—

The Rising Tide of AI in Cryptocurrency: A New Frontier Unfolded

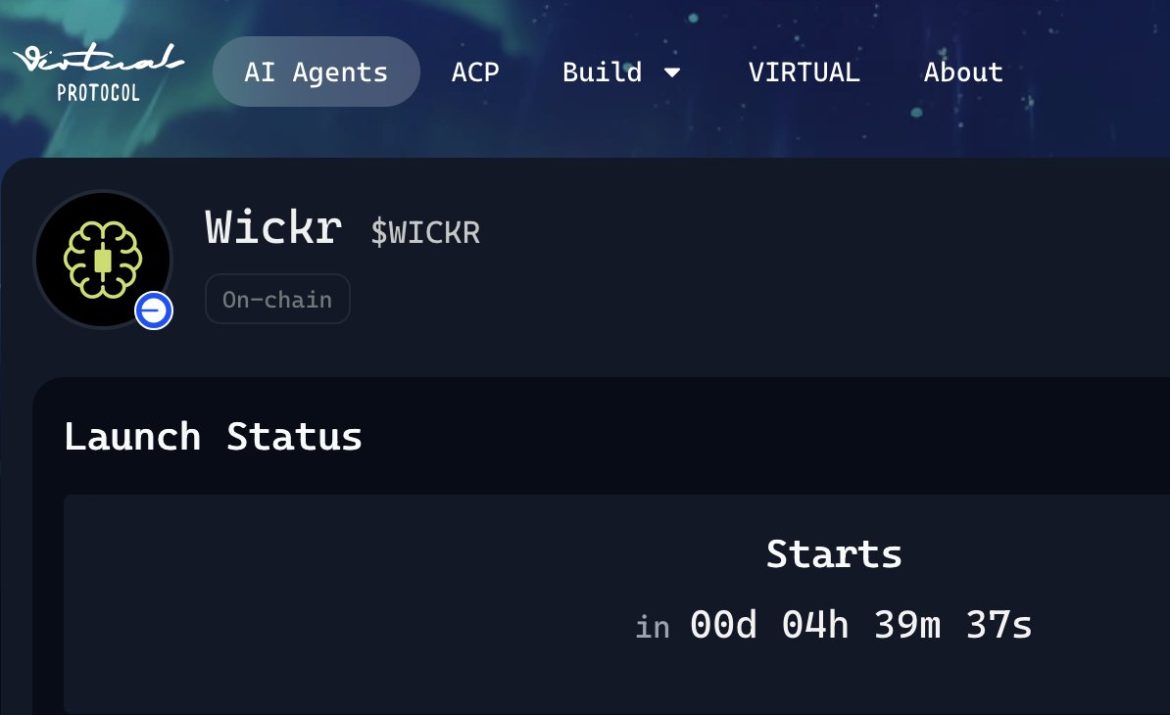

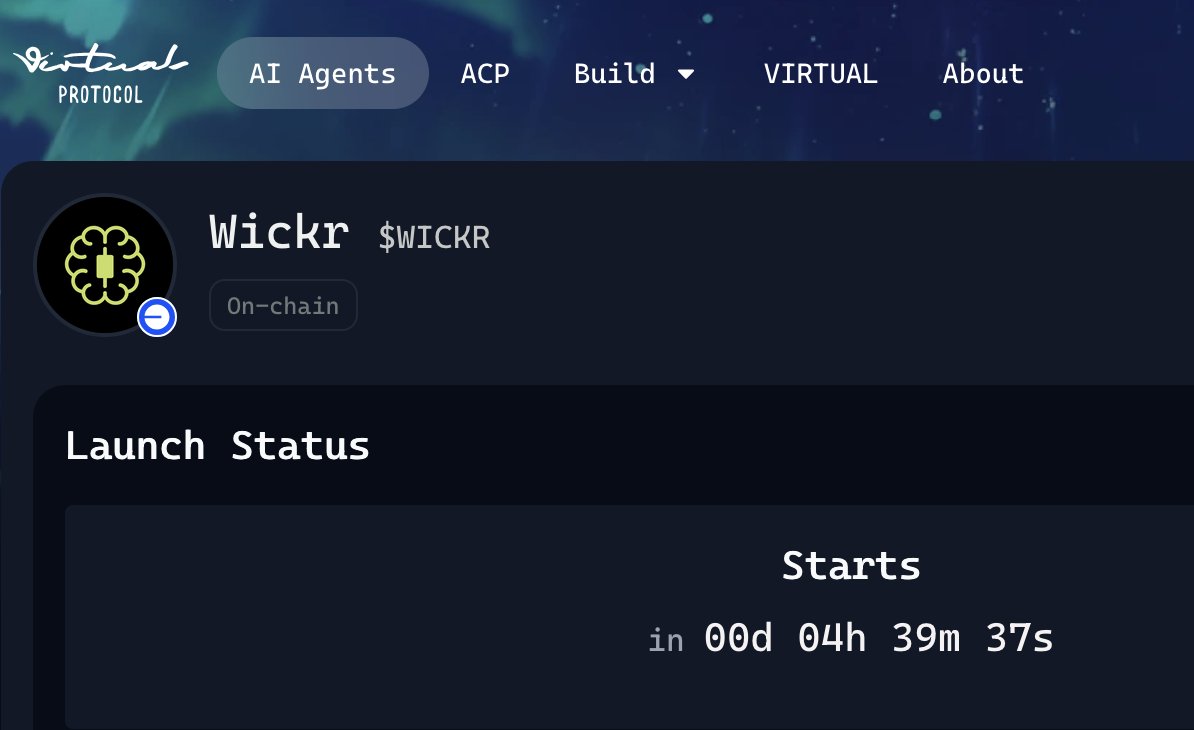

The intersection of artificial intelligence (AI) and cryptocurrency is no longer a speculative concept—it is the unfolding reality shaping the digital finance ecosystem. On May 19, 2025, this convergence was epitomized by the launch of WickrFun, an AI-driven multi-platform tool designed to transform how crypto data is analyzed and leveraged. Beyond tools, the broader crypto market dynamics illustrate how AI is becoming both an analytical engine and a market influencer, guiding strategies for traders and institutions alike. This report dives into the transformative role of AI in cryptocurrency, exploring its impact, technical synergies, market reception, and future trajectories.

—

AI-Powered Analytics: Democratizing Complex Insights

With blockchain data growing exponentially in depth and complexity, navigating raw data requires more than traditional charting and gut feeling. Enter WickrFun—an AI agent accessible via commonly used platforms like Telegram and Web, offering multi-chain analysis across Ethereum, Solana, Base, and beyond. This accessibility is pivotal: it shifts the power of sophisticated on-chain intelligence from specialized analysts to everyday traders and enthusiasts.

AI’s role here is twofold. First, it processes and contextualizes complex blockchain transactions, identifying patterns and anomalies that human analysis might overlook or take hours to uncover. Second, by integrating across familiar communication channels, it embeds itself into traders’ workflows, reducing friction and speeding decision-making.

This development points to a democratizing trend: as AI lifts the veil on blockchain complexity, it empowers a wider audience to engage confidently with crypto markets, potentially increasing liquidity, participation, and market depth.

—

AI Enhancing Market Technical Analysis

Technical analysis—a staple for crypto trading—has historically relied on pattern recognition, support/resistance zoning, and volume profiling. AI expands this toolkit dramatically. For instance, WickrFun and similar AI tools use machine learning algorithms to dynamically update support and resistance levels, spot micro-trends, and even predict probable correction phases by analyzing vast datasets in real-time.

Looking at specific assets:

– WLD: Monitoring the 1.057 support level with AI helps traders anticipate breakout or breakdown scenarios with refined timing signals.

– POLYX: AI-assisted tracking of the 0.1554 support base can inform nuanced strategies, as shifts here indicate underlying liquidity and institutional interest changing.

– DYDX and BTCUSDT: AI-driven pattern recognition captures descending formations and rejection wicks with greater subtlety, projecting possible liquidation events and price reversals sooner than manual analysis might allow.

The central tenet here is AI’s ability to provide layered context—combining historical data, current transaction flows, and behavioral signals—thus enabling traders to navigate the volatility-prone crypto space with more precision.

—

Macro-Level Implications: AI Amid Growing Market Complexity

On the larger stage, the cryptocurrency market’s bullish momentum in 2025 is supported by complex interplays of technical signals and geopolitical-economic factors. AI contributes to making sense of this macro complexity by integrating diverse data sources:

– Market capitalization trends reflect investor confidence and shifting capital.

– Policy developments, such as the advancing tax cut bill and G7 meetings, inject regulatory uncertainty or momentum. AI tools can rapidly synthesize news sentiment alongside price movements, providing near real-time clarity.

– Decentralized finance (DeFi) innovations and token launches benefit from AI monitoring, as projects like DEX Coin symbolize the maturation of decentralized liquidity protocols and self-sovereign trading paradigms.

By linking fragmented data points across technology, policy, market behavior, and social sentiment, AI serves as a multi-dimensional compass pointing toward emerging risks and opportunities.

—

Sentiment and Narrative: AI as a Catalyst for Market Psychology

Beyond raw numbers, cryptocurrency is a theater of narratives—from playful valuations comparing “1 Bitcoin equals 1 House” to smart money accumulation signals. AI tools analyze social media chatter, trader behaviors, and market flows to gauge sentiment—an invaluable asset for positioning in a market where emotions often dictate pricing dynamics.

These insights promote balanced decision-making, countering impulsive trading with data-driven perspectives. Moreover, as AI continues to evolve, it may even assist in detecting coordinated market manipulations or fraudulent schemes, enhancing market integrity.

—

Looking Forward: Challenges and Opportunities in AI-Crypto Symbiosis

While AI’s transformative potential is evident, challenges remain:

– Data Quality: Blockchain data is public but noisy, requiring sophisticated cleaning and interpretation.

– Model Transparency: AI predictions can lack explainability, posing risks for decision-making confidence.

– Regulatory Scrutiny: As AI tools influence markets, regulators may seek to ensure fairness and manage systemic risks.

Nevertheless, opportunities abound. AI could fuel personalized trading advisors, improve portfolio risk management, automate regulatory compliance, and uncover novel DeFi strategies.

For investors, embracing AI tools like WickrFun is not just about technology adoption—it’s about gaining a strategic edge in an increasingly complex digital asset environment.

—

Conclusion: AI as the New Beacon in Cryptocurrency’s Expanding Ocean

The cryptocurrency market’s evolution is intricately linked with the advancement of AI technologies. May 19, 2025, serves as a milestone illustrating this synergy through innovations like WickrFun and AI-enhanced market insights. As crypto markets surge through volatility, regulatory flux, and technological breakthroughs, AI stands out as a pivotal navigator—demystifying data complexity, amplifying analytical precision, and enriching market participation.

The future of cryptocurrency is not just digital and decentralized; it is intelligent. Those who harness AI’s capabilities will likely ride the waves more skillfully, uncovering deeper value and navigating uncertainty with confidence. The days ahead invite a fusion of human intuition and artificial insight—a combination poised to redefine what’s possible in the realm of digital finance.

—

Sources

– WickrFun launch announcement on Twitter

– Market analyses from Ehsan Soltani (@Rainman_em) on Twitter

– UMA’s DEX Coin project insights on Twitter (@umaonsol)

– Cryptocurrency market cap and technical interpretations by DYNAMIC TRADE CALLS (@Ben_smithscott5)

– Macro policy updates from AstralX (@Astral_Global_)

– Various trade and analysis tweets by Vaibhav Mahadkar (@CryptoBuletin8) and George Samaropoulos (@GSamaropoulos)

*All links open in new tabs.*