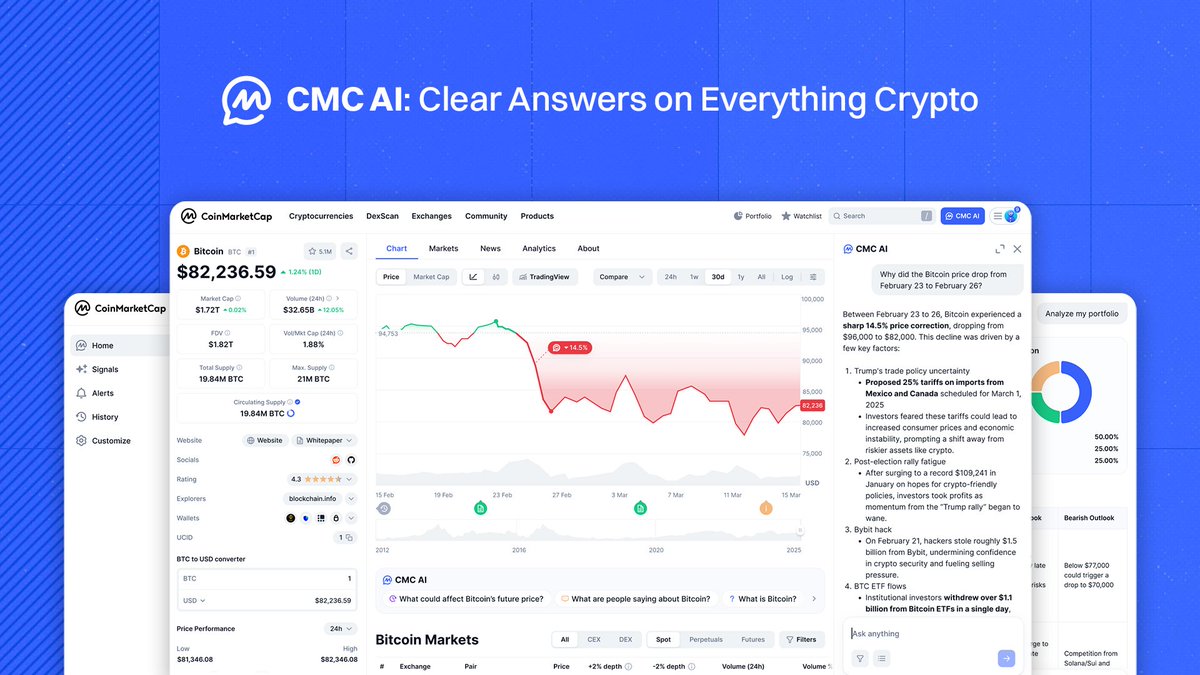

Enter AI. Tools like CoinMarketCap’s newly launched CMC AI platform are harnessing machine learning algorithms to streamline this complexity. By filtering vast datasets, identifying subtle market signals, and forecasting potential price trends, AI platforms transform raw data into actionable insights. Features such as real-time sentiment analysis and predictive modeling allow users, whether individual traders or institutional investors, to anticipate market behavior with greater confidence and precision.

CMC AI exemplifies this shift, attempting to bridge the gap between noisy data and meaningful narratives. Rather than simply presenting numbers, it enriches analysis by contextualizing asset dynamics—whether a sudden price spike owes more to social media hype or underlying fundamental improvements. This nuanced understanding is crucial in crypto, where speculation and technological development often intermingle unpredictably.

AI-Powered Technical Analysis: Beyond Human Pattern Recognition

Technical analysis, a cornerstone of trading strategy, benefits immensely from AI methodologies. AI-driven pattern recognition transcends human limitations, detecting formations like Solana’s recent rounded bottom pattern with greater speed and reliability.

For instance, Solana’s consolidation phase and emerging bullish signals, such as the pullback around $160-$165 followed by recovery prospects toward $180-$200, can be precisely charted with AI-supported tools. Automated monitoring reduces the risk of missing critical trend reversals or support/resistance dynamics that traditional chart study might overlook or delay.

Similarly, Cardano’s rigorous periodic assessments combine quantitative techniques embedded with AI insights to capture momentum changes and volume shifts. These assessments provide traders with a continuous, data-backed narrative, helping demystify price fluctuations amid market noise.

Sentiment Analysis: Navigating the Emotional Undercurrents

Cryptocurrency markets are notoriously influenced by collective psychology. Trader sentiment can swing from euphoric greed to fear-driven sell-offs in moments, often precipitated by viral social media trends or external news events.

AI platforms excel in capturing these emotional undercurrents through advanced sentiment analysis. By scanning vast datasets from Twitter, Reddit, forums, and news outlets, AI generates fear and greed indexes or sentiment heatmaps, indicating when the market mood might become a contrarian signal.

This ability to quantify what was once intangible emotional data helps investors avoid herd mentality pitfalls. For example, observing a spike in positive sentiment surrounding meme tokens or niche assets, like pig-themed cryptocurrencies on Solana, can highlight speculative bubbles or early-stage hype cycles. Conversely, detecting shifts toward caution or panic allows strategic pauses or safe exits.

AI’s Role in Real-Time Market Monitoring and Autonomous Trading

A frontier where AI’s impact is becoming palpably profound is in real-time tracking and autonomous trading. Platforms such as @cookiedotfun exemplify the intersection between AI and decentralized finance by monitoring the activities of AI agents across blockchain networks. This capability opens doors to spotting decentralized autonomous organization (DAO) movements, emerging airdrops, or token distribution events faster than traditional tools.

Moreover, algorithmic trading—powered by machine learning—deploys AI to execute trades based on pre-set criteria or adaptive learning without human intervention. This not only increases efficiency but also reduces emotional biases that often impair human judgment under volatile conditions.

Challenges and Considerations in AI Adoption for Crypto

While AI’s promise in cryptocurrency markets is vast, it comes with caveats. Data quality and algorithm transparency remain critical concerns. Poor or biased data inputs can misguide AI conclusions, leading to costly errors. Additionally, the crypto market’s high volatility and frequent regulatory shifts pose unique challenges for AI models trained on historical data.

Another dimension is accessibility. Sophisticated AI platforms may require technical expertise, potentially creating a divide between retail traders and institutional players. Efforts to make AI-based analytical tools user-friendly and affordable will determine their widespread impact.

Looking Ahead: AI as a Catalyst for Crypto Market Evolution

As AI continues to embed itself deeply into crypto ecosystems, it propels the market toward a more mature, data-driven phase. The synergy of machine intelligence and human insight offers a multifaceted perspective that can harness volatility into opportunity, turning guesswork into strategy.

From enhanced research platforms like CMC AI to sentiment-driven trading decisions, and autonomous agents navigating complex networks—AI is not simply augmenting current processes but redefining the very fabric of crypto market participation.

Conclusion: Embracing AI Without Losing the Human Touch

Artificial intelligence stands as an indispensable ally in the ever-changing cryptocurrency landscape of 2025. It empowers investors to deal with complexity through clarity, speed, and accuracy. However, the narrative should not solely glorify AI’s capabilities. Instead, the most successful traders and analysts will be those who integrate AI’s quantitative power with qualitative intuition—understanding technology limitations, market psychology, and the unpredictable nature of innovation-driven assets.

In this dance between algorithms and human judgment, AI shines as a powerful tool—but not a crystal ball. For crypto’s future, it is a compass guiding the way, helping navigate the tumultuous seas of blockchain finance toward smarter, more informed horizons.

—

Sources:

– CoinMarketCap Launches New AI-Powered Tool CMC AI

– Solana Technical Analysis Twitter Update

– Crypto Sentiment Analysis and Market Commentary

– AI Agent Monitoring Platform @cookiedotfun