Artificial intelligence (AI) has become a transformative force across various industries, and its impact on the rapidly evolving cryptocurrency market is particularly striking. The marriage of AI-powered tools with real-time blockchain analytics is reshaping how traders, investors, and enthusiasts engage with digital assets. This report unpacks these ongoing changes, focusing on the rise of AI-driven platforms like WickrFun, recent technical trade analyses, emerging digital tokens, and overarching market sentiments. Through this lens, we can appreciate the complex, dynamic nature of the crypto ecosystem and its future trajectory.

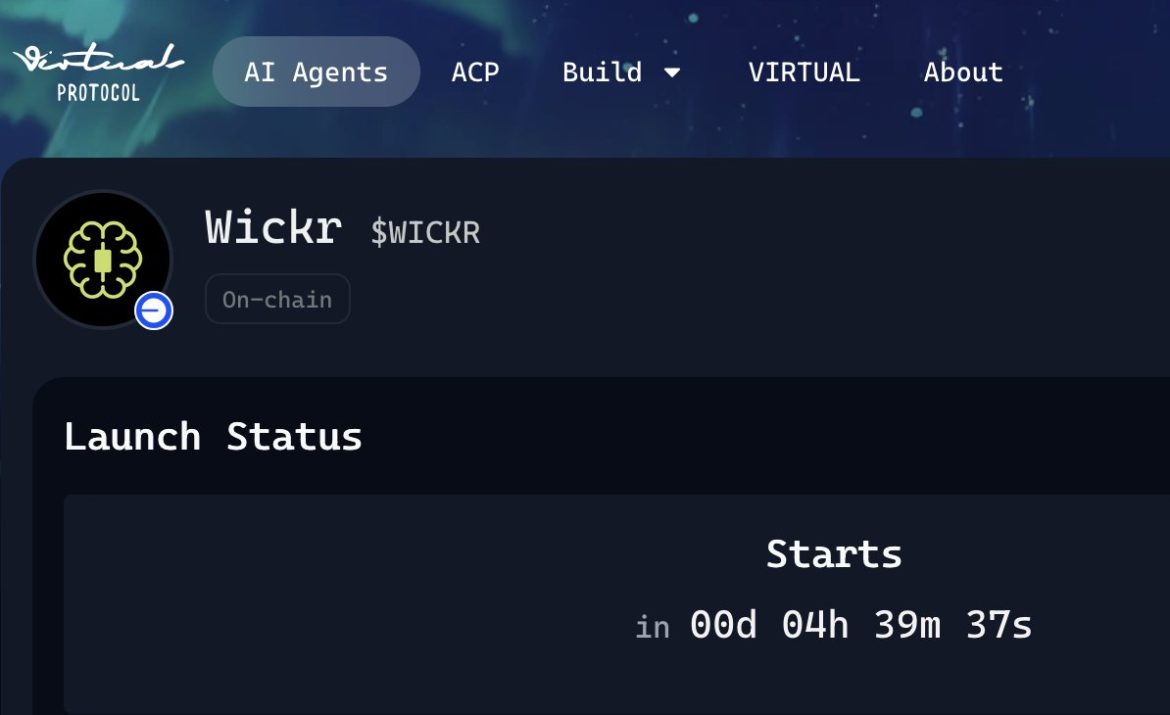

Revolutionizing Crypto Analysis: The Advent of AI Tools Like WickrFun

WickrFun, an AI cryptocurrency analysis agent, represents a significant milestone in the confluence of artificial intelligence and blockchain technology. Available on multiple platforms such as Telegram, Web, Farcaster, and X (formerly Twitter), WickrFun brings sophisticated, multi-chain analytics directly to users regardless of their preferred communication channels. By tracking major blockchains—Ethereum, Solana, Base—and aggregating this data in real-time, WickrFun democratizes access to advanced crypto insights that were traditionally the domain of institutional players or those with high technical expertise.

This shift is more than just convenience; it redefines accessibility and speed in strategic decision-making. Users no longer need to toggle between multiple analytics platforms or understand raw on-chain data intricacies. WickrFun’s AI engine synthesizes the complexities of cross-chain information with ease, providing tailored insights quickly. This is especially beneficial for retail traders who often face time constraints and information overload. In institutional contexts, the acceleration and precision of AI analysis can mean sharper market entries and exits, optimizing portfolio management in a highly volatile environment.

Technical Analysis In the Age of AI: Preserving Core Market Wisdom

While AI brings unprecedented computational power and velocity to data processing, traditional technical analysis principles remain as relevant as ever. Recent analyses covering tokens like Wilder World (#WLD) and Polyx (#POLYX) illustrate this well. Both tokens maintain well-defined support levels—1.057 for WLD and 0.1554 for POLYX on the hourly and four-hour charts respectively—that traders monitor closely. These levels, carved out from historical price action, volume trends, and liquidity clusters, function as psychological anchors for market participants.

AI tools, including WickrFun, augment these insights by enabling continuous monitoring of these support and resistance zones across multiple tokens and chains simultaneously. More importantly, AI helps identify nuanced, evolving patterns that may escape static technical setups. Hence, AI and traditional analysis form a complementary duo: AI accelerates data parsing and highlights emergent trends, but the foundational principles of market psychology embodied in support and resistance remain guiding beacons in the crypto trading landscape.

Innovations on the Horizon: Emerging Tokens and Platform Development

Cryptocurrency’s ongoing evolution is not limited to analysis tools; innovation thrives at the asset and platform levels as well. Projects like UMA’s decentralized exchange (DEX) token and WEEX, an emerging blockchain platform, reflect the sector’s broadening ambitions. UMA’s DEX coin aims to deepen DeFi usability by powering decentralized exchanges with enhanced liquidity and governance features, pushing the boundaries of decentralized finance infrastructure.

WEEX’s platform innovations, emphasizing new functionalities to attract users and developers, signify the competitive, fast-paced nature of blockchain ecosystems. These projects indicate a market growing beyond mere token speculation into complex infrastructure capable of supporting vibrant ecosystems encompassing finance, governance, analytics, and more. Such development suggests the crypto space is maturing, gearing up for wider adoption and more sophisticated use cases.

Market Sentiment and Capital Flows: Reading the Bullish Signs

On a macro level, the crypto market is signaling a positive momentum phase. Recent data shows total market capitalization breaking out of an ascending triangle—a technical pattern often signaling accumulation before a price surge—supported by strong trading volumes. Coinciding with this is a bullish stance highlighted by the Ichimoku Cloud, a multi-dimensional charting system that assesses trend direction, support, and resistance levels effectively.

The combination of volume spikes and supportive indicators suggests active buyer interest and confidence in upward price movement. Such patterns often precede meaningful breakouts in volatile markets, making them valuable signals for traders aiming to capitalize on momentum while managing risk. Yet, as always, these technical signs should be interpreted within a broader context of market news, regulatory developments, and global economic dynamics.

Human Themes Amid the Algorithms: Caution and Cultural Narratives

Despite the cutting-edge technological advances in AI and crypto analysis, the human element remains vital. Industry experts consistently emphasize responsible trading and the inherent risks associated with crypto markets, underscoring that tools and advice are for educational purposes—not guaranteed financial outcomes. This sober perspective serves as a reminder that volatility and unpredictability have not been banished by AI.

Moreover, cultural undercurrents—memes, storytelling, and social sentiment—continue to shape the crypto space profoundly. For example, playful token valuations like “1 Bitcoin equals 1 House” for the $B=H token highlight how humor and community narratives intersect with trading behavior. These elements enrich the crypto ecosystem, providing a social layer that influences market psychology beyond raw data.

Looking Ahead: A Smarter, More Connected Crypto Future

The integration of AI-powered multi-chain analytics like WickrFun with traditional technical analysis and innovative blockchain projects marks a pivotal evolution. As AI tools become increasingly sophisticated and accessible, they lower the barriers for participation, allowing a broader spectrum of traders and investors to navigate the crypto market confidently and knowledgeably.

This fusion promises a future where crypto trading is quicker, more informed, and broadly democratized, yet still grounded in enduring market principles. Nevertheless, the landscape remains complex and volatile; prudence and informed decision-making are as crucial as ever. The coming years will likely see AI and blockchain technologies intertwine even more deeply, driving a crypto ecosystem that is resilient, adaptive, and richly layered.

—

Sources

– WickrFun Official Announcements

– UMA Project Updates

– Technical Analysis Fundamentals — Investopedia

– Crypto Market Patterns and Ichimoku Cloud Indicator — TradingView

– WEEX Platform Overview