The Emotional Landscape of Cryptocurrency

Imagine riding a rollercoaster where the tracks are drawn by market sentiment, regulatory news, and technological breakthroughs. Welcome to the world of cryptocurrency, a realm where emotions and analysis intersect in a dance as volatile as it is exhilarating. In this landscape, investors are constantly seeking ways to navigate the emotional highs and lows, to find clarity amidst the chaos. This report delves into the intersection of emotions and analysis in the crypto world, exploring how experts and enthusiasts alike are finding opportunities amidst the volatility.

The Emotional Rollercoaster

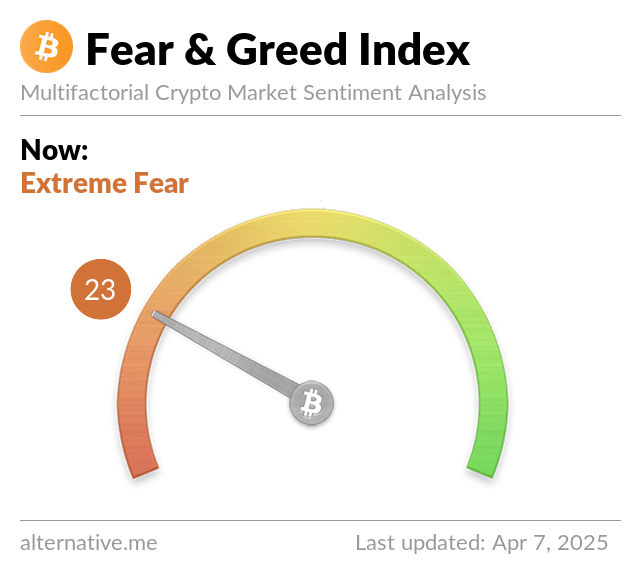

Cryptocurrency markets are infamous for their wild swings. Prices can soar one day and crash the next, leaving investors on an emotional rollercoaster. This volatility is fueled by a mix of market sentiment, regulatory changes, and technological advancements. For some, the adrenaline rush is part of the allure. For others, it’s a source of stress and uncertainty.

In this tumultuous environment, maintaining a clear mind and making informed decisions can be daunting. This is where expert analysis steps in, offering data-driven insights to help investors steer through the market’s tumultuous waves.

The Role of Expert Analysis

Expert analysis is a beacon of light in the stormy seas of crypto volatility. By providing data-driven insights and trends, analysts help investors spot potential opportunities and dodge risks. This is especially vital in the crypto world, where emotions can easily cloud judgment.

Data-Driven Insights

Platforms like @TAPfintech offer expert analysis to help investors filter out the noise and focus on actionable insights. By delivering clear, concise, and practical information, TAPfintech assists investors in identifying opportunities amidst the market’s volatility[1].

Similarly, @CyberFrogsNFT underscores the importance of clarity, analysis, and intuition in navigating the crypto market. By locking in before being locked out, investors can capitalize on potential opportunities and avoid the traps of emotional decision-making[2].

The Power of Community

In the crypto world, community is king. From Twitter to Telegram, crypto enthusiasts are constantly sharing insights, tips, and strategies. This collective wisdom can be a powerful tool for investors, offering a wealth of information and perspectives.

Community Engagement

For example, @NFTBatGremlin shares his analysis of the SOL cryptocurrency, providing insights into potential support levels and market trends. By engaging with the community and sharing his expertise, Gremlin Guy helps other investors make informed decisions[3].

Similarly, @CryptoJournaal offers a fundamental analysis of EpicChain ($EPIC), a blockchain platform focused on delivering fast, secure, and scalable solutions for the emerging DeFi and NFT markets. By sharing his insights with the community, CryptoJournaal helps investors understand the potential of this emerging technology[4].

The Importance of Technical Analysis

Technical analysis is a crucial tool for investors looking to navigate the crypto market’s volatility. By analyzing price charts, trends, and indicators, investors can identify potential opportunities and make informed decisions.

Charting the Course

For instance, @SammysAnalysis provides technical analysis of various cryptocurrencies, including SOL and EOS. By identifying key support and resistance levels, Sammy helps investors understand the market’s potential movements and make informed trading decisions[5][6].

The Future of Crypto Analysis

As the crypto market continues to evolve, so too will the tools and techniques used to analyze it. From advanced algorithms to AI-driven insights, the future of crypto analysis is promising. However, one thing is certain: the intersection of emotions and analysis will continue to shape the market’s trends and opportunities.

Innovations on the Horizon

The integration of artificial intelligence and machine learning is set to revolutionize crypto analysis. These technologies can process vast amounts of data in real-time, providing investors with more accurate and timely insights. Moreover, the rise of decentralized finance (DeFi) and non-fungible tokens (NFTs) will create new avenues for analysis and investment.

Embracing the Emotional Journey

In the world of cryptocurrency, emotions and analysis are inextricably linked. By embracing the emotional journey and leveraging expert insights, investors can navigate the market’s volatility and find opportunities amidst the chaos. Whether it’s through community engagement, technical analysis, or data-driven insights, the key to success in the crypto world lies in finding clarity amidst the noise.

The Path Forward

So, the next time you find yourself on an emotional rollercoaster, remember that there are opportunities out there. Find them. Embrace the journey, and let the power of analysis guide you towards success. The crypto world is a dynamic and ever-changing landscape, but with the right tools and mindset, you can turn its volatility into your advantage.

[1]: Andy | (!FF) (@AndyRewNFT) April 7, 2025

[2]: Cyber Frogs (!FF) (@CyberFrogsNFT) April 7, 2025

[3]: Gremlin Guy (@NFTBatGremlin) April 7, 2025

[4]: CryptoJournaal (@CryptoJournaal) April 7, 2025

[5]: TASammy💜 (@SammysAnalysis) April 7, 2025

[6]: TASammy💜 (@SammysAnalysis) April 7, 2025

Andy | (!FF) (@AndyRewNFT) April 7, 2025

Cyber Frogs (!FF) (@CyberFrogsNFT) April 7, 2025

Gremlin Guy (@NFTBatGremlin) April 7, 2025

CryptoJournaal (@CryptoJournaal) April 7, 2025