The Rhyming Echoes of Bitcoin’s Past

Imagine standing at the edge of a vast, digital frontier. The wind whispers tales of fortunes made and lost, of bubbles bursting and markets soaring. This is the world of Bitcoin, a digital currency that has captivated minds and disrupted economies. As we stand here in 2025, let’s explore the patterns of Bitcoin’s past and the potential paths of its future.

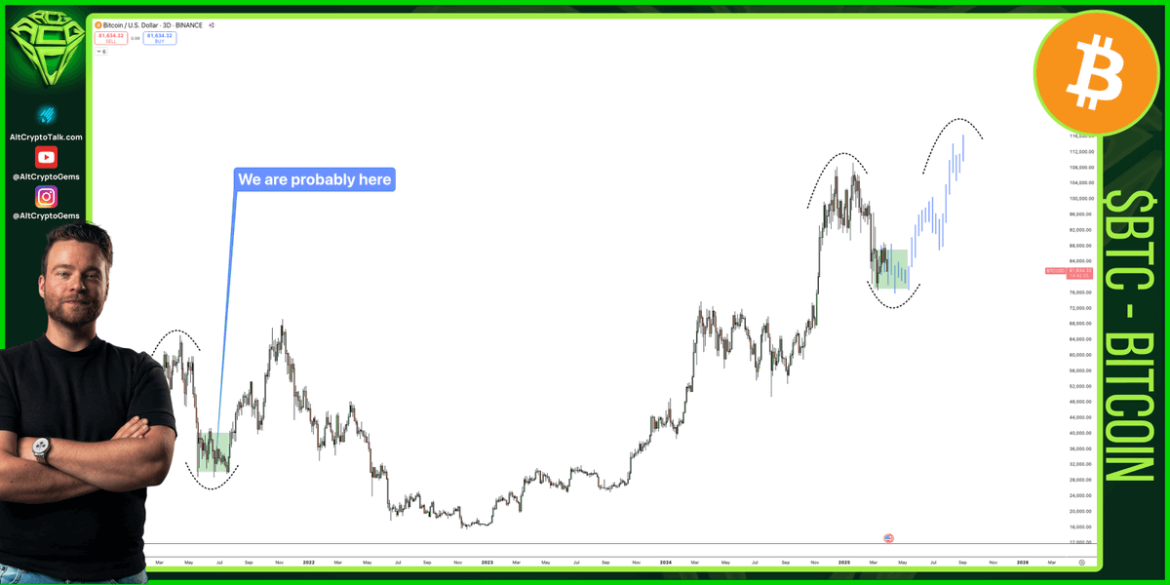

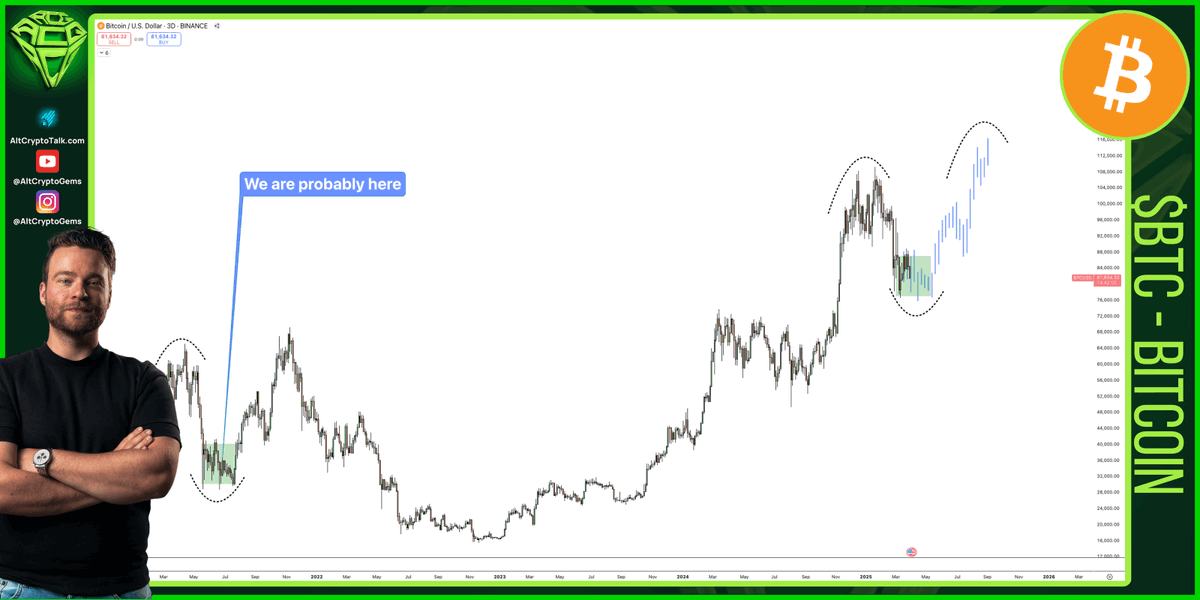

The Historical Rhymes of Bitcoin

Bitcoin, the first and most well-known cryptocurrency, has a history that is as volatile as it is fascinating. Launched in 2009, it has seen dramatic price swings, from being virtually worthless to reaching an all-time high of over $68,000 in 2021. The phrase “history doesn’t repeat but it often rhymes” encapsulates the cyclical nature of Bitcoin’s price movements. Let’s delve into some of these rhymes.

The Bull and Bear Cycles

Bitcoin’s price history is marked by distinct cycles of bullish and bearish trends. These cycles typically last about four years, coinciding with the Bitcoin halving events, where the block reward for miners is reduced by half. This reduction in supply often precedes a significant price increase. For instance, the 2013 and 2017 bull runs were followed by sharp corrections, only to be succeeded by even higher peaks. This pattern suggests that Bitcoin’s price movements are not random but follow a discernible rhythm.

The Parabolic Rises and Sharp Corrections

One of the most striking features of Bitcoin’s price chart is its parabolic rises followed by sharp corrections. These parabolic moves are characterized by an exponential increase in price, often driven by speculative fervor and media hype. However, these rises are usually unsustainable and lead to sharp corrections, sometimes wiping out a significant portion of the gains. The 2017 bull run, for example, saw Bitcoin’s price skyrocket to nearly $20,000 before crashing to around $3,000 in 2018. This pattern of rapid ascent and steep descent is a recurring theme in Bitcoin’s history.

The Technological Underpinnings

While the price movements are captivating, it’s essential to understand the technological underpinnings that drive Bitcoin’s value. Bitcoin operates on a decentralized ledger technology called blockchain, which ensures transparency and security. However, the technology is not static; it evolves, and these evolutions can significantly impact Bitcoin’s price.

The Lightning Network

One such evolution is the Lightning Network, a layer-2 solution designed to enable fast and cheap transactions on the Bitcoin blockchain. By allowing off-chain transactions, the Lightning Network addresses some of Bitcoin’s scalability issues, making it more practical for everyday use. As the Lightning Network gains adoption, it could drive Bitcoin’s value higher, echoing the past rhymes of technological advancements leading to price increases.

The Taproot Upgrade

Another significant technological development is the Taproot upgrade, implemented in 2021. Taproot enhances Bitcoin’s smart contract capabilities, making it more versatile and efficient. This upgrade could pave the way for more complex financial instruments and applications on the Bitcoin blockchain, potentially driving up its value. As we look to the future, these technological advancements could very well be the rhymes that echo Bitcoin’s past successes.

The Market Dynamics

Beyond technology, market dynamics play a crucial role in Bitcoin’s price movements. These dynamics include regulatory environments, institutional adoption, and macroeconomic factors.

Institutional Adoption

In recent years, we’ve seen a significant increase in institutional adoption of Bitcoin. Companies like MicroStrategy and Tesla have added Bitcoin to their balance sheets, viewing it as a store of value akin to gold. This institutional interest has lent legitimacy to Bitcoin and driven up its price. As more institutions adopt Bitcoin, we could see a rhyming echo of past price surges.

Regulatory Environment

The regulatory environment is another critical factor. Governments worldwide are grappling with how to regulate cryptocurrencies, and their decisions can significantly impact Bitcoin’s price. For instance, China’s crackdown on cryptocurrencies in 2021 led to a sharp price correction. Conversely, favorable regulations can drive up prices, as seen in countries like El Salvador, which adopted Bitcoin as legal tender. As regulatory frameworks evolve, they could very well be the rhymes that shape Bitcoin’s future.

The Future: A Symphony of Rhymes

As we stand on the precipice of Bitcoin’s future, it’s essential to remember that while history may not repeat, it often rhymes. The patterns of the past—bull and bear cycles, parabolic rises, technological advancements, and market dynamics—will likely continue to influence Bitcoin’s price movements. However, the future is not set in stone. New technologies, regulatory changes, and market dynamics can create new rhymes, driving Bitcoin’s price in unexpected directions.

The Potential Paths

One potential path is continued institutional adoption, leading to a sustained bull run. Another is a technological breakthrough, such as a significant improvement in scalability or privacy, driving up Bitcoin’s value. Conversely, adverse regulatory changes or macroeconomic factors could lead to a bearish trend. The future is a symphony of possibilities, each playing a unique rhythm of Bitcoin’s past.

The Call to Action

As we navigate this digital frontier, it’s crucial to stay informed and adaptable. The rhymes of Bitcoin’s past can guide us, but they do not dictate the future. By understanding the patterns and staying attuned to the evolving landscape, we can make informed decisions and perhaps even create new rhymes in Bitcoin’s symphony.

Embrace the Uncertainty

The world of Bitcoin is uncertain, volatile, and exhilarating. It’s a place where fortunes can be made and lost in the blink of an eye. But it’s also a place of innovation, disruption, and endless possibilities. Embrace the uncertainty, stay informed, and perhaps, just perhaps, you’ll find yourself standing at the edge of the next big rhyme in Bitcoin’s symphony.

Sources