Billionaire Salinas Claims Delisting Elektra Will Set Him Free: A Comprehensive Evaluation

Introduction

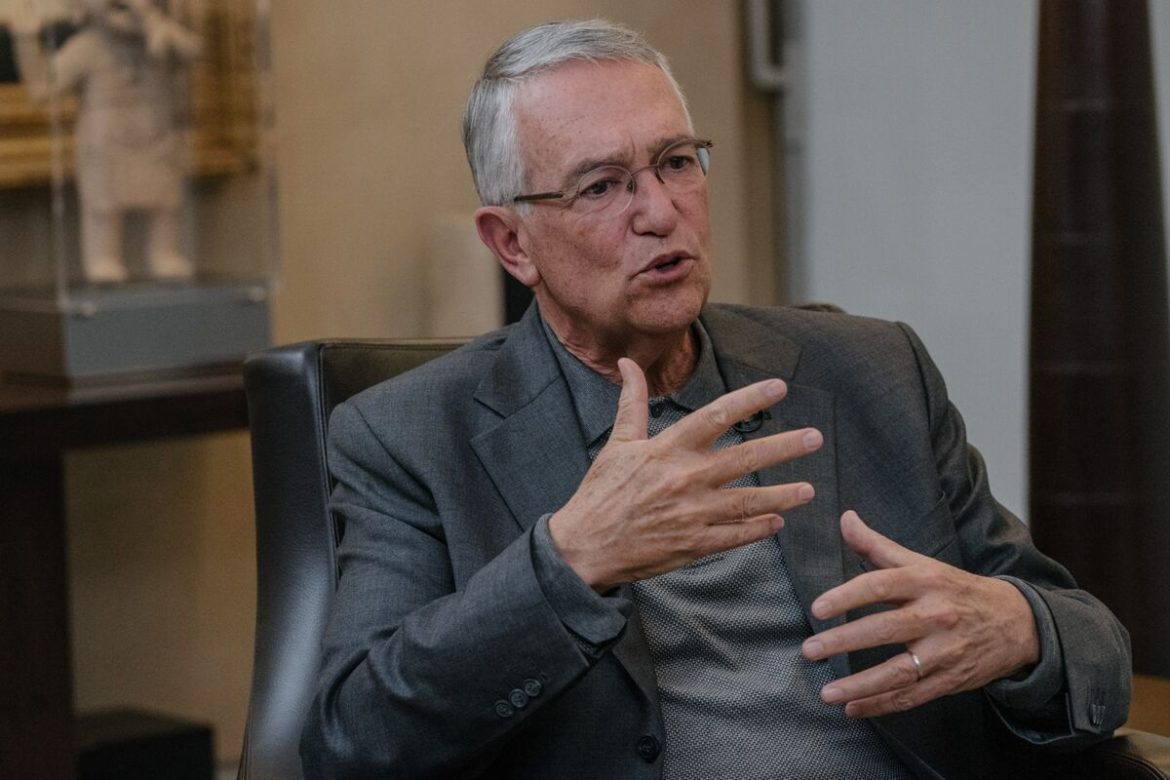

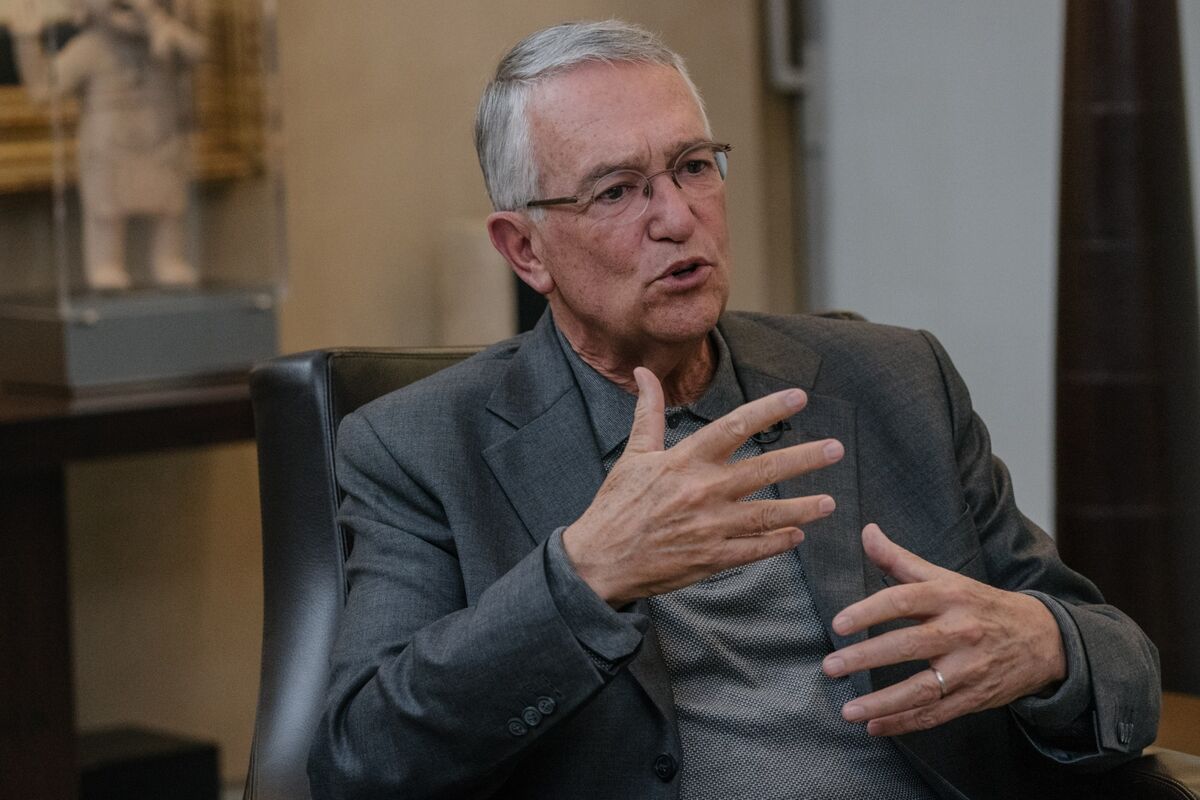

Picture a seasoned captain steering a ship through uncharted waters. Billionaire Ricardo Salinas, the mastermind behind Grupo Elektra, believes that removing Elektra from the stock market will grant him the freedom to navigate the company’s course with unwavering determination. This bold move forms part of a grand strategy to reorganize Elektra’s business facets and potentially forge alliances rather than relying solely on financial backing. Let’s delve into the intricate details surrounding Elektra’s delisting and how it resonates with Salinas’ vision for the company’s future.

Background: Grupo Elektra and Its Operations

Imagine a bustling marketplace teeming with diverse offerings, where Grupo Elektra stands as a steadfast pillar with interests spanning retail, banking, and beyond. For many moons, this Mexican conglomerate has graced the floors of the Mexican Stock Exchange (BMV), adhering to a stringent set of rules and regulations. Nonetheless, Salinas envisions that delisting Elektra will breathe newfound vitality into its activities, providing the latitude to make carefully calculated moves without the watchful eyes of public scrutiny.

Reasons for Delisting

- Operational Flexibility: By cutting ties with the stock market, Elektra can liberate itself from the shackles of rigorous reporting standards and compliance obligations. This newfound flexibility is akin to sprouting wings and soaring high, enabling swift decision-making sans the burden of disclosing intricate financial details to the masses.

- Financial Strategy: Salinas envisions a radical overhaul of Elektra’s financial blueprint by venturing into partnerships, steering away from traditional debt or equity financing. This strategic maneuver promises reduced financial risks and a more reliable source of funding.

- Strategic Partnerships: Delisting greases the wheels for Elektra to venture into partnerships that might have seemed unattainable under the scrutiny of public markets. These partnerships possess the potential to fortify the company’s competitive edge and fuel exponential growth.

Implications of Delisting

- Market Perception: The decision to delist could cast shadows on investor confidence, projecting a veiled facade that might diminish transparency and accountability.

- Regulatory Environment: While delisting eases the grip of stock exchange regulations, Elektra must still heed other regulatory mandates, especially in areas like banking.

- Future Growth: Unleashing the chains of restriction could foster quicker decision-making and spur innovation, potentially paving the way for amplified growth and a fiercer competitive stance for Elektra.

Conclusion

In a nutshell, Billionaire Ricardo Salinas’ audacious step to delist Elektra symbolizes a strategic leap towards enhanced operational fluidity and financial robustness. While this move may cast ripples in the realms of transparency and investor trust, it harmonizes with Salinas’ vision for Elektra’s future expansion and competitive prowess. The viability of this strategic pivot hinges on Elektra’s adept utilization of its newfound flexibility to secure strategic alliances and propel innovative strides.

Recommendations

- Monitor Regulatory Compliance: Vigilantly ensure Elektra adheres to all pertinent regulations beyond stock exchange mandates.

- Communicate with Stakeholders: Foster open dialogue with stakeholders to address concerns regarding transparency and accountability.

- Explore Diverse Partnerships: Actively seek partnerships that align with Elektra’s strategic objectives and fortify its market positioning.

By heeding these recommendations, Elektra can harness the full potential of delisting while mitigating potential pitfalls.

Related sources:

[3] cdn-lfs.hf.co