Detailed Analysis: The Resilience of Bitcoin ETFs in a Turbulent Market

The cryptocurrency world is like a stormy sea, where waves of uncertainty and fear often rock the boat of investor confidence. Recent events, including the Bybit hack and widespread market turmoil, have tested the mettle of Bitcoin ETFs. Yet, amid the chaos, funds like ARK 21Shares and Fidelity have emerged as beacons of stability.

Weathering the Cryptocurrency Storm

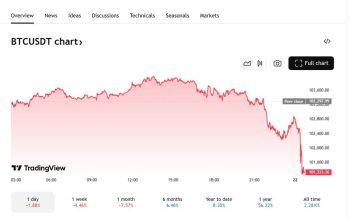

Picture a rocky ride in the cryptocurrency market, with the Bybit hack causing a $1.5 billion ripple that sent shivers through investors. Bitcoin’s price plunged below $90,000, and Ethereum faced its own share of losses. But in the eye of this storm, Bitcoin ETFs stood tall, offering a safe harbor for wary investors.

ARK 21Shares: The Unsinkable Bitcoin ETF

Think of ARK 21Shares as a sturdy ship sailing through turbulent waters. While others floundered, this ETF managed to attract a bounty of $53.6 million in inflows during a period of escalating global tensions. The Securities and Exchange Commission’s shifting stance only added to its allure, proving its resilience in times of uncertainty.

Fidelity’s Wise Origin Bitcoin Fund: A Beacon of Hope

Imagine Fidelity’s Wise Origin Bitcoin Fund as a guiding light for investors lost at sea. After an 8-day spell of outflows, this fund witnessed a reversal of fortunes with $49.7 million in fresh inflows. Its steady performance underscores the enduring appeal of Bitcoin ETFs amidst market upheaval.

Decoding the Currents of Change

The recent inflows into ARK 21Shares and Fidelity Bitcoin ETFs signal a shift in the winds of investor sentiment:

- Navigating Market Storms: As storms of volatility rage, Bitcoin ETFs offer stability, acting as a reliable hedge against economic turbulence.

- Regulatory Winds of Change: Signals from regulatory bodies like the SEC have bolstered trust in Bitcoin ETFs, hinting at a future conducive to cryptocurrency growth.

- Optimism Amidst the Swells: Despite setbacks, a glimmer of optimism shines through, driving continued investment in Bitcoin ETFs even when market conditions seem bleak.

Charting a Course for the Future

The resurgence of inflows into ARK 21Shares and Fidelity Bitcoin ETFs signals a new dawn for the cryptocurrency market. These funds serve as pillars of strength in times of uncertainty, beckoning investors and institutions alike to embrace the evolving landscape of digital assets.

Guiding Lights in the Crypto Seas

Recommendations

For those navigating the volatile waters of cryptocurrency investments:

- Investors: Consider Bitcoin ETFs as a stable investment option to weather market storms.

- Regulatory Bodies: Provide clear guidelines to foster cryptocurrency sector growth.

- Financial Institutions: Enhance Bitcoin ETF offerings to meet rising demand from investors.

By heeding these insights and staying attuned to the changing tides of cryptocurrency, investors and institutions can chart a steady course in a sea of digital uncertainties.

Related sources:

[1] www.etf.com

[2] www.ccn.com

[3] www.statista.com

[4] www.etf.com