Analysis: Why Trump’s Crypto Order Disappointed

Introduction

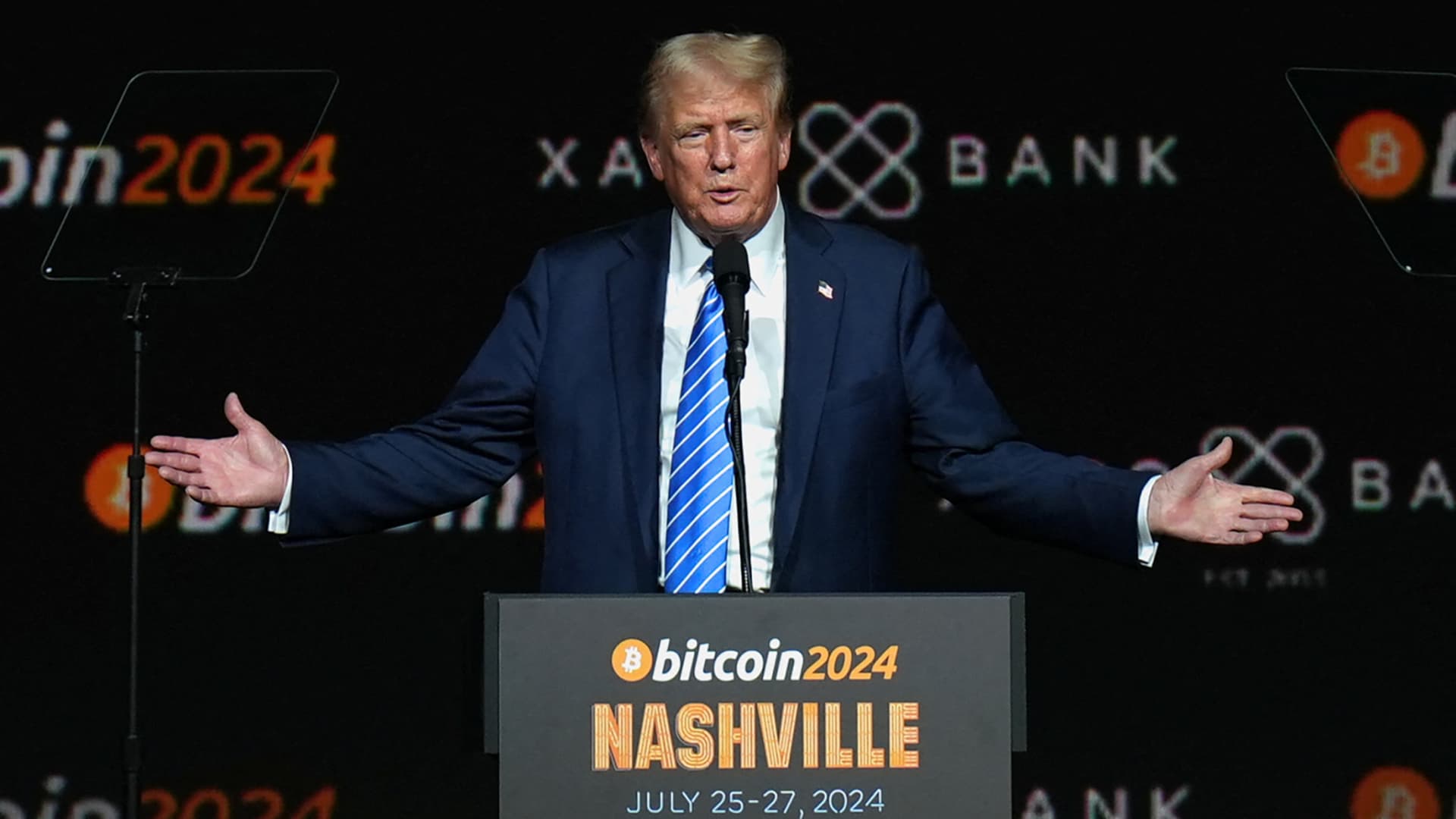

Picture this: On a fateful day in 2025, President Donald Trump penned his signature on an executive order that birthed the Strategic Bitcoin Reserve and the United States Digital Asset Stockpile. This move was poised to be a giant leap in the U.S. government’s crypto stance. Yet, the grand unveiling fell flat among the crypto crowd. Let’s delve into the reasons behind this dismay and the ripples it creates.

Background

Imagine a haven, a vault of confiscated Bitcoin and digital riches, fashioned by the executive order. This digital Fort Knox, painted as a bastion of value, was the government’s vision. But alas, the decree didn’t welcome fresh acquisitions of Bitcoin or other digital coins. A twist that left many yearning investors and enthusiasts disheartened.

Disappointment Factors

Lack of New Acquisitions

- The directive barred the adoption of new Bitcoin or other cryptos, resulting in a stash solely built on seized assets. A far cry from the robust move anticipated.

- Envisioned was a bolder stride akin to nations amassing gold reserves, stirring the hearts of many.

No Market Impact

- The proclamation echoed across markets, causing a dent in Bitcoin’s value, plunging by a staggering 5% to $85,000. Ethereum, Ripple, Cardano, and Solana danced to the tune, witnessing dips between 4% to 8%.

- This market whimper signaled a desire for a weightier U.S. government commitment, with anticipated price surges left in the shadows.

Perception of Inaction

- Critics raised their voices, deeming the effort mere posturing without a solid buying blueprint. Charles Edwards likened it to “lipstick on a pig,” pointing to a hollow gesture shrouded in little substance.

Implications and Future Directions

- Global Impact: Nonetheless the discontent, the birth of a Bitcoin haven could echo across borders, nudging other nations to follow suit. A global nod to Bitcoin’s prowess as a strategic delight.

- Policy and Legislation: The decree underscores a call for crystal-clear rules and policy frameworks enveloping digital assets. A whisper prompts a relook at the U.S. government’s roadmap to harness the crypto bouquet fully.

- Market Sentiment: What unfolds portrays a tale of cautious investors eyeing government strides, yearning for actions that fuel cryptocurrency investments. A vigilant watch casts its eye on impending policy shifts hinting at deeper entanglement with the crypto cosmos.

Conclusion

All had naively hoped for Trump’s executive order on the Bitcoin Reserve and Digital Asset Stockpile to dazzle. But the spark was dim, clashing with expectations. While a nod in the direction of acknowledging crypto’s value, fresh acquisitions were a dream unfulfilled. It’s the dawn of a clarion call for robust policies, catalyzing market trust and a broader digital asset embrace.

References

- Coindesk: Trump Signs Order Setting Up Bitcoin ‘Fort Knox’ and Digital Assets Stockpile

- Atlantic Council: Commentary and Testimony

- White House: Establishment of the Strategic Bitcoin Reserve and United States Digital Asset Stockpile

Additional Insights

Economic and Geopolitical Context: As the U.S. tentatively steps into the digital asset arena, a global financial labyrinth looms. Emerging markets stand resilient yet teeter on the cusp of external tremors. The role of multilateral institutions and the enduring grip of the U.S. dollar weave a complex backdrop.

Future Policy Directions: Pondering proactive strategies, the U.S. government must spin the wheel on expanding its digital assets horizons. Perhaps, a dance with legislative nuances or an international tango for digital asset management guidelines could be the key.

Related sources:

[1] www.coindesk.com

[4] news.va.gov